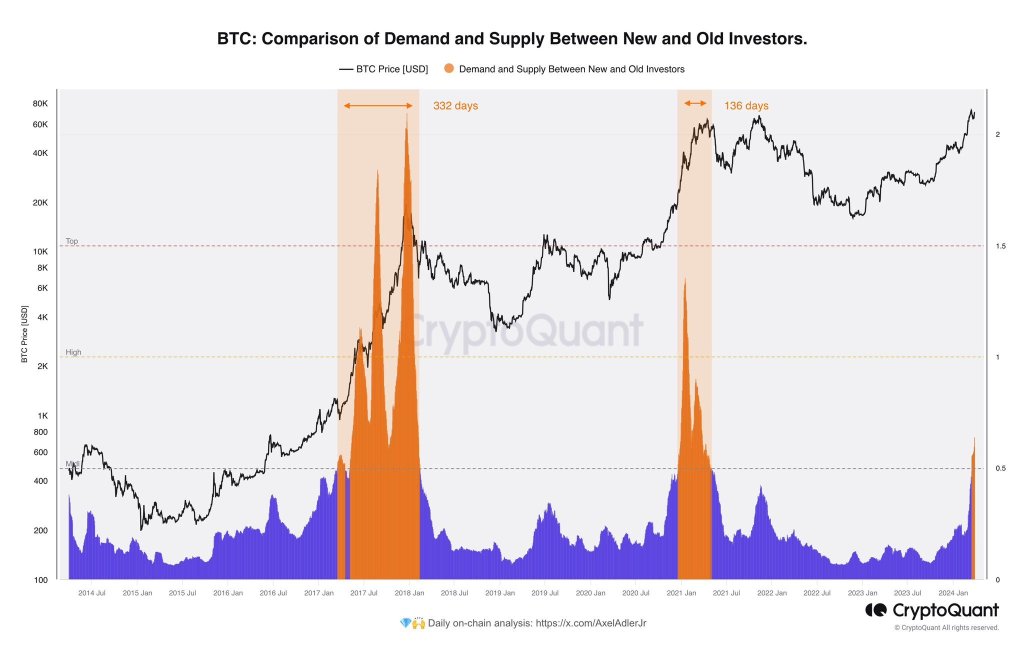

Ki Young Ju, the founder of CryptoQuant, a blockchain analytics firm, has noticed a curious trend. In a post on X, the founder shared a snapshot suggesting that Bitcoin “old whales” might be shifting their holdings to “new whales,” mainly traditional finance heavyweights like Fidelity and BlackRock.

The United States Securities and Exchange Commission (SEC) recently approved these new whales to list spot Bitcoin exchange-traded funds (ETFs) for all investors.

“Old Whales” Moving Coins: Selling Or Risk Mitigation?

While a definitive sell-off isn’t confirmed, commentators replying to the founder’s post believe these “old whales” could be mitigating risk. In their assessment, moving their Bitcoin stash from self-custody to a regulated investment vehicle like spot Bitcoin ETFs is a better measure of covering unexpected eventualities.

If this is the approach, then it could prove strategic. Bitcoin holders can transact without depending on a third party. Notably, this development coincides with a significant drop in BTC inventory on major exchanges like Coinbase and Binance, as well as at GBTC.

The decline has accelerated since the introduction of spot Bitcoin ETFs, hinting at a potential departure from exchanges. Meanwhile, the operators of GBTC are unwinding the product and converting it to a spot Bitcoin ETF following a court decision.

Will Spot BTC ETFs Gain Traction?

Even so, that “old whales” are moving their coins to centralized products like ETFs contradicts the core philosophy of BTC as a tool for financial self-sovereignty. Whether more users, mainly retailers, will choose to own spot Bitcoin ETF shares rather than the underlying coins directly remains to be seen.

Institutions might be obliged by law to use a regulated product if they need to be exposed to BTC. However, retailers can choose to buy directly from exchanges or mine. This freedom might lead to more retailers opting to buy BTC.

This trend emerges ahead of the highly anticipated Bitcoin halving. This event is set for mid-April 2024 and will further reduce BTC’s circulating supply, potentially driving higher prices. Before then, BTC prices are firm, steady above $70,000 at the time of writing.