B2Broker Shakes Up the Market with a Next-Gen Copy Trading Platform

The copy trading industry is growing, and brokers’ demand for sophisticated copy trading solutions that meet their traders’ needs is increasing. In response, the B2Broker team is introducing a new generation of B2Copy, B2Broker’s in-house investment platform!

While many solutions exist for MT4 and MT5, B2Broker is the first company after Spotware (cTrader Copy) to provide enterprise-grade copy trading solutions and the first to introduce PAMM for cTrader.

B2Copy is a 3-in-1 investment platform that combines copy trading, PAMM, and MAM, enabling diverse business models to streamline their investment operations and enhance efficiency. The new generation of the platform includes massive performance upgrades, UI/UX improvements, and deeper customisation options. Let’s explore these in more detail.

Superior Performance Measures

- Ultra-Fast Execution and Extensive User Base

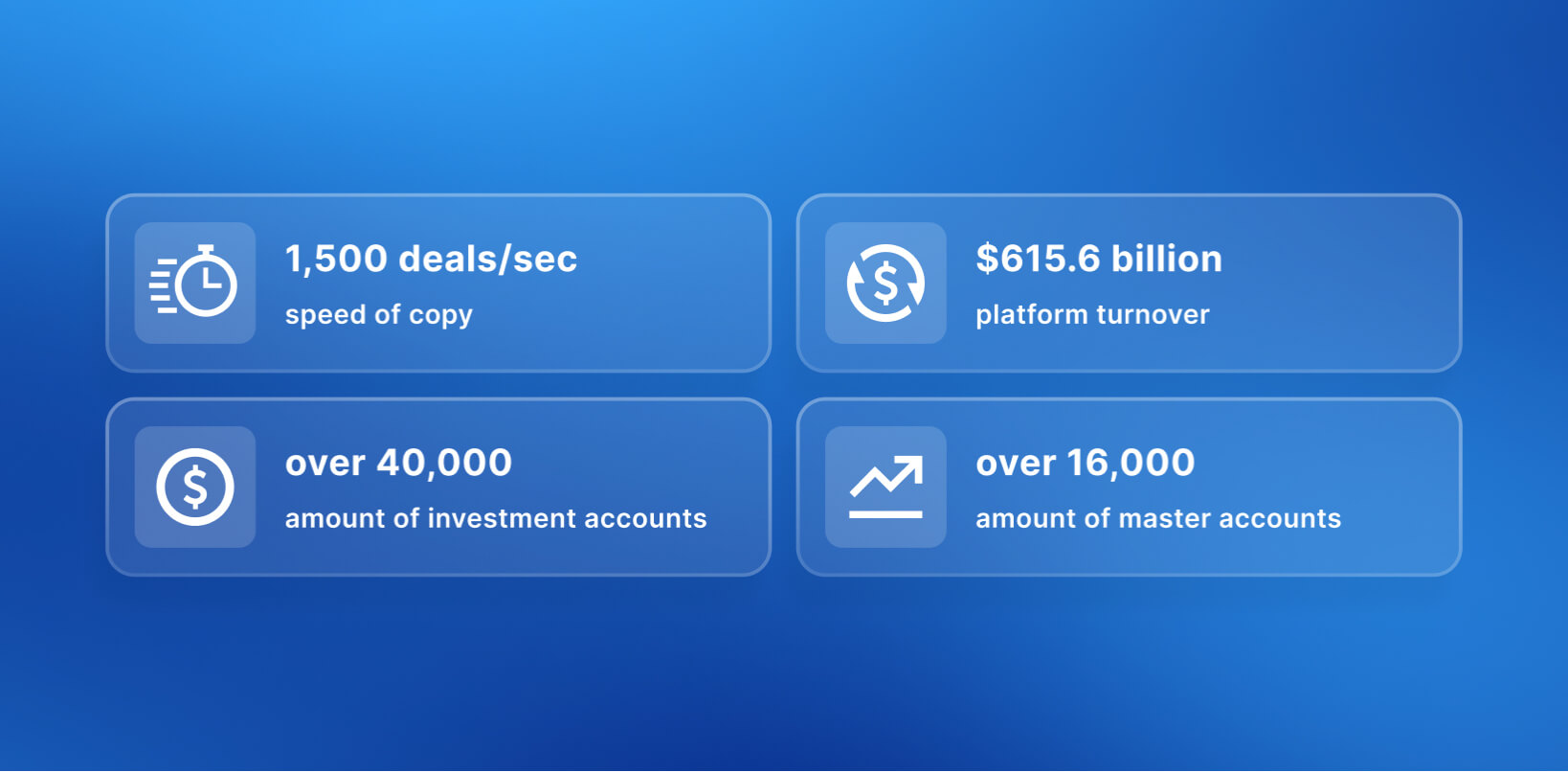

B2Copy ensures maximum trade execution without delays by managing transactions swiftly and effectively, processing approximately 1,500 trades every second. Thanks to the platform’s powerful connectivity features, more than 1,000 investors can be linked to a PAMM master and more than 5,000 investors to a single copy master.

- Platform Turnover

Currently, B2Copy supports 40,000 investment accounts, 16,000 master accounts, and more than 65 active brokers. Between May 2023 and April 2024, it accomplished a total turnover of $615.6 billion, showcasing its significant position in the worldwide trading market and proving its capacity to manage substantial financial volumes.

