At spot rates, Bitcoin is resilient, soaking in selling pressure and bouncing off the 20-day moving average, as evident in the daily chart. As BTC floats above $69,000, it appears that bulls are preparing for even more gains in the days ahead.

For now, BTC has a strong rejection at $72,000. However, if this level is broken, the coin might easily break all-time highs and chart to fresh territory in Q2 2024.

Speculators Are Flowing Back: Will Bitcoin Extend Gains?

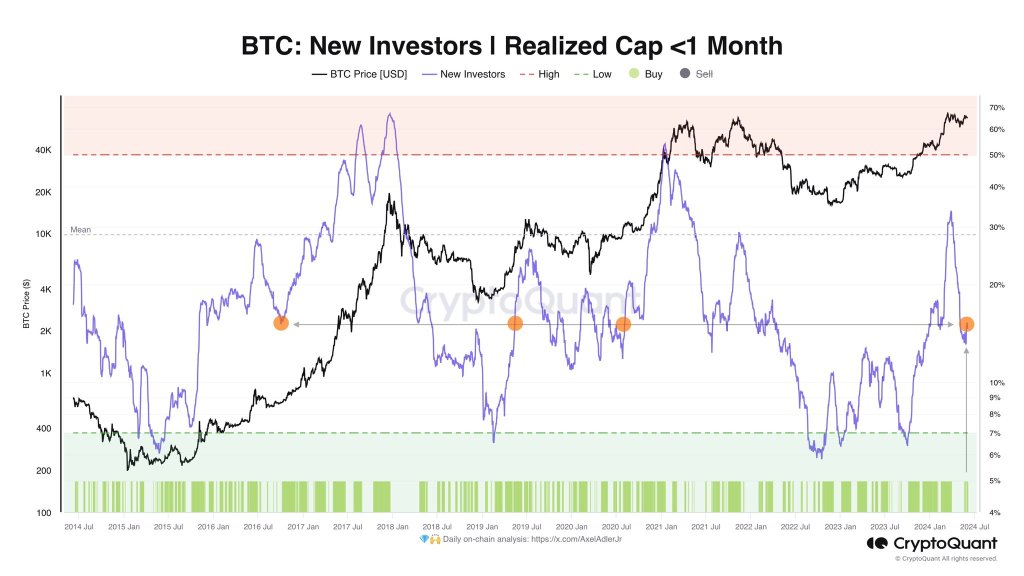

Citing on-chain developments, one analyst predicts that the coin might register higher highs in the days ahead. The analyst pointed out the behavior of short-term BTC holders, observing that their behavior could suggest that more is yet to come.

So far, the realized market cap for investors holding Bitcoin for one month or less has been picking up momentum and rising. Historically, when this metric rises, as in 2020, it could signal that the market is preparing to head higher, driven by an influx of fresh capital.

Usually, the realized market cap is used to gauge sentiment. It measures the value of BTC in circulation based on its acquisition price. In the above case, the realized market cap of all BTC acquired in less than one month is rising, suggesting that more people are buying, confident of what lies ahead.

As short-term holders double down, other metrics show that their realized profit is down by 32%. This reduction indicates that holders are not rushing to lock in profits by selling at current prices.

Instead, they are ready to HODL, anticipating further price gains in the future. This bullish sentiment points to an improving market sentiment, reinforcing the positive outlook.

Bitcoin Volatility Incoming? Roadblock At $72,000

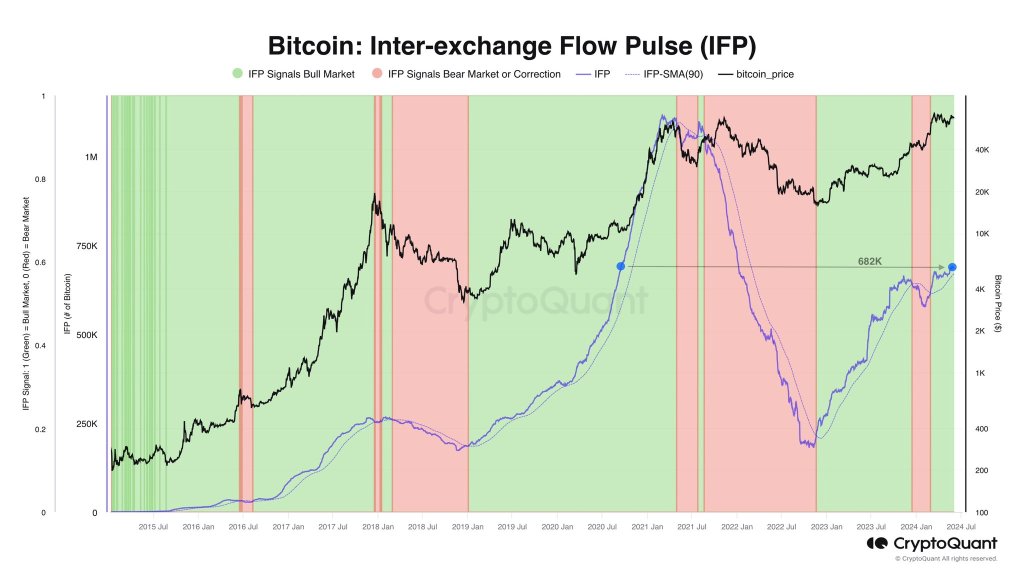

As short-term holders flow back, there is a noticeable spike in BTC transfers from spot to derivatives exchanges.

According to the analyst, this emerging trend suggests that more investors, mostly whales, are beginning to take on leveraged positions, placing BTC as a margin. Their engagement could lead to more volatility, which benefits speculators.

Though on-chain metrics point to confidence, it remains to be seen how prices will pan out in the days ahead. For now, the immediate liquidation line is at $72,000.

As Bitcoin bounces from the middle BB, confirming June 3 gains is necessary for trend continuation. A convincing close above $72,000 would accelerate the leg up, possibly driving the coin above $74,000.