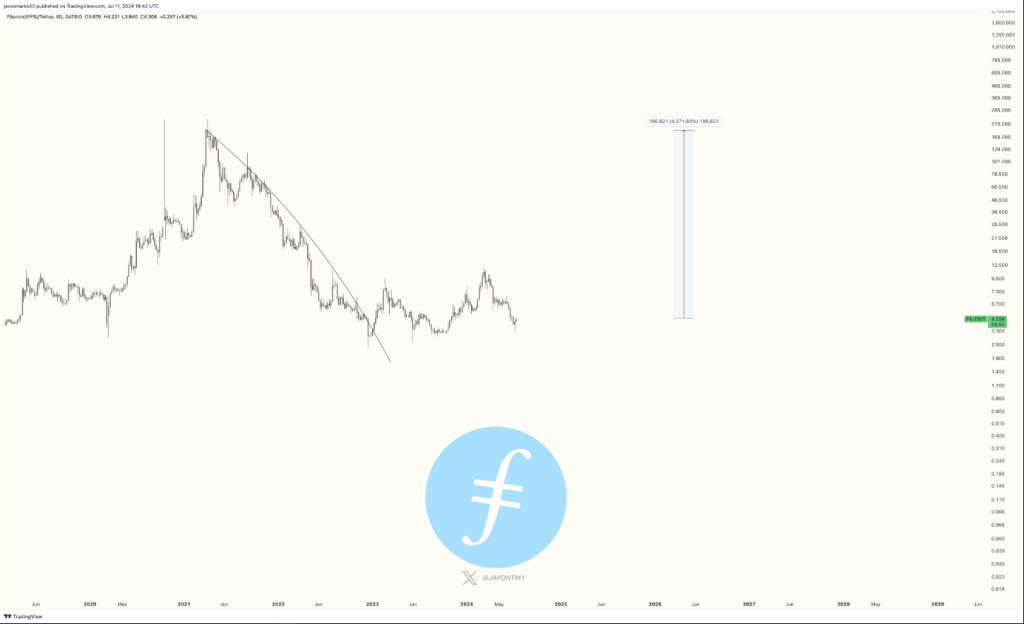

Popular analyst Javon Marks projects a significant 44X increase in Filecoin (FIL), therefore transforming the token from its present value of $4.40 to $190.

This daring prognosis that he calls an “uphill run” has attracted the interest of the bitcoin community. Based on careful technical study and a hopeful perspective of the future of the market, this ambitious projection shows a startling 4310% growth.

Technical Discovery Sparks Hope

Marks’ faith in Filecoin’s promise derives from a recent technological discovery. Marks underlined in his most recent study posted on social networking site X that Filecoin has broken a significant resistance trendᅳa sign usually indicating a positive future.

Though first seeming as a tiny technical bounce, Marks sees this breakthrough as a big indicator of long-term bullish momentum.

$FIL (Filecoin) may only be preparing here for a more than 44X back to the $190 levels as prices hold well broken out of a once critical resisting trend.

As prices hold this breakout, sideways action and pullbacks may only contribute to this >4,310% uphill run. https://t.co/tVPvBKX7mn pic.twitter.com/Vipqp2Xypj

— JAVON

MARKS (@JavonTM1) July 11, 2024

Breaking this level of resistance is a good indication of continuous optimistic tendencies. Even if we see some sideways trade or slight pullbacks, the long-term view remains absolutely bullish as long as the prices maintain above this prior barrier.

Market Mood And Institutional Interest

Beyond technical study, Marks notes other general market elements that could support Filecoin’s development. Institutional investors, many of whom value distributed storage solutions, are showing fresh interest in cryptocurrencies generally. Filecoin’s strong technological architecture helps it to profit from this trend.

It is impossible to overestimate the growing institutional curiosity in distributed storage solutions, the analyst suggested. The demand for Filecoin’s services will naturally rise as more businesses grasp and use these technologies, therefore increasing the value of the currency.

Marks also underlined the generally rising attitude in the bitcoin market. Filecoin stands out among many investors looking for chances with great potential for growth because of its excellent technical basis and market relevance.

Present Market Activity And Prices

Filecoin fetches for $4.40 at the time of writing, a tiny 1.9% rise over the past trading session. Within a 24-hour range of $4.10 to $4.25, the token’s price has varied very steadily but somewhat higher tendency in the short run. These increases have been seen among changing investor attitude and different market situations.

With a good trading volume of $180 million over the past 24 hours, Filecoin indicates strong market activity. Reaching as $2.5 billion, its market capitalisation confirmed its prominence in the crypto scene.

Optimism Among Variability

The analyst counsels investors to approach with cautious optimism even with the positive indications. The natural volatility of the bitcoin market implies that, despite best intentions, forecasts can frequently fall short because of unanticipated market dynamics.

While the technicals and market circumstances are positive, investors need to be cautious of the risks, Marks said. Strong signs might be overwhelmed by unexpected changes; the crypto market is famously erratic. Investors have to be aware of these hazards and control their expectations accordingly.

A Possible Game Change

Strong technical indications and favourable market circumstances help Javon Marks’ study of Filecoin to present a convincing picture of its future. Filecoin’s special position in the distributed storage space might definitely help to open the path for notable expansion as the bitcoin industry develops.

Filecoin is under constant observation by both experts and investors, hence the next months will show if this ambitious projection will materialise or if market volatility will once again change the scene.

Featured image from Binance Academy, chart from TradingView