UI/UX Updates

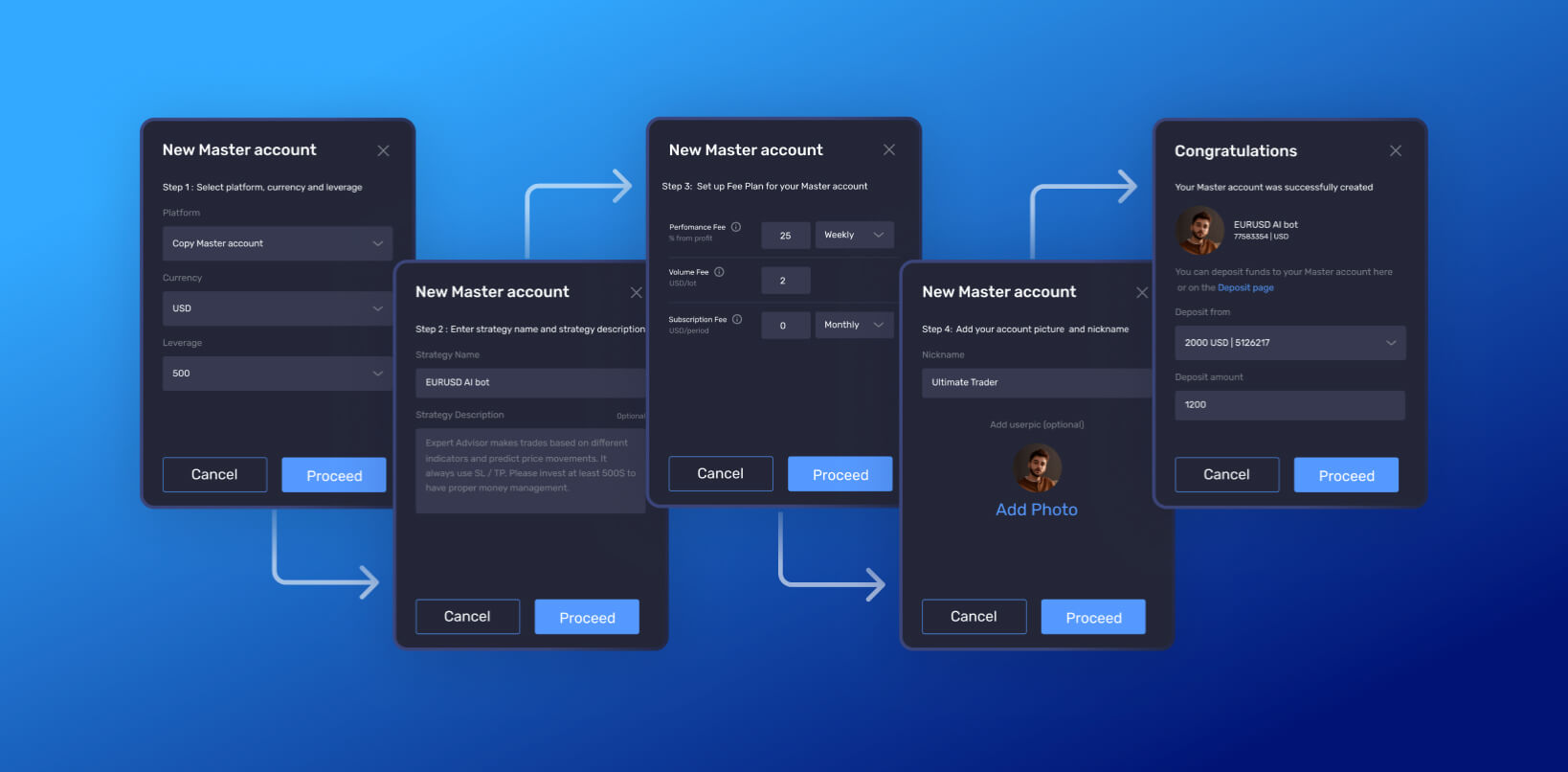

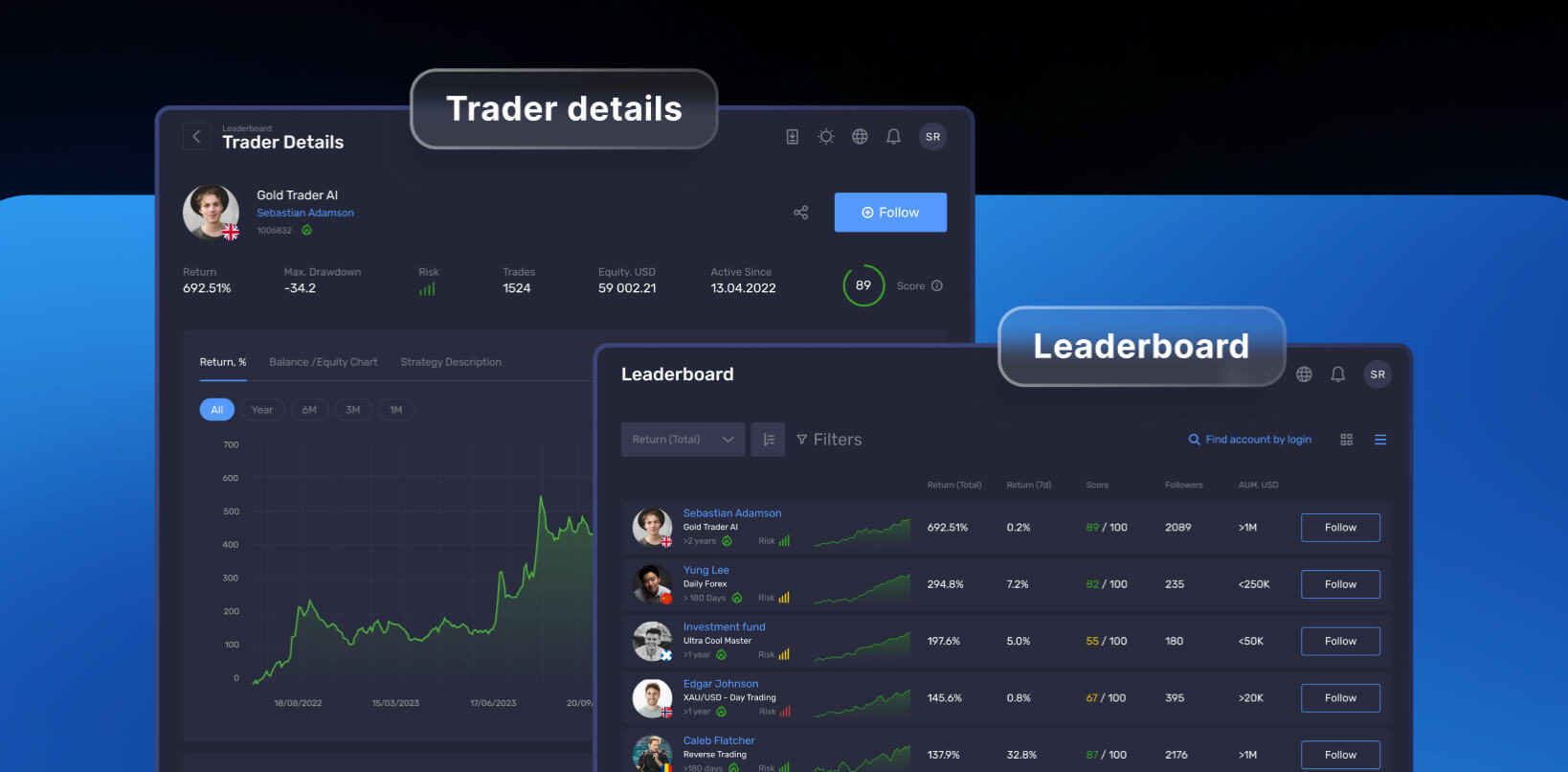

B2Copy’s UI has been redesigned to be more intuitive and visually appealing. Complex processes are simplified into five easy steps with alternatives in guided wizards. Certain tasks can be automated after setting up a master account or becoming an investor, reducing manual effort. Additionally, trading bots are included to boost trading activity and enhance the UX.

More Customisation Options

In the latest edition, several personalisation options have been included. Master traders can add nicknames, images, and descriptions to their accounts to make them more unique and professionally promote themselves. Among the significant customising enhancements are:

