Crypto and Bitcoin traders should prepare for another sharp leg up, especially if the coin breaks above the $35,750 to $36,000 resistance wall this week. According to an X user, Alex Thorn, the Head of Firmwide Research, the $250 zone between those prices is a crucial liquidation barrier that derivatives traders closely watch.

If bulls have the upper hand and push above the upper limit of the belt, prices could rip higher this week primarily because of the resulting demand in the spot market.

Is Bitcoin Ready For Another Rally?

Thorn compares the current setup evolving in the Bitcoin chart to the events last week, which saw the coin explode. At spot rates, Bitcoin is stable but trending around 2023 highs, with buyers expecting more gains as market sentiment improves.

Though most users are looking at the United States Securities and Exchange Commission (SEC) and the potential approval of a spot Bitcoin Exchange-Traded Fund (ETF) as a trigger for the next leg up, Thorn is closely tracking events in the Bitcoin trading scene, specifically, the derivatives market. In the analyst’s assessment, options traders will be the primary drivers of the next bull run.

Why $36,000 Is A Key Price Level To Watch

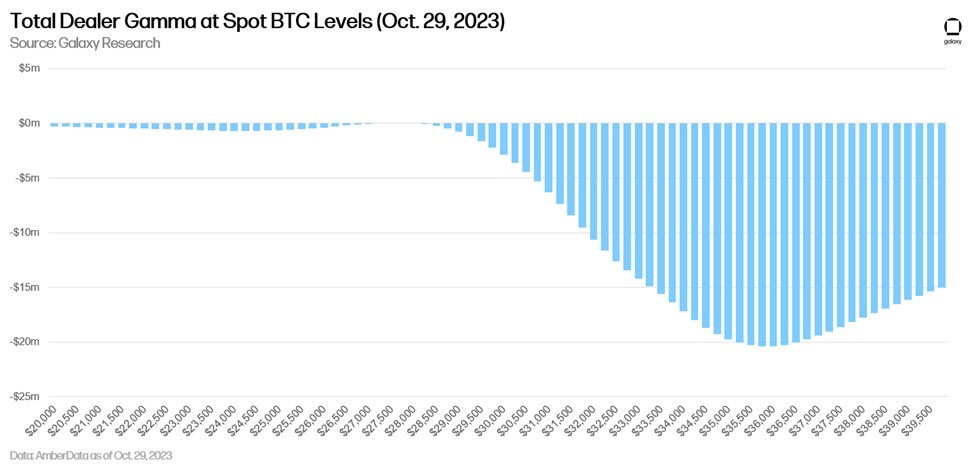

Based on the analyst’s assessment, once Bitcoin breaks the $35,750 to $36,000 zone, “options dealers will need to buy $20m in spot BTC for every 1% upside move,” driving prices higher. The reason dealers have to buy or sell Bitcoin at the spot market depends on whether they are “short or long gamma.”

The objective, when this happens, is to stay “delta neutral.” The decision to buy at the spot market comes after a “gamma squeeze,” which, as Thorn notes, lifted prices last week.

Technically, a gamma squeeze arises when there is a spike in call (or buy) options being purchased, forcing options dealers, most of whom are market makers, to buy the underlying asset, in this case, Bitcoin, to hedge their positions and stay “delta neutral.” Going by trends and the current setup, especially in the daily chart, this could happen.

Looking at other metrics, Thorn noticed a divergence in supply held by speculators and long-term holders, opining that on-chain liquidity could be dwindling. However, on the bright side, the Z-Score ratio of market price to realized price shows that Bitcoin is in a “healthy” position.

As of October 30, Bitcoin is within a bullish breakout formation, with traders bullish. Whether the uptrend remains depends on whether buyers follow through, pushing the coin above recent highs, away from the breakout level at around $32,000.