Quick Take

Marathon Digital Holdings Inc. (MARA), the largest Bitcoin mining company in terms of market cap, is set to join the S&P SmallCap 600 index, effective before the opening of trading on May 8. The news, announced on May 3, sent Marathon’s share price soaring 18% on May 6. Marathon will replace Aaon Inc. in the widely followed small-cap stock index.

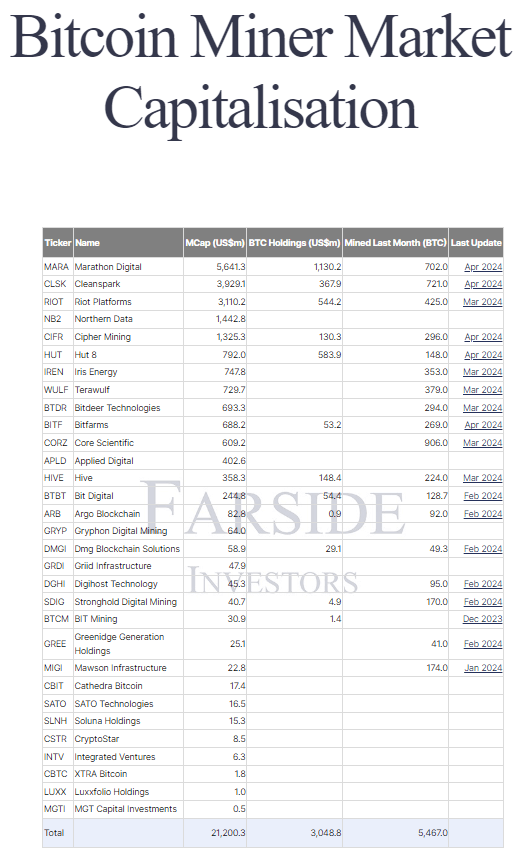

The S&P SmallCap 600 is an index tracking the small-cap segment of the US equity market. According to Farside data, Marathon is currently the largest publicly traded Bitcoin miner, with a market capitalization of around $5.6 billion.

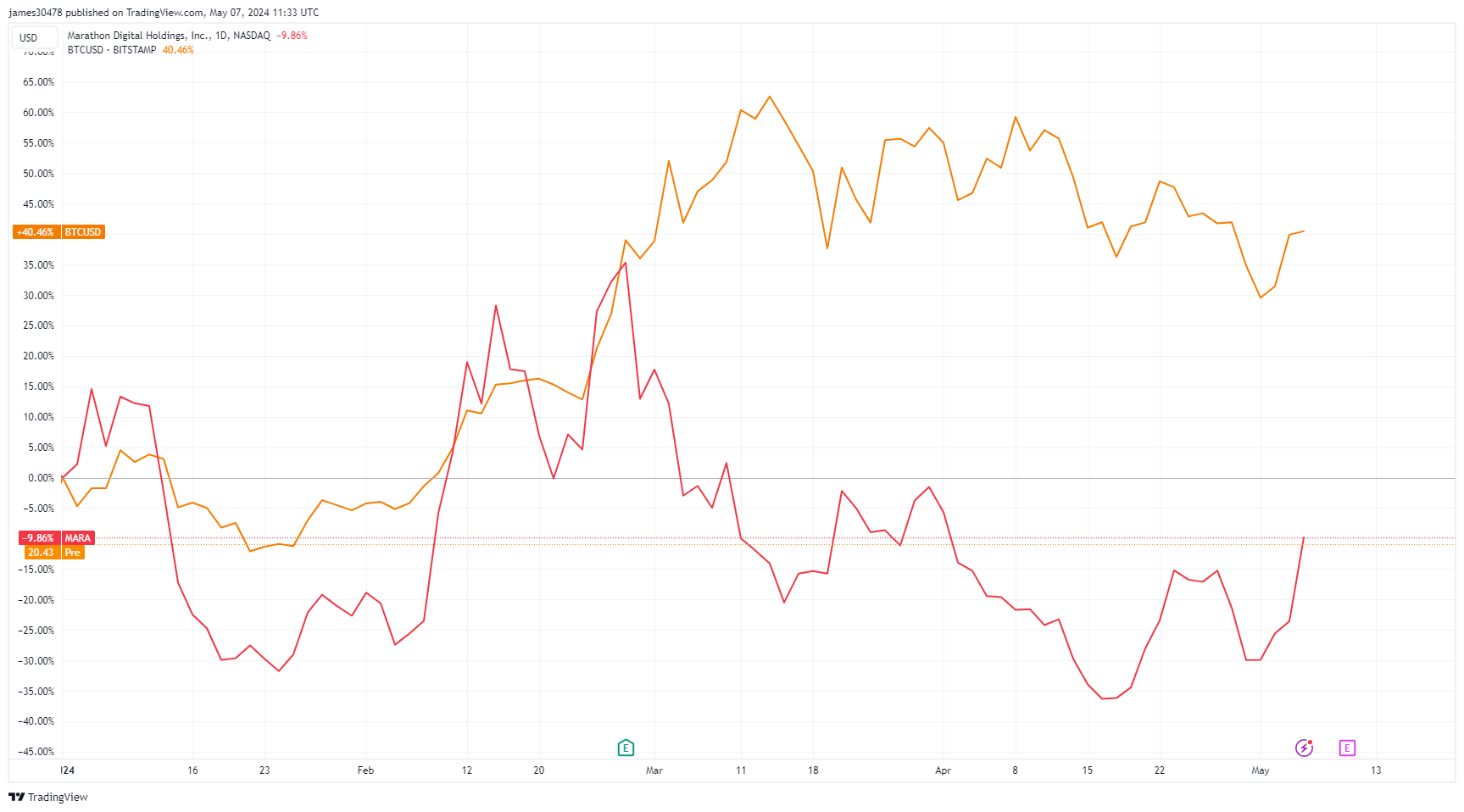

The company reported holding 17,631 unrestricted Bitcoins as of April 30. While Marathon’s stock is down 10% year-to-date, its inclusion in the S&P SmallCap 600 index could provide a significant boost. MARA has significantly underperformed Bitcoin this year, as BTC saw a 40% YTD increase while MARA posted losses.

Investors will closely watch Marathon’s performance as the first publicly traded Bitcoin mining company to be added to an index fund traded on a US stock exchange.

The post As Marathon Digital joins S&P SmallCap 600, shares surge 18% appeared first on CryptoSlate.