Quick Take

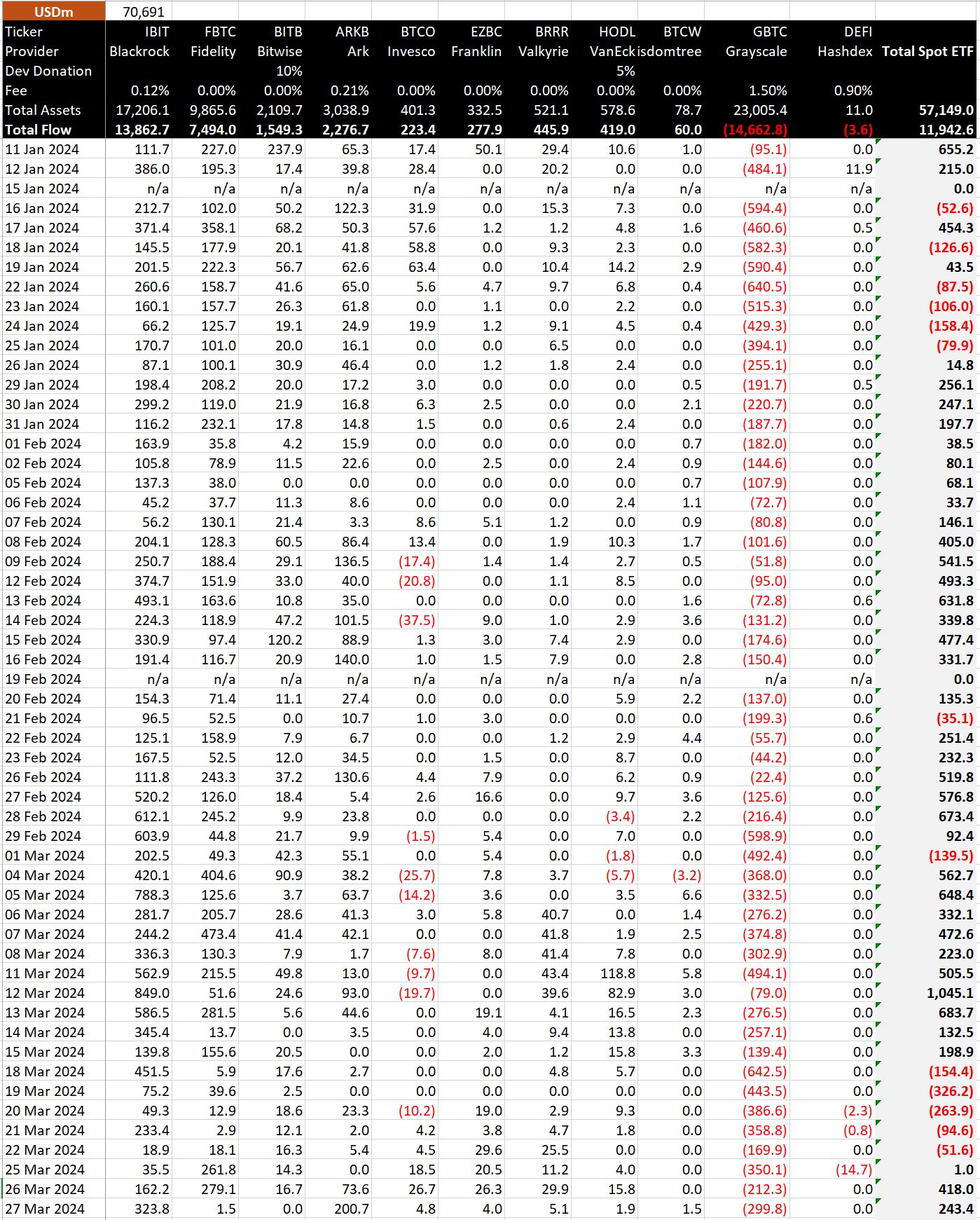

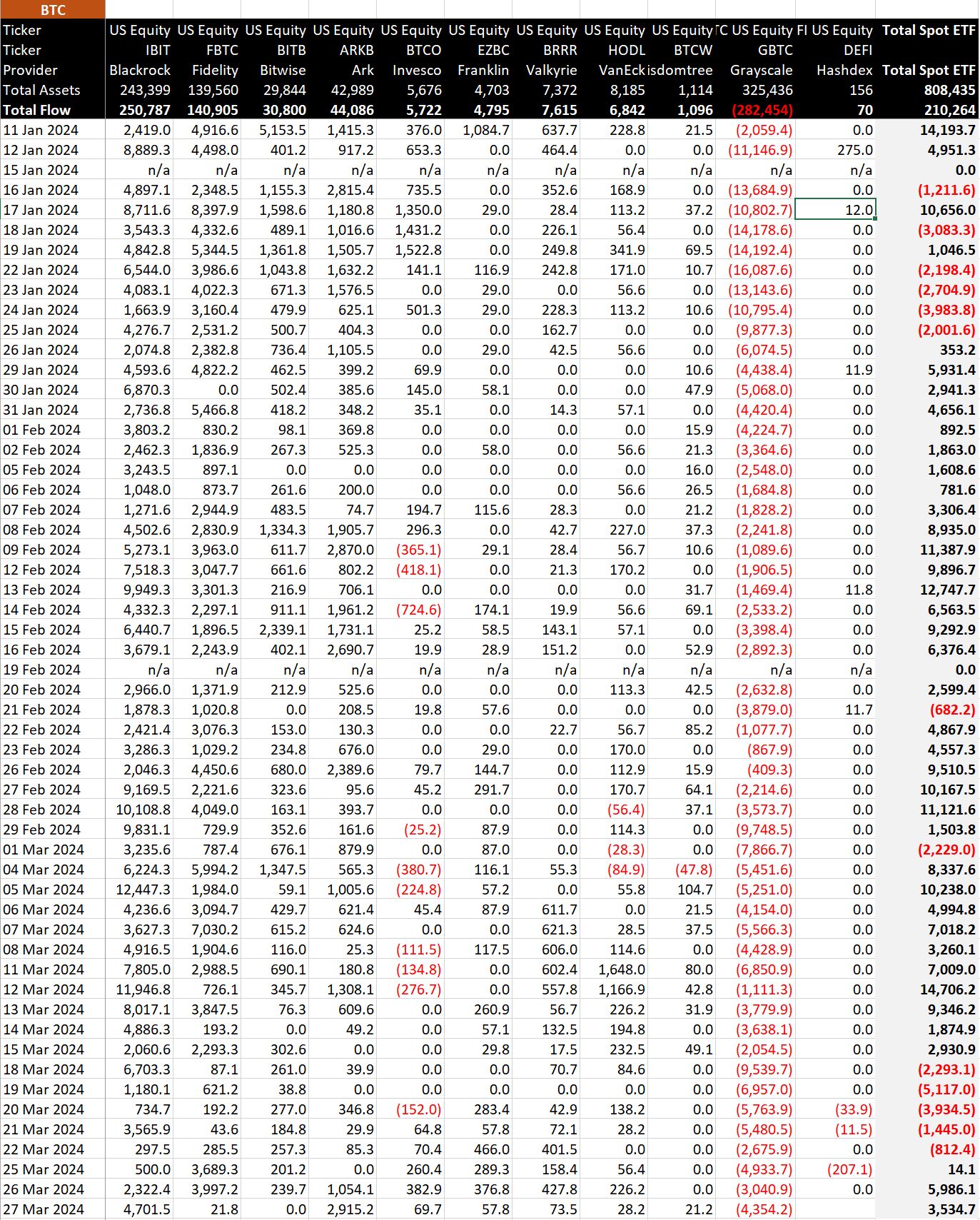

Bitcoin (BTC) ETFs witnessed net inflows on March 27, totaling a solid $243.4 million, equivalent to 3,534.7 BTC. Leading the charge was BlackRock’s IBIT, which recorded a net inflow of $323.8 million, or 4,701.5 BTC, bringing its total net inflow to an impressive $13,862.7 billion, equivalent to 250,787 BTC. This is the largest inflow BlackRock has seen in 7 days and over ten times more than its lowest inflow just last week.

BitMEX data shows that Ark Investment Management’s ArkB had a record day, raking in $200.7 million in net inflows, equivalent to 2,915.2 BTC, pushing its total net inflows to $2,276.7 billion or equivalent to 44,086 BTC. However, the Grayscale Bitcoin Trust (GBTC) continued to experience outflows, with $299.8 million, or 4,354.2 BTC, leaving the fund, bringing its total net outflows to a staggering $14,662.8 billion, equivalent to 282,454 BTC.

Fidelity’s FBTC experienced a notably record low inflow of just $1.5 million, equating to 21.8 BTC. This addition brought their total net inflows to an impressive $7,494.0 billion, equivalent to 140,905 BTC, according to BitMEX.

Despite the outflows from GBTC, the overall net inflows into Bitcoin ETFs reached $11,942.6 billion, equivalent to 210,264 BTC, according to BitMEX.

The post Ark’s Bitcoin ETF witnesses record-breaking inflow day appeared first on CryptoSlate.