Avalanche (AVAX), the smart contracts platform known for its fast transaction speeds, is stirring excitement in the crypto world. With a recent price dip seemingly nearing its end, analysts are eyeing a potential breakout that could propel AVAX to new highs. However, amidst the bullish whispers, experts advise a dose of cautious optimism before investors jump on the bandwagon.

A Consolidation Phase Hints At Breakout Potential

The current price movement of AVAX has analysts glued to their charts. The coin is consolidating within a falling wedge pattern, a technical indicator that often precedes a bullish breakout. This consolidation suggests a healthy correction after a previous downtrend, explains prominent crypto analyst Worlds Of Charts.

Consolidating In Falling Wedge Chart Pattern Seems Like Healthy Correction Has Almost Completed Now Getting Ready For Breakout & Preparing For Bullish Continuation Expecting Move Towards 60-65$ In Case Of Successful Breakout #Crypto #Avax pic.twitter.com/XafWguyk8w

— World Of Charts (@WorldOfCharts1) July 1, 2024

The falling wedge is a key signal that AVAX might be coiling up for a significant upward surge, the analyst said. Worlds Of Charts predicts a price surge towards the $60-$65 range if the breakout materializes.

Backing this sentiment, CoinCodex, a popular crypto prediction platform, offers a more aggressive forecast. Their data suggests a staggering 227% increase for AVAX, propelling the price to a lofty $91.46 by August 2nd, 2024.

On-Chain Metrics Reveal Investor Confidence

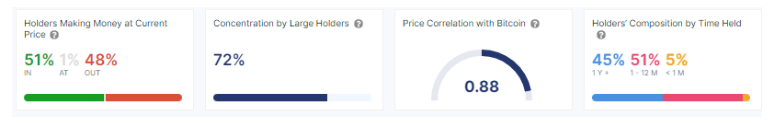

Meanwhile, on-chain data from IntoTheBlock paints a picture of investor confidence. Over half (51%) of AVAX holders are currently in profit, showcasing a positive long-term outlook.

Further bolstering this confidence, a whopping 45% of investors have held onto their AVAX for over a year, indicating a commitment to the project’s long-term vision.

The dominance of large investors, often referred to as whales, in the AVAX ecosystem is another noteworthy point. These whales hold a significant 72% of the circulating supply, contributing to a sense of stability. Whale activity can significantly impact price movements, and their continued investment in AVAX suggests they see value in the platform’s potential.

A Call For Measured Optimism

The recent price dip also serves as a reminder of the inherent volatility in the crypto market. While the falling wedge pattern suggests a potential reversal, a confirmed breakout remains to be seen. With careful analysis and a well-defined investment strategy,

Avalanche could be poised for a significant climb. However, for now, investors are wise to exercise caution and avoid being swept away by the current of bullish enthusiasm.

Featured image from Pexels, chart from TradingView