A cryptocurrency exchange accused the US government of undermining the cryptocurrency sector orchestrating a campaign against digital currencies.

Coinbase revealed that the US Federal Deposit Insurance Corporation (FDIC) has been employing tactics to dissuade financial institutions from engaging in crypto-related activities.

FDIC: Stay Away From Crypto

Coinbase claimed that FDIC had sent letters to several financial establishments to ask them to stay away from getting involved in cryptocurrency-related investments.

Coinbase’s Chief Legal Officer Paul Grewal revealed that they have found proof of FDIC’s anti-crypto campaign, telling American financial institutions to keep their hands off digital currency investments.

So far, Grewal said that they had come across “more than 20 examples” of these tactics opposing cryptocurrencies, adding that the US agency told financial institutions to “pause”, “refrain from providing” or “not proceed” with providing banking services for digital assets.

Slowly but surely, the picture is becoming clear. After we sued, @FDICgov finally started giving us information related to our FOIA request about the pause letters it sent to financial institutions as part of Operation Chokepoint 2.0. In short, the contents are a shameful example…

— paulgrewal.eth (@iampaulgrewal) November 1, 2024

“Slowly but surely, the picture is becoming clear,” Grewal said in a post as Coinbase started receiving the information from the FDIC for its Freedom of Information Act (FOIA) request regarding the letters sent to banks in line with the so-called Operation Chokepoint 2.0.

In an earlier interview, US Senator Bill Hagerty said that Operation Choke Point 2.0 is the “coordinated effort” by the government’s financial authorities to suffocate the domestic digital currency economy by “de-banking the industry” and deterring American entrepreneurs from having interest in digital assets.

Coinbase Calls For Transparency

Grewal said the American public should know the truth because they deserve transparency, criticizing FDIC for using such tactics and “working behind a bureaucratic curtain.”

He described the contents of the letters as shameful examples of a state-run agency making an effort to keep law-abiding American companies away from accessing cryptocurrencies.

A Cloud Of Doubt

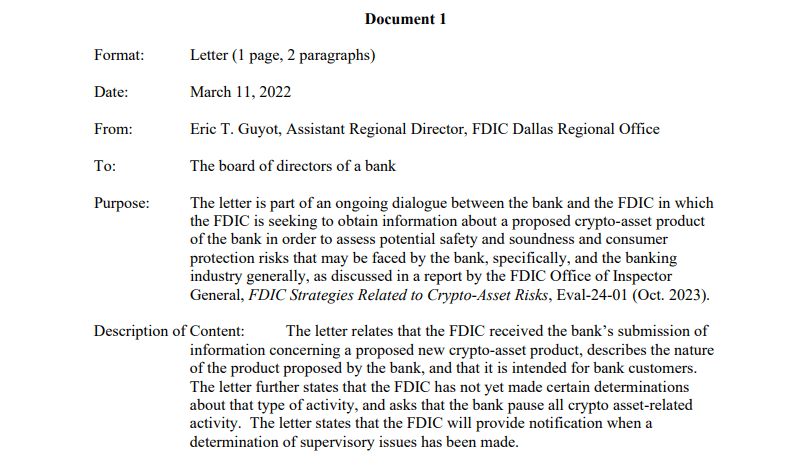

Documents submitted to the court showed that FDIC doubts the risk assessments being performed by banks involving bitcoin services, hence the US financial agency told banks to hold off their plans of offering such services until the evaluation is done.

In one of the letters, FDIC Assistant Regional Director Eric T. Guyot asked a certain financial institution to “pause all crypto asset-related activity” to allow the FDIC to examine the safety and soundness of the crypto product the bank planned to offer.

In another letter dated March 25, 2022, FDIC acting Regional Director Jessica A. Kaemingk persuaded a financial establishment to “rethink” their proposal of rolling out a digital asset product, questioning the planned offering’s “safety and soundness” and urging the bank to submit additional documents.

Financial Regulations

The current battle between Coinbase and FDIC is part of the ongoing saga on the true relationship between government regulations and the cryptocurrency space. It will be an added item to the continuous debate on how to strike a balance between consumer protection and innovation in cryptocurrency.

Featured image from Banner Health, chart from TradingView