The recent plunge of the Bitcoin price from $25,200 to $22,780 has once again triggered great fear among investors that the price is not only in a correction phase, but will face significant further downside. However, there are good arguments that contradict this theory. We have collected numerous reasons from reputable analysts.

This Is Why The Bitcoin Price Is On The Verge Of A Bull Market

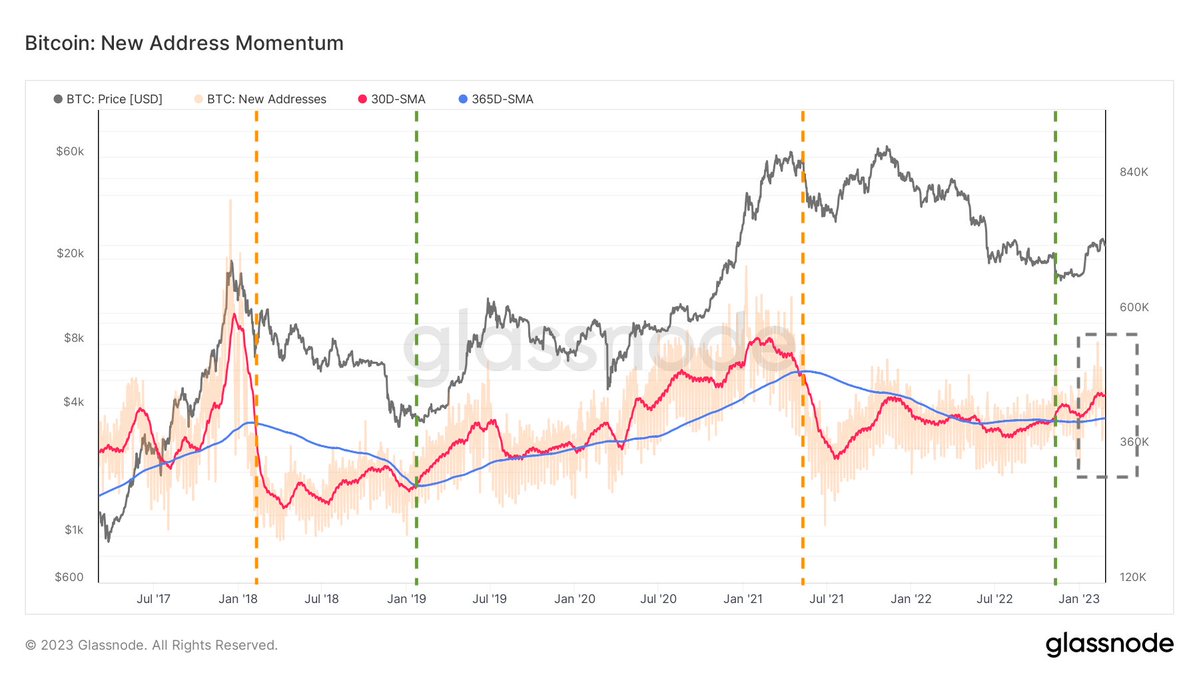

Analyst Ali Martinez writes in his latest tweet on Bitcoin that the momentum of the new Bitcoin addresses indicator suggests that a new bull run has begun. The indicator compares the monthly average of new addresses to the annual average to show relative swings in sentiment.

“Note the spike after FTX collapse, but growing network utilization prevails,” Martinez explains in reference to the chart below.

Renowned technical analyst Michaël van de Poppe explained yesterday that there are currently two scenarios for Bitcoin. In the bearish scenario, Bitcoin suffers another setback at the crucial $23,800 level. This would mean that there could be another test of support at $22,600.

If the sweep happens and the $23,800 support is reclaimed, the $25,000 test is inevitable and long positions are triggered, according to van der Poppe. In favor of this scenario is the fact that the total market cap for crypto still paints a clear picture.

“Retest of all-time high in 2017. Double bottom retest. Weekly bullish divergence, first time ever. Breaking above 200-week MA and holding support. One more week of consolidation before up, likely,” van der Poppe outlined.

On-chain service Santiment wrote today via Twitter that last week, for the first time this year, more investors in Bitcoin and Ethereum sold at a loss than sold at a profit. “Historically, once the crowd is exiting their positions more frequently at a loss, bottoms are more likely to form,” Sanitiment explained.

Analyst “Rekt Capital” thinks that the upcoming month of March will be crucial. “BTC will need to breach ~$25000 to break the macro downtrend and confirm a new macro uptrend,” the analyst states.

Historically, the month before the breakout from the BTC macro downtrend tends to be slow. However, if history repeats itself, there is a chance that March will test the macro downtrend, the analyst outlined, referring to the chart below.

However, there are also good reasons why the start of a bull market might still be a while away. Besides macroeconomic fears and worries about a recession and a hawkish US central bank, liquidity in the Bitcoin and crypto market still looks very poor, as Will Clemente recently wrote.

Jokes aside — Data shows that liquidity is still poor post FTX collapse

(h/t @KaikoData) pic.twitter.com/TpgqR1PX4d

— Will Clemente (@WClementeIII) February 24, 2023

But there is hope in this regard as well. Analyst Alex Adler wrote today: “Volatility is coming back? 24h change 1.93 (+3.69%),” and referred to the chart below.