- Fee Structure

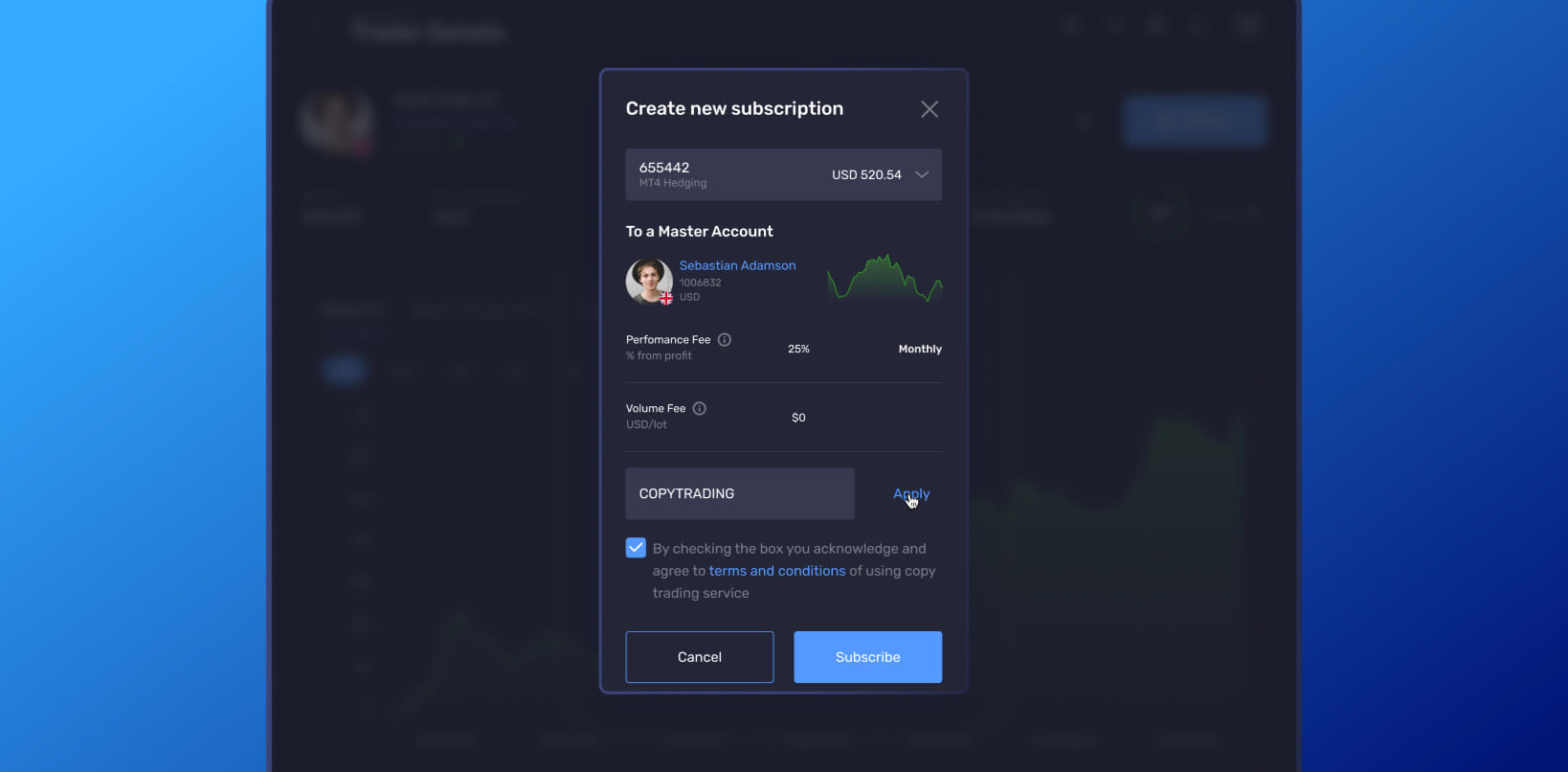

The new pricing structure includes performance, trading, subscription, profit, management, and joining fees. Master traders have two cost management options and six techniques for determining performance fees to bill investors for the signal provision or PAMM account opportunities.

- Modifications to the Minimum Deposit

Masters can specify a minimum investment amount to ensure strategies match account sizes. This feature is essential for a strategy with $1,000 or $10,000 minimum commitments since it provides proper investments, which improves investor satisfaction and performance.

- New Widgets

The data and leaderboard sections of new widgets for brokers’ websites are now separate. Because they can offer direct links to their statistics pages, masters find showcasing their performance on social media easier.

- Promo and Subscription Codes

Promo codes enable masters to establish unique terms and offer exclusive discounts. They can also create private, invitation-only strategies that are password-protected and use subscription codes to promote their strategies beyond the brokerage website. While these accounts appear on the leaderboard, access to detailed information and registration is limited to users with the special code.

- Evaluation and Comprehensive Analysis

The leaderboard’s updated scoring system simplifies identifying top-performing masters using multiple characteristics. Investors can evaluate a master trader’s strategy thoroughly with 29 statistical parameters available on the statistics page. The platform offers over 250 customisable settings to meet the specific needs of each broker and user, ensuring a seamless experience.

