Arbitrum Foundation said it sold 10 million ARB tokens to fund pre-existing contracts and to pay for near-term operating costs.

In an April 2 Twitter thread, the Ethereum (ETH) layer2 solution foundation clarified that the token sales were essential for running its operation because it is a separate entity from Offchain Labs and was established with no funds.

It added that the purpose of the Foundation is not to sell tokens, and it has no plans to sell more tokens for the foreseeable future.

Arbitrum Foundation under fire

The Arbitrum Foundation’s explanation comes amid the controversy surrounding its AIP-1 proposal. The proposal was meant for the Arbitrum DAO to ratify earlier decisions taken by the Foundation — including the assignment of 750 million ARB tokens to itself.

On-chain data showed that the Foundation had moved 50 million of the assigned tokens without the community’s approval. However, it clarified that 40 million of these tokens were given as a “loan to a sophisticated actor in the financial markets space.”

Crypto market maker Wintermute confirmed it received the 40 million ARB token loan.

The Foundation added that the remaining 10 million tokens have been converted to fiat and dedicated towards operational costs.

Proposed solutions

According to the Foundation, it has decided to act on the DAO feedback by splitting the AIP-1 into multiple proposals. The Foundation believes this action will enable the community to discuss and vote on each segment.

Additionally, it will add more accountability to the proposal, especially on the 750 million tokens allocated to the Arbitrum Foundation. This would include the inclusion of a vesting period and transparency reports.

The Foundation also plans to rename the Special Grants program as “Ecosystem Development Fund” and provide clarity on its usage. It added that all the new AIPs would be proposed this week for the DAO to discuss before voting.

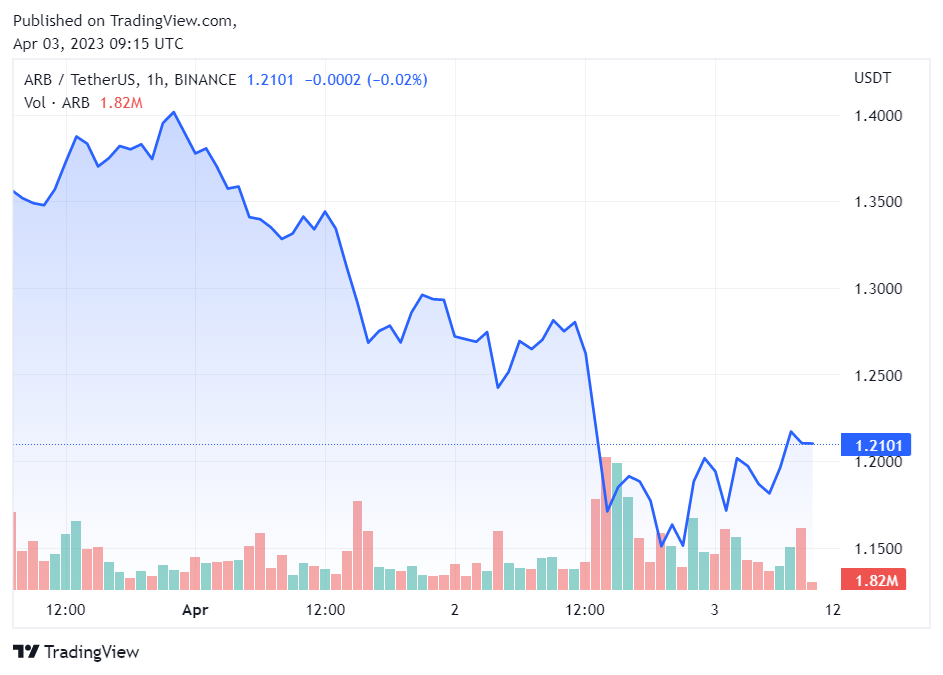

ARB is down 5%

The drama surrounding the Arbitrum Foundation has pushed the ARB token down 4.97% in the last 24 hours to $1.20 as of press time.

After experiencing a heavy sell-off following its airdrop, ARB has traded above the $1 mark and is among the top 40 crypto assets by market cap, according to CryptoSlate data.

The post Arbitrum Foundation said it sold 10M ARB tokens to fund operating cost appeared first on CryptoSlate.