ApeCoin (APE) has seen its price jump by over 100% today, driven largely by the rollout of advanced technologies and newly implemented incentive programs. These initiatives are designed to boost user participation and broaden the token’s utility across multiple networks, fueling the recent surge in value.

Layer Zero Integration And Interoperability

The Layer Zero’s Omnichain Fungible Token (OFT) standard has now been integrated with ApeCoin through the latest update to its smart contract. This version greatly enhances ApeCoin’s capabilities, enabling it to be more than just a utility token and a governance token but also it is now the native gas token on its own blockchain, ApeChain. That way, it brings the integration of ApeCoin as a foundational part of the Yuga Labs ecosystem.

@apecoin goes omnichain!

APE, the native gas token of ApeChain and a core asset in the @yugalabs ecosystem, is used for transaction fees, voting in ApeCoin DAO, and as a payment method in Yuga Labs titles and IRL purchases. It is now an OFT that can be seamlessly transferred… pic.twitter.com/azgIlAUW3B

— LayerZero (@LayerZero_Core) October 17, 2024

Another major feature of this token is Layer Zero integration, which smoothes transfers of APE across multiple blockchains—ApeChain, Ethereum, and Arbitrum. This was a much-needed improvement in the token with regards to setting a new benchmark of token interoperability and increasing users’ appeal towards developers, while its excellent development process also smoothens asset transfer between networks.

Native Yield Mechanism And Market Response

A further aspect responsible for the recent increase in price of ApeCoin involves the implementation of a Native Yield mechanism co-developed with Decent.xyz. This means that the holders of ApeCoin receive a passive income on their holdings through this, without requiring any input from the user. The yields are credited to wallets at the end of each block with no hassle, thus leaving a highly rewarding proposition for the token holder.

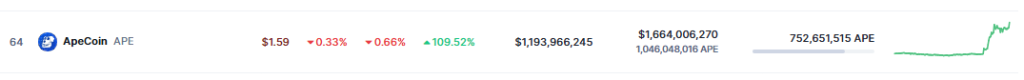

The updates had received wide welcome in the market, as ApeCoin traded at over 6,400% and broke out to approximately $1.84 billion in its trading volume, as the market capitalization of ApeCoin has also broken into more than $1 billion, increasing by 100% in just one 24-hour cycle.

Greater Liquidity And Future Prospects

Today, the cross-chain bridges support APE, ETH, and stablecoins transfer between the chains. This has made the network sustain relatively high liquidity, attracted investor attention and developer involvement. It has made transfer operations within the network smoother and more efficient.

ApeChain is off to a strong start, with $25m volume traded in the first 12 hours

Over 148 pools have been created with 62,700 transactions. Memes launched on @ape_express_ are then traded on Camelot.

Be a Knight and start aping now

https://t.co/aRc3dH1Iry pic.twitter.com/QOCBvjeKzn

— Camelot (@CamelotDEX) October 20, 2024

Since the upgrade, ApeChain’s performance has been impressive, with over $25 million in trading volume generated in just 12 hours. The creation of 148 liquidity pools and more than 62,000 transactions highlights strong user activity and growing interest in the platform.

The core user incentive program of ApeCoin will be launched in the near future, so it will gain more value and increase demand in the market. Some details about the program are yet to be disclosed, however, the market is already on tenterhooks for it.

At the moment, ApeCoin is trading at $1.58 and, during the last 24 hours, it increased by about 109%. Despite the great momentum and rising utility, prospects for the growth of ApeCoin in the decentralized environment seem pretty good.

Featured image from Techopedia, chart from TradingView