Significant Development Ahead

B2Broker, serving numerous large brokerage firms with multiple trading servers for MT4, MT5, and cTrader platforms, is actively developing cross-server copying capabilities. This innovation will enable clients on one server to copy positions from another.

Additionally, B2Broker is crafting a multi-platform copying solution that will allow clients to select their preferred trading platform—be it MT4, MT5, or cTrader—without needing to switch platforms, maximising flexibility for brokers and their clients.

Cutting-Edge Integrations

B2Copy seamlessly integrates with cTrader, MT4, and MT5, allowing investors to maintain their existing accounts and master traders to connect their profiles easily. It also smoothly integrates with in-house CRM, back-office systems, and B2Core, merging features like e-wallets, IB modules, and referral schemes into a unified platform that enhances broker functionality. B2Copy also supports integration with other exclusive broker CRMs, ensuring improved functionality whether used alone or with B2Core.

Final Remarks

B2Copy is an advanced investing platform notable for its innovative features, scalability, and speed. It is a top option for brokers and their end customers globally because of its forward-thinking architecture and significant influence on the trading business.

Brokers that move customers from other Copy/PAMM systems to B2Copy are entitled to a special offer.

Contacts:

+44 208 068 8636

[email protected]

The post B2Broker Shakes Up the Market with a Next-Gen Copy Trading Platform appeared first on CryptoSlate.