The post Biggest Crypto Hack in History: Market Crashes After Bybit Faces $1.5 Billion ETH Hack appeared first on Coinpedia Fintech News

The crypto market experienced a significant downturn after Bybit, a prominent cryptocurrency exchange, announced a devastating hack involving $1.5 billion worth of cryptocurrencies. This incident marks the largest crypto hack to date. Recent updates, including statements from the CEO, confirm that Bybit was compromised, resulting in the loss of approximately $1.5 billion in Ethereum.

Bybit Faces Biggest Hack in History

Bybit, the Singapore-based centralized crypto exchange, appears to have been hacked. Early estimates suggest the exchange has lost over $1.46 billion worth of ETH, though the investigation is ongoing.

The CEO described the hack on Bybit’s Ethereum multisig cold wallet, where attackers manipulated the signing interface to trick signers into approving a change in the wallet’s smart contract logic, allowing the theft of all ETH in that wallet.

CEO Ben Zhou said, “Bybit ETH multisig cold wallet just made a transfer to our warm wallet about 1 hr ago. It appears that this specific transaction was musked, all the signers saw the musked UI which showed the correct address and the URL was from Safe. However, the signing message was to change the smart contract logic of our ETH cold wallet. This resulted Hacker took control of the specific ETH cold wallet we signed and transfered all ETH in the cold wallet to this unidentified address. Please rest assured that all other cold wallets are secure. All withdraws are NORMAL. I will keep you guys posted as more develops, If any team can help us to track the stolen fund will be appreciated.”

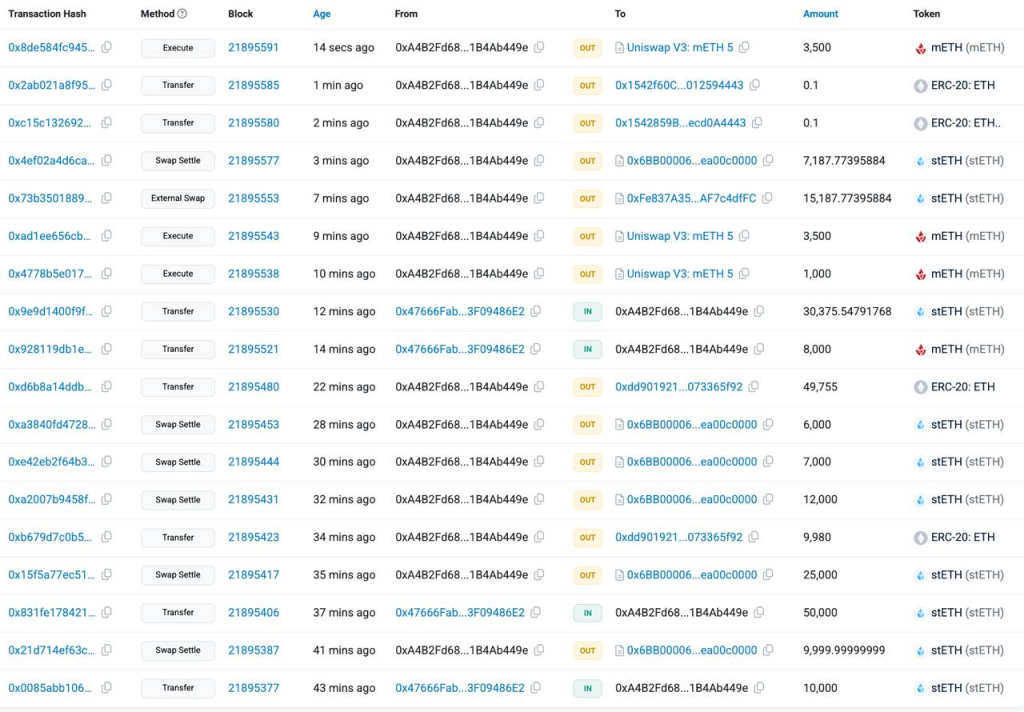

On Tuesday, the exchange announced that it would conduct scheduled maintenance on its live server, extending from today into tomorrow. The hack was first reported by ZachXBT, who noted that according to on-chain data, mETH and stETH were actively being exchanged for Ethereum on decentralized exchanges (DEXs).

The attacker has transferred tens of thousands of Ethereum to 48 different addresses. ZachXBT has called on exchanges and services to blacklist these addresses to prevent further movement of the stolen funds.

Ethereum’s Price Faces a Sharp Drop

The funds were first sent to an address starting with 0x476, which received assets totaling over $1.1 billion, including 400,000 ETH, 90,000 stETH, 15,000 cmETH, and 8,000 cETH. The majority were then transferred to a second address, 0xa4b2f, where they were exchanged on decentralized platforms such as Uniswap, Paraswap, and KyberSwap.

Following the hack, the price of Ethereum has sharply fallen. Coinmarketcap reports that ETH experienced a 5% drop, reaching a low of around $2,680. Meanwhile, the CEO of Bybit has assured that clients affected by the hack will be reimbursed for their lost funds.

He stated, “Bybit Hot wallet, Warm wallet and all other cold wallets are fine. The only cold wallet that was hacked was ETH cold wallet. ALL withdraws are NORMAL.”

He also said, “Bybit is Solvent even if this hack loss is not recovered, all of clients assets are 1 to 1 backed, we can cover the loss.”

Regrettably, this incident is the largest crypto hack in history, surpassing the previous record held by the Ronin Network, where $625 million was stolen.