Avalanche (AVAX) has been on a phenomenal upward trend as overall market optimism has buoyed it. Recently, the token surpassed crucial resistance levels fueled by recent Federal Reserve rate cuts and Donald Trump’s election victory.

These events appear to have reignited investor enthusiasm, thereby increasing interest in the altcoin and driving its price upward.

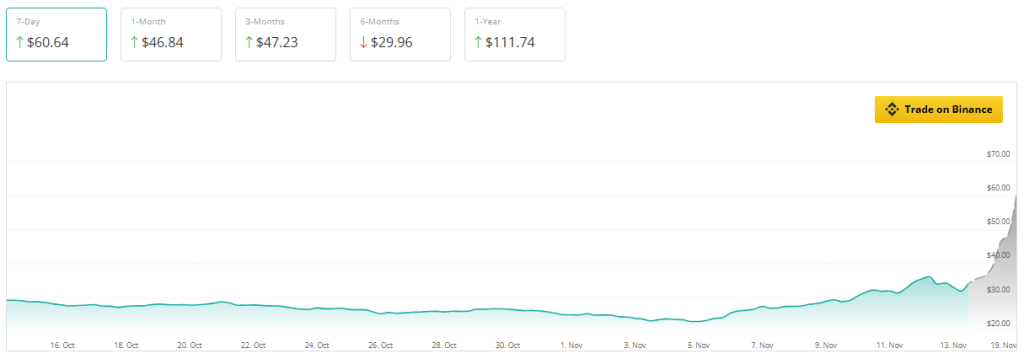

Currently, AVAX is trading at $33.33, which represents a 28% increase in the past week. Market observers anticipate that it may reach $50 in the near future.

Confidence Encouraged By Technical Performance

Crypto analyst KALEO posted to X, predicting a price spike for AVAX of up to $50.

$50 $AVAX within the next two days.

Book it. pic.twitter.com/oufHApbn4U

— K A L E O (@CryptoKaleo) November 11, 2024

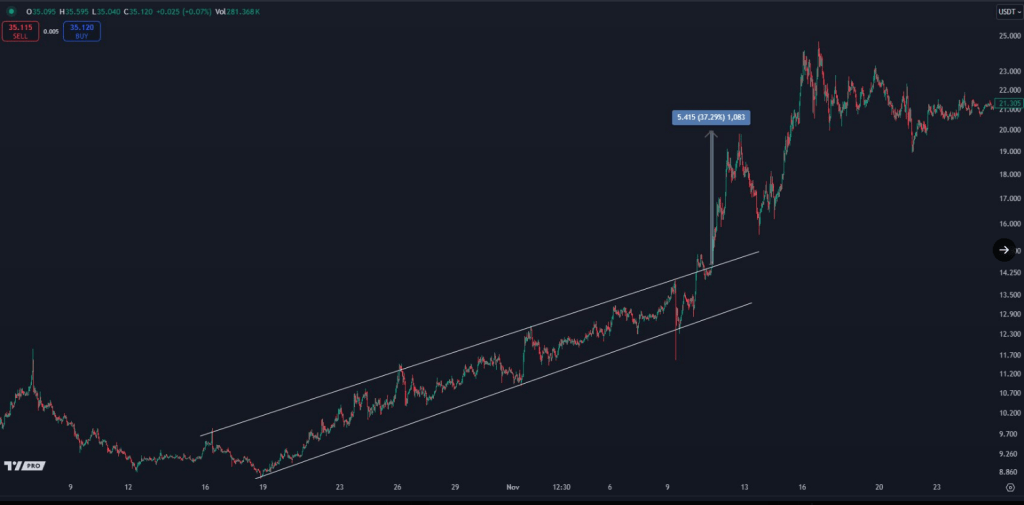

According to a chart provided by KALEO, AVAX is currently trading within an ascending channel, suggesting that the momentum is expected to persist. Numerous investors are enthusiastic about this technical configuration, with some anticipating additional gains in the near future.

The next obstacle could be the breach of $40 if the upward trend persists, which would establish the foundation for a rally toward $50 by the end of the week.

Market Sentiment And Institutional Support

Additionally, the recent price increase coincides with an increase in institutional interest in Avalanche. The renewed engagement from institutional investors following Trump’s election victory on November 5 was emphasized by Jason Yanowitz, co-founder of Blockworks.

He mentioned that hedge funds and venture capitalists have begun increasing their investments, which indicates their confidence in AVAX’s future development. The token’s value is anticipated to be further enhanced by the influx of capital into the market as a result of this institutional activity.

Avalanche: Long-term Outlook Remains Optimistic

Analysts are bullish on the long-term prospects of Avalanche. The token is seen hitting the $90 target for 2024, according to forecasts from the House of Crypto. Others predict a rally towards $60 and $72 by December, after which it is possible to rise to $135 toward the early months of the following year.

P.s This is not financial advice. Just my thoughts!This Time next year… My price predictions of top 24 Trending coins. Am I right?

$bitcoin – $175,000

$toncoin – $64 $solana – $920 $dog – $0.13 $icp – $150

$ethereum – $8400 $Kaspa – $1.60 $xrp – $6.20

$pepe -…— The House Of Crypto (@HouseOfCrypto3) November 11, 2024

The medium and long-term are still good for AVAX despite short-term volatility and the possibility of corrections as foreseen in certain estimates. Over the next three months, the token is expected to grow by over 38%, and there is an expectation of a 220% growth over the next year. Thus it becomes an opportunity that will attract many long-term investors.

Avalanche’s performance in the upcoming weeks will be the primary focus as it continues to acquire momentum. AVAX may be on the cusp of another significant rally, given its favorable technical outlook and robust institutional support.

Featured image from DALL-E, chart from TradingView