With the market correction still felt by most of the altcoin market, Aptos rose through the ranks clutching a win for investors and traders. APT bulls pulled through, with the latest market data marking an 18% uptick in value since last week, a sign that the token might continue to push through the bearish onslaught plaguing the broader market.

Although APT’s movement has garnered much-deserved attention, it remains to be seen whether the sudden flip in sentiment is a solid move toward a better position. Recent developments have shown that Aptos’s recent price move is the start of an upward trajectory that will place the token at the forefront of investors’ and traders’ attention.

Aptos Q2 Performance Boosts Retail Interest

Recently, Messari released an ecosystem review on Aptos. The quarter posted excellent growth across almost every metric on the platform. DeFi numbers have also been up on Aptos. TVL on the platform has risen by 123% QoQ. As of writing, Aptos stands proud with $716 million in TVL and increased more than 11% in the last 24 hours.

This growth was primarily due to the gradually growing user base of the platform. Average daily new addresses have been recorded to have grown by 43% QoQ, which indicates a considerable level of growth in users since the launch.

Over 20 million addresses in less than 2 years. Big math, and big moves only.

Hear from @AptosLabs‘ CEO & Co-Founder, @moshaikhs, for more on the rapid growth of the Aptos ecosystem

https://t.co/klIMVqcQFg

— Aptos (@Aptos) October 11, 2024

In a recent interview, Aptos CEO and Co-founder Mo Shaikh revealed that the platform is operating for over 20 million addresses in only under two years. The growth experienced by the platform is largely due to an emphasis on user experience with Aptos capable of handling over 10,000 transactions per second, being one of the fastest L1s available in the market.

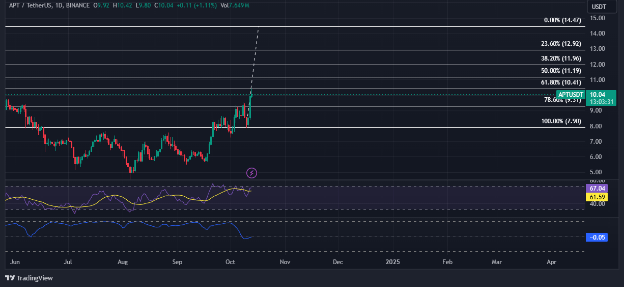

Rejection On $10.41 Inevitable, Swings Momentum To Short Positions

Despite APT’s astonishing movement in the past 24 hours, APT bulls are in the middle of a breakthrough attempt on the $10.41 resistance level that will inevitably reject the current attempt before the token stabilizes above $9.31 in the medium term.

With the token’s relative strength index (RSI) maxed out, APT’s short-term trajectory can only point downward. As it currently stands, the token will remain at its current $9.31-$10.41 trading range with the bulls targeting $10.41 in the medium term.

However, investors and traders should still exercise caution as the token’s RSI signals that the token’s value will fall. As of writing, the bears aim to flip the $9.31 support to resistance with a long-term target of $7.90.

If APT does fall below $9.31 in the medium term, investor sentiment will take a hit possibly leading to a deeper fall.

Featured image from Asia Crypto Today, chart from TradingView