Australia is set to make an entry into the crypto investment landscape with the launch of its first spot Bitcoin exchange-traded fund (ETF) tomorrow. Monochrome Asset Management’s Bitcoin ETF (IBTC) will begin trading on the Cboe Australia exchange on June 4th, pending any last-minute delays. This development marks Australia’s alignment with global trends following the US’s regulatory approval of spot BTC ETFs earlier this year.

Australia Also Introduces Spot Bitcoin ETFs

Monochrome Asset Management, an Australia-based firm, is at the forefront of this launch. The IBTC ETF will trade under the ticker IBTC and carry a management fee of 0.98%. The ETF is designed to offer investors direct exposure to BTC, tracking the CME CF Bitcoin Reference Rate index, which ties its value directly to the spot price. This approach eliminates the complexities and technical challenges associated with purchasing and managing actual Bitcoin.

Prior to this launch, Australian investors could only access Bitcoin indirectly through offshore products or local ETFs that did not hold BTC directly. “Before IBTC, Australian investors were only able to invest in ETFs that indirectly hold Bitcoin or through offshore Bitcoin products, both of which don’t benefit from the investor protection rules under the directly held crypto asset Australian Financial Services Licensing (AFSL) licensing regime,” Monochrome Asset Management stated.

The introduction of IBTC represents a significant regulatory milestone, achieved through the approval of the Australian Securities & Investments Commission (ASIC) and subsequent listing on Cboe Australia. This positions Cboe as the first Australian exchange to list a BTC ETF, ahead of the larger Australian Securities Exchange (ASX), which is also expected to approve spot BTC ETFs by the end of the year.

The approval process for IBTC was relatively swift, reflecting Australia’s intent to keep pace with the global adoption of crypto-related ETFs. Monochrome Asset Management applied for the ETF in April 2024, and the quick turnaround highlights the nation’s regulatory agility in the evolving crypto asset space.

The launch of IBTC taps into a growing interest in regulated investment vehicles. The approval of spot BTC ETFs in the US earlier this year catalyzed substantial inflows from both institutional and retail investors, signaling a broader acceptance of BTC as a legitimate asset class. This trend has been mirrored in other regions, with Canada, Brazil, the UK, Europe, and Hong Kong all seeing the launch of regulated Bitcoin ETFs.

Australia’s foray into this market underscores its commitment to providing secure and accessible Bitcoin investment options within a regulated framework. As the first and only ETF in Australia to hold BTC directly, IBTC offers a new level of investor protection and ease of access, which is expected to attract a diverse range of investors.

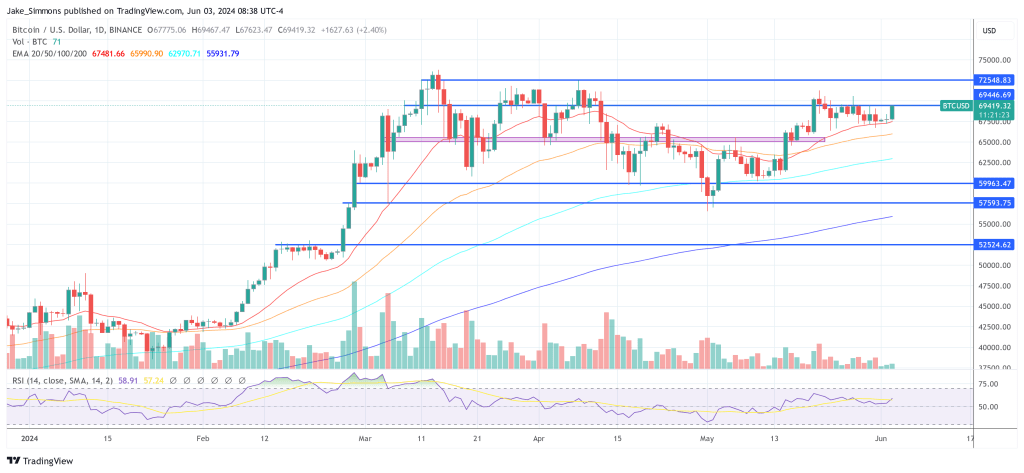

At press time, BTC traded at $69,419.