The post AAVE Set for 25% Rally, Traders Eye $375 appeared first on Coinpedia Fintech News

After experiencing a notable price decline in the past few days, the overall market sentiment seems to be recovering. Amid this market recovery, Aave (AAVE) appears bullish and is poised for a double-digit price gain, reflecting its recent price action observed on the daily time frame.

AAVE Technical Analysis and Upcoming Levels

According to expert technical analysis, AAVE is forming a bullish double-bottom pattern. However, the pattern is not yet complete. It is gaining support from investors, has successfully formed the second bottom, and has begun building upside momentum.

Based on recent price action, if AAVE holds above the second bottom, it could surge by 25% to reach the neckline at $375 in the future.

On the positive side, AAVE’s Relative Strength Index (RSI) stands at 52, indicating rising buying pressure and a strong possibility that the price could soar significantly.

Bullish On-Chain Metrics

With this strong bullish price action, trader and investor participation has skyrocketed, as revealed by the on-chain analytics firms Coinglass and IntoTheBlock. Data on spot inflows/outflows show that exchanges have witnessed an outflow of over $3.5 million worth of AAVE tokens.

However, experts view this outflow as a potential accumulation by long-term holders, as they transfer assets from exchanges to their wallets.

Along with potential accumulation by investors, intraday trader participation has skyrocketed in the past 24 hours. Data reveals that AAVE’s open interest (OI) has jumped by 7.5%, indicating a rise in new open positions as sentiment begins to shift.

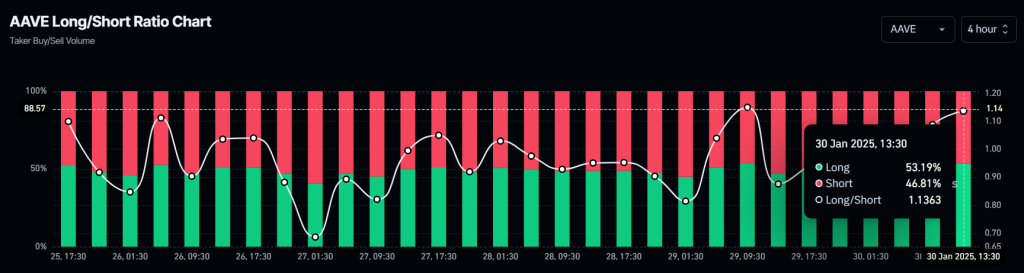

However, on-chain metrics further revealed that the majority of traders’ positions are on the long side, as indicated by the AAVE Long/Short Ratio, which currently stands at 1.13. This ratio suggests that for every 1.13 long positions, there is a single short position, reflecting bullish sentiment among traders.

Current Price Momentum

AAVE is currently trading near $317 and has experienced a price surge of over 10% in the past 24 hours. Additionally, during the same period, its trading volume jumped by 20%, indicating heightened participation from traders and investors compared to the previous day.