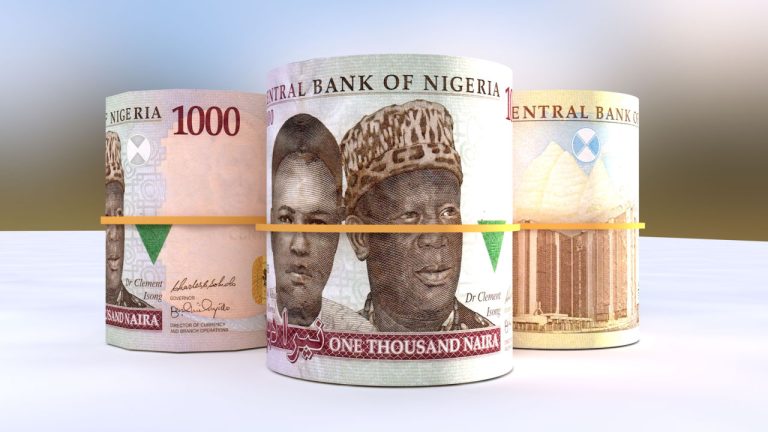

The Nigerian central bank has said the recently demonetized ₦200, ₦500 and ₦1,000 banknotes will remain legal tender until Dec. 31, 2023. The central bank statement, which reaffirms a Supreme Court ruling that extended the lifespan of the demonetized naira banknotes, followed a rebuke of the CBN by the outgoing Nigerian president, Muhammadu Buhari.

Central Bank’s Silence and the Resulting Speculation

The Central Bank of Nigeria finally issued a statement on March 13 reaffirming a Supreme Court ruling which extended the lifespan of the recently demonetized naira notes. In the statement, the CBN said the ₦200, ₦500 and ₦1,000 banknotes would “remain legal tender alongside the redesigned banknotes till December 31, 2023.”

After the Nigerian Supreme Court ruled against the central bank’s decision to demonetize the old naira banknotes, the CBN initially did not issue a statement directing banks and the public to accept the old notes. CBN Governor Godwin Emefiele, as well as the outgoing Nigerian president Muhammadu Buhari’s silence reportedly led to speculation that the central bank would not abide by the court’s decision.

STATE HOUSE PRESS RELEASE

PRESIDENT BUHARI NEVER TOLD A.G. AND CBN GOV TO DEFY SUPREME COURT ORDER#Thread

— Presidency Nigeria (@NGRPresident) March 13, 2023

However, in what was described as a rare public rebuke of the CBN, the Nigerian presidency tweeted that Buhari had not instructed “the Attorney General and the CBN Governor to disobey any court orders involving the government and other parties.” It added the CBN “has no reason not to comply with court orders on the excuse of waiting for directives from the President.”

CBN’s ‘Established Tradition of Obedience to Court Orders’

Moments after Buhari’s reprimand, the CBN claimed in its own statement that it has always obeyed the decisions of the courts and that it will similarly abide by the Supreme Court’s March 3 ruling.

“In compliance with the established tradition of obedience to court orders and sustenance of the Rule of Law Principle that characterized the government of President Muhammadu Buhari, and by extension, the operations of the Central Bank of Nigeria (CBN), as a regulator, Deposit Money Banks operating in Nigeria have been directed to comply with the Supreme Court judgement of March 3, 2023,” the CBN said in a statement.

Register your email here to get a weekly update on African news sent to your inbox:

What are your thoughts on this story? Let us know what you think in the comments section below.