Solana (SOL), one of the leading cryptocurrencies by market cap, has recently shown signs of a potential price recovery after a bearish performance in August.

The asset, which experienced nearly a 10% decline in the past week, has started to regain momentum as it entered September. Solana has risen from a recent low of $124 to above $134 in early trading hours today, showing a 2.7% increase in the last 24 hours, now trading at $132.

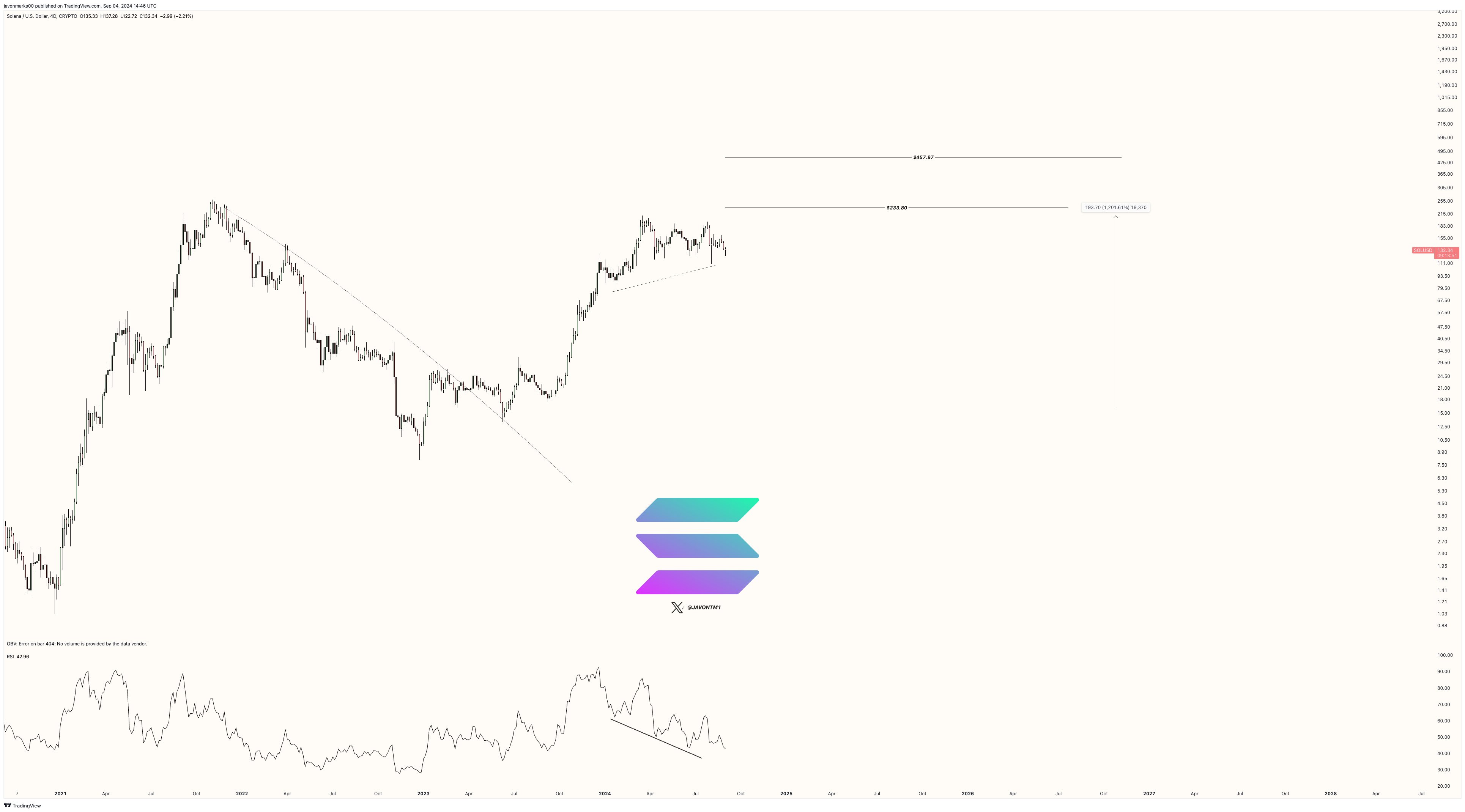

Amid this recovery, renowned crypto analyst Javon Marks has recently maintained a bullish outlook on Solana, with a long-standing target of $233.8 for the asset.

Why Is A $233 Target in Sight For Solana?

According to Marks, Solana has shown signs of a continued upward trend, with its price potentially rising to $233.8 and even higher if momentum continues.

The analyst’s projection for SOL reaching this mark and beyond is based on a hidden bullish divergence pattern, which SOL has been trading within for quite a while now.

Marks particularly noted in the prediction post on X:

Our $233.8 Target for SOL (Solana) has been maintained since mid 2023 at $16.12, with prices seeing an approximately 1,203% climb afterwards towards the meeting of it. Now, with the pullback just under, this target goes unchanged as the breakout bringing it in play, continues to hold, and with bullish signals coming in, a nearly +72% climb to finish that process of meeting it could be in development.

The analyst further suggested that if Solana breaks past this $233.8 price level, it could see a further rise towards $457, representing an additional 93% increase.

SOL Breakpoint Approaches

In addition to the price outlook from Javon Marks, other analysts have weighed in on Solana’s potential price movements, particularly around the upcoming SOL Breakpoint event.

Crypto analyst Marty Party, responding to a post by another analyst named Sai on X, pointed out that historically, Solana’s price has seen significant gains leading up to this event.

Marty Party noted: “Solana Breakpoint pump average is 62%. With SOL currently trading at $133, a 62% increase could push it to $215.46.”

Sai’s post highlighted Solana’s price behavior before previous Breakpoint events. In 2021, Solana saw a 68% price surge leading up to the conference, followed by a 42% rise in 2022 and a 58% increase in 2023.

The Breakpoint event, which showcases the Solana ecosystem’s innovation and development, has historically attracted attention from investors, contributing to the pre-event price rallies.

#Solana Breakpoint in 16 days. Do you know how the Solana price behaves before the breakpoint?

68% price surge in 2021 before Breakpoint

42% price surge in 2022 before Breakpoint

58% Price surge in 2023 before BreakpointFollow the

Thread

to make sure you don’t miss 2024…

— Sai (@SaiPrathap846) September 4, 2024

This year, the Breakpoint event will take place on September 20th in Singapore, and excitement is already building in the Solana community.

With only 16 days to go, analysts like Sai anticipate a potential rally similar to previous years. Whether Solana can replicate its past price surges remains to be seen, but historical data and bullish technical signals suggest the possibility of significant upward movement.

Featured image created with DALL-E, Chart from TradingView