In a recent report analyzing the second quarter (Q2) performance of the Layer 1 (L1) blockchain Algorand (ALGO), data analytics firm Messari highlighted several notable milestones achieved by the network during the period, with a record in transactions being one of the most notable ones.

Rapid Network Growth

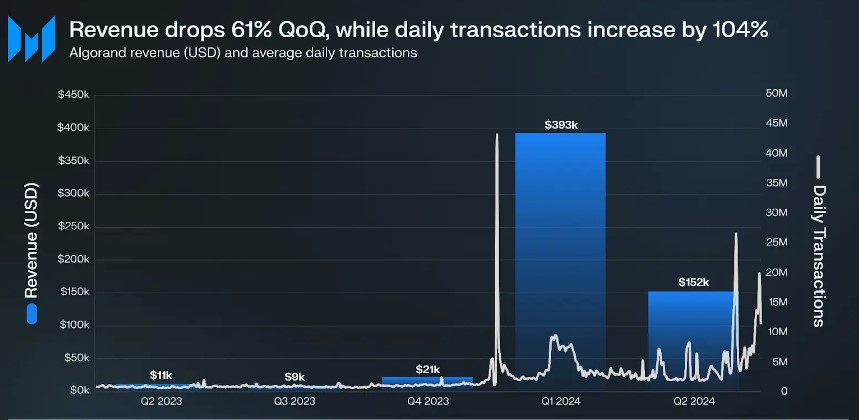

One of the key metrics that stood out was the surge in Algorand’s average daily transactions, which skyrocketed by 104% to reach 4.7 million. The total transactions recorded a more modest 6% quarter-over-quarter (QoQ) increase, reaching 425 million.

Despite this heightened transaction volume, Algorand’s revenue took a hit, declining by 61% to $152,000. The report attributed this to a 46% depreciation in the value of ALGO against the US dollar compared to the previous quarter. Even though the average transaction fee rose by 44%, the overall dollar revenue still declined.

The 61% decrease in quarterly revenue was also traced to a correction following ALGO’s 1,747% surge in Q1, driven by a one-day spike of 43 million transactions linked to the ORA memecoin project.

However, on a year-over-year (YoY) basis, Algorand’s revenue saw a substantial 1,241% increase, climbing from $11,000 to $152,000.

On a positive note, Algorand reached a significant milestone of 2 billion transactions during the quarter, showcasing the network’s growth and adoption. Notably, the network took four years to achieve its first billion transactions, while the second billion was reached within just one year.

Algorand Staking Drops To Lowest Level In A Year

In Q2 2024, the amount of ALGO staked on the Algorand network declined 38% YoY and 6% QoQ, reaching its lowest level at 1.6 billion ALGO staked in a year. Messari believes this may be due to the decreasing rewards allocated per governance period.

The percentage of Algorand’s eligible supply that was staked decreased by 4.7% QoQ and now stands at 20.2%. Meanwhile, Algorand’s circulating supply increased by 1.2% to 8.2 billion ALGO.

Lastly, data shows that the market cap for stablecoins on Algorand increased by 15% QoQ, rising from $73 million to $85 million, primarily driven by a 32% increase in Circle’s USDC stablecoin market cap, which now accounts for 78% of the total stablecoin market cap on Algorand.

Conversely, Tether’s USDT market cap dropped by 22%, making up 21% of Algorand’s stablecoin market share. EURD’s market cap remained at a 1% share of Algorand’s stablecoin market cap.

ALGO Price Faces Make-Or-Break Moment

The ALGO token has seen significant price gains in recent weeks after a challenging Q2 for the price and the broader market. CoinGecko data shows that the token has seen a 14% price increase in the last two weeks and 12% in the last seven days alone.

This has resulted in ALGO trading at $0.1357, just below its 200-day exponential moving average (EMA), marked by the yellow line on the ALGO/USDT daily chart below, which currently acts as a wall of resistance for the token.

It will be essential to clear this hurdle for a potential continuation of the price’s uptrend in the coming days and to establish the same near-term support in the event of a correction.

Featured image from DALL-E, chart from TradingView.com