According to data from CoinMarketCap, Bitcoin has had an unimpressive week with its market price falling by 4.65% over the last seven days. However, prominent crypto analyst Ali Martinez has released a price alert indicating that the market leader could be set for more losses if it fails to secure a certain support zone.

Bitcoin URPD Chart Shows Potential Correction – Analyst

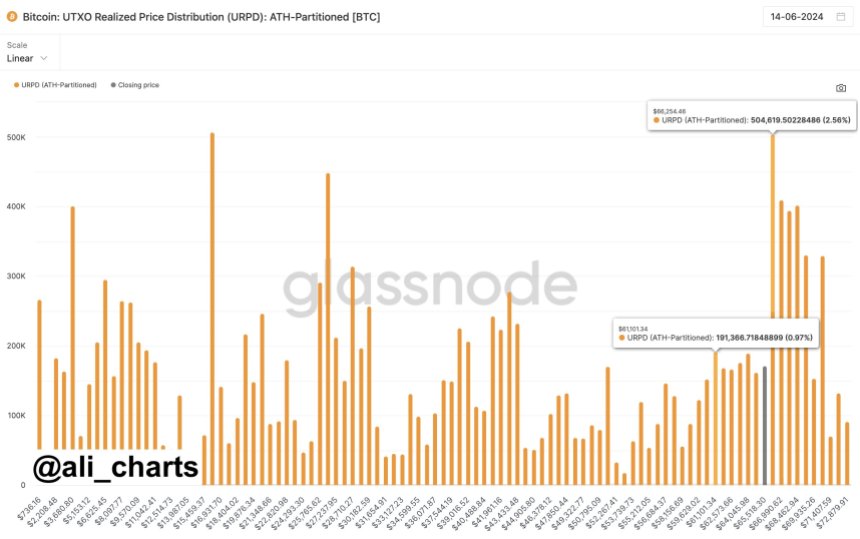

In an X post on June 15, Martinez stated that Bitcoin needs to quickly rise above $66,254 else it risks a potential decline to around the $61,100 price mark. Martinez based his theory on the UTXO Realized Price Distribution (URPD) chart generated by the data analytics platform Glassnode.

#Bitcoin needs to climb back above $66,254 quickly to avoid a potential correction down to $61,100! pic.twitter.com/WMr7jcAVJU

— Ali (@ali_charts) June 14, 2024

For context, an unspent transaction output (UTXO) refers to units of Bitcoin that are unspent after a transaction. Each UTXO has a realized price i.e. the price the market price at the time of UTXO was transacted. In a UTXO Realized Price Distribution chart, Bitcoin’s supply is broken down based on the realized prices of UXTOs showing how much BTC was acquired at different levels.

This data can be used to study market sentiment, distribution analysis as well as support and resistance levels. More importantly, investor behavior can also be studied as a high concentration of UTXOs indicates levels at which most investors bought Bitcoin which can translate into a potential resistance or support level.

According to the URPD chart shared by Martinez, 504,619 BTC was purchased at $66,254 thus indicating a strong potential to serve as a support for Bitcoin amidst its current downtrend. Furthermore, the next realized price with the highest number of Bitcoin (191,366) bought is $61,101 representing the next support level should the premier cryptocurrency fail to reclaim the $66,254 price mark.

Bitcoin Price Overview

At the time of writing, Bitcoin trades at $66,151 reflecting a price decline of 1.15% in the last day. In tandem, the BTC’s daily trading volume is also down by 5.54% and valued at $25.4 billion. However, Bitcoin remains in the green on the monthly chart with a 5.80% gain which is a notable positive, especially for long-term traders.

According to Coincodex, the general sentiment is bearish nevertheless, the fear and greed index stands at 74 which indicates current optimism as well as risk-taking behavior among investors which highlights a potential for high market volatility.