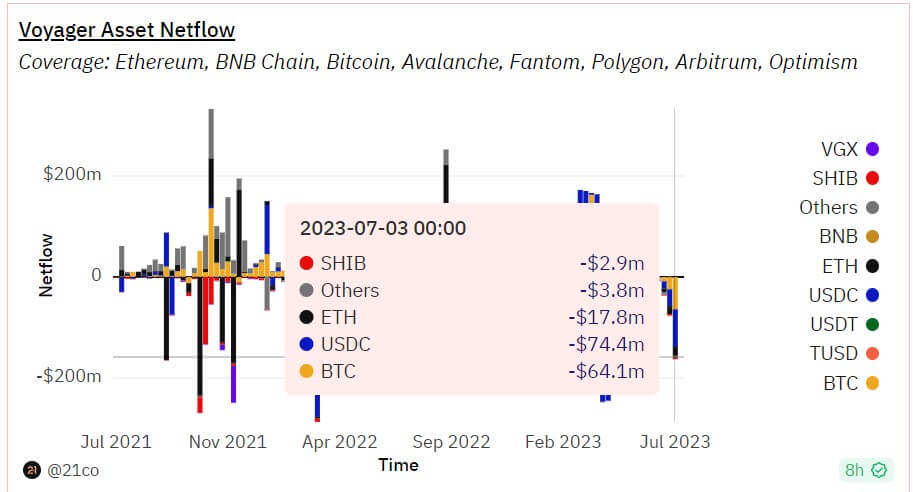

Voyager, the now-bankrupt crypto lender, has seen approximately $250 million in net outflows since it reactivated its withdrawal function on June 23, as per data from Dune Analytics.

Data from Dune showed that Voyager saw massive withdrawals during the week starting July 3, as users withdrew $64 million worth of Bitcoin (BTC), $74 million in USDC, and over $17 million in Ethereum (ETH). The platform also recorded significant withdrawals in Shiba Inu (SHIB) and other cryptocurrencies.

Voyager users have been withdrawing their assets to centralized exchanges, including Kraken, Crypto.com, and others.

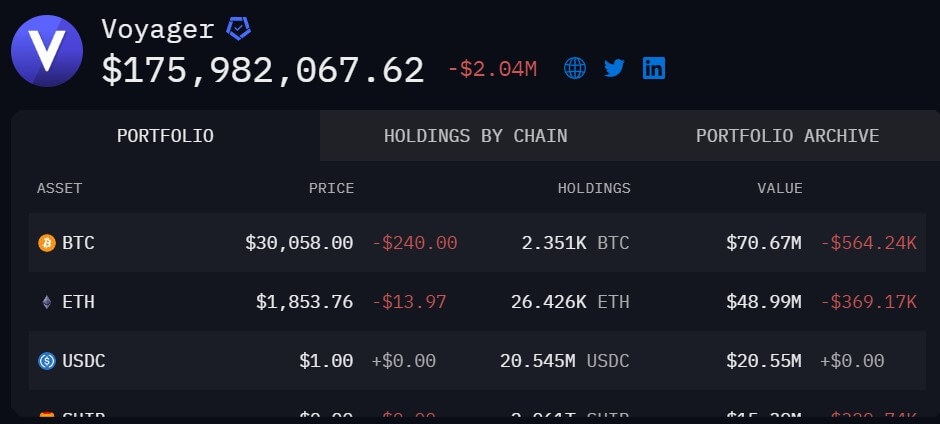

Meanwhile, the Arkham Intelligence dashboard shows that the lender’s current crypto holdings balance is $175.98 million as of July 10.

The lender’s BTC holdings account for $70.91 million of the remaining funds, while its ETH balance is $49.18 million. USDC, SHIB, and its VGX token complete the bankrupt’s firm top five assets balances.

Voyager users withdraw only 35% of assets.

On May 19, the U.S. bankruptcy court approved Voyager’s plan to return over $1 billion in cryptocurrencies to customers.

Following the news, the lender’s bankruptcy plan administrator, Paul Hage, revealed the firm’s plan to open a 30-day window period to allow impacted users to withdraw 35.72% of their balance on the platform.

According to the lender’s website, users who fail to withdraw their crypto assets during this period will be repaid in fiat U.S. Dollars later.

Meanwhile, Hage stated that Voyager’s focus will “shift to recovering additional assets that can be distributed to creditors” after it completes the initial distribution of cryptocurrencies.

Some of the lender’s debtors include the bankrupt crypto hedge fund Three Arrows Capital, which also owes a substantial amount to the failed FTX and its related entities.

The post Bankrupt Voyager experiences $250M withdrawal surge as users move assets to centralized exchanges appeared first on CryptoSlate.