Cardano (ADA) has been on a rollercoaster ride in the cryptocurrency market, with its recent price recovery rally encountering some significant challenges.

As of the latest data from CoinGecko, ADA is trading at $0.261, showing a modest 1.7% gain in the past 24 hours, but boasting a seven-day rally of 4.9%. However, beneath the surface, there are signs of growing overhead pressure that could limit ADA’s upward momentum.

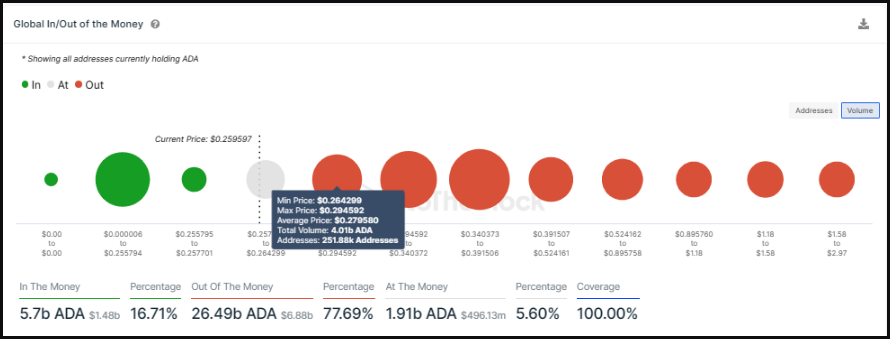

ADA’s journey to reclaim its previous highs faces its first major hurdle at the $0.26 mark. But this is just the beginning, as multiple layers of resistance lie above it, signifying significant supplier congestion levels. The price recovery may be stalling due to these formidable barriers.

Cardano: Key Insights

To gain a deeper understanding of ADA’s current price dynamics, we turn to a new price analysis. Data reveals a crucial level of buying interest at $0.25. In fact, over 600,000 ADA buy limit orders are placed at this level.

This suggests that if ADA can breach the range-high and the 50-day Exponential Moving Average (EMA), it might find support around the mid-range of $0.25.

On the sell side, key sell limit orders start to emerge between $0.265 and $0.270, indicating that there is substantial selling pressure just above the current price levels.

The fate of ADA’s price also hinges on Bitcoin’s performance. Should Bitcoin post losses and dip below $27,500, ADA could follow suit, potentially finding support at the mid-range of $0.25. Conversely, a bullish rally in Bitcoin could set the stage for ADA to re-target its next hurdle at $0.28.

Technical Indicators Signal Caution

Technical indicators are also raising caution flags for ADA investors. The Relative Strength Index (RSI) is currently below the 50 level and trending downward, indicating fading momentum. Furthermore, the Awesome Oscillator (AO) remains in negative territory, signaling a lack of bullish sentiment.

Descent To Range Low Likely

Considering the current market conditions and technical indicators, analysts are leaning towards a bearish outlook for Cardano’s price. There is a possibility that ADA could descend to test the support floor at $0.2415. In a worst-case scenario, the price could plummet further, potentially reaching the range low of $0.2200, marking a substantial 15% drop from its current levels.

While Cardano has shown resilience with its recent gains, the road ahead is riddled with resistance levels, and Bitcoin’s influence remains a significant factor. Investors should closely monitor the developments in ADA’s price, as it navigates through these challenging market conditions. The cryptocurrency landscape is as unpredictable as ever, and ADA’s journey is far from certain.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from