After years of refinement, Ethereum, the world’s largest smart contracts platform, is scaling. However, it does not scale in the way most decentralization purists desire. The network, trying to accommodate all its users, now relies mainly on off-chain solutions using roll-up techniques to process more transactions and relieve the mainnet.

The Ethereum Layer-2 Boom

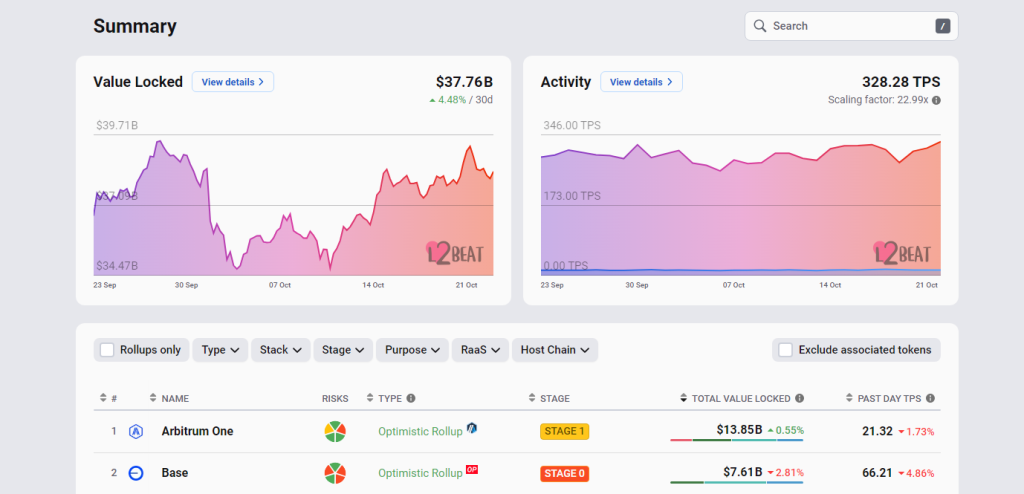

The result has seen a boom with layer-2 platforms. According to L2Beat, all these off-chain solutions scaling Ethereum manage over $37 billion worth of assets. The largest of them all is Arbitrum, which controls more than $13 billion.

Despite the boom, the question of decentralization still lingers. Arbitrum, Base, and other layer-2s on Ethereum might be gaining traction, but most have yet to decentralize.

For example, their developers’ failure to release a decentralized fault-proof system or a sequencer makes them a weakness in the broader Ethereum ecosystem.

Public data shows that Arbitrum has a permissioned fault-proof system, with Optimism having to withdraw after audits reveal flaws. In any layer-2 setup, a fault-proof system exists to ensure any transaction sent to the sequencer is valid, just like it would if sent on the mainnet.

From the fault-proof, it is sequenced before batched and confirmed on the mainnet. There is a fee paid whenever Ethereum validators settle this batch of transactions.

Will L2s Have To Buy Decentralization From Mainnet Validators?

The problem is that fees have fallen fast over the past few months after Dencun’s activation. This trend suggests that low gas fees amidst a booming layer-2 ecosystem could disincentivize validators. While this is a concern, Token Terminal analysts are convinced that this is about to change.

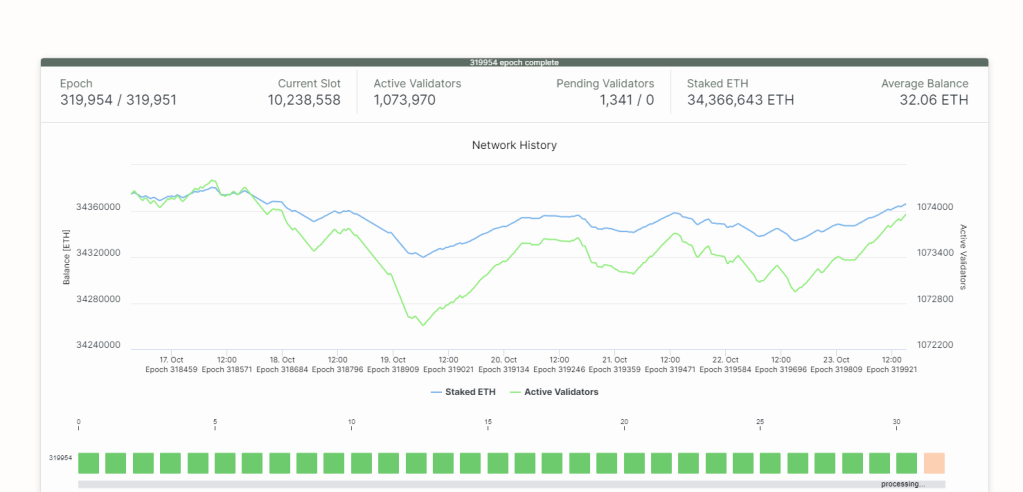

In their prediction, all Ethereum layer-2s will eventually have to “buy” decentralization from mainnet validators. The good news is there are many to choose from. According to Beaconcha.in, over one million validators are securing the blockchain.

Token Terminal argues that though they can also choose to build, creating a complex web of a decentralized network of layer-2 validators will be resource-intensive.

For this reason, buying decentralization from a subset of Ethereum layer-1 validators will be feasible. If picked, these validators will negotiate for better fees than the network offers, significantly increasing their revenues.

At the same time, as the demand for layer-2 decentralization solution rises, the validators’ stream will also spike.