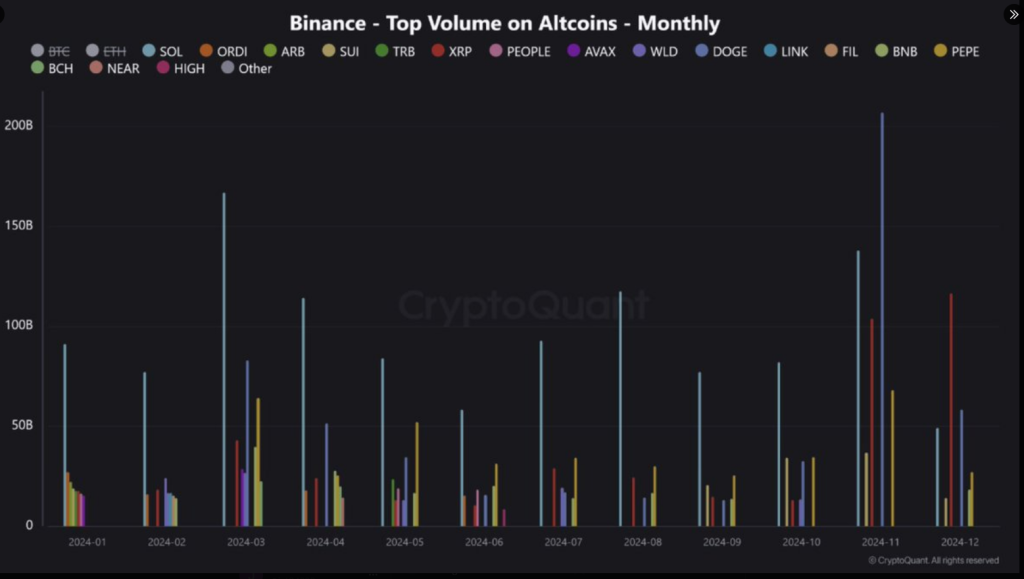

XRP has taken the cryptocurrency world by storm in December, becoming the most traded altcoin on Binance. According to recent data, the coin had an astounding trading volume of more than $116 million on Binance Futures, demonstrating its growing appeal with traders. Despite a tough market, XRP’s success stands out, especially given that other cryptocurrencies, such as Bitcoin, have had large price reductions.

Rising Interest Amidst Market Challenges

The digital currency market as a whole has recently experienced some volatility. Bitcoin and numerous altcoins have battled with falling values, but XRP appears to be doing better than many of its competitors. Though down 11% over the past week, the altcoin is still selling at roughly $2.25 and still shows a pretty decent 250% annual increase in value. This resilience draws investors looking for strong choices in a turbulent climate.

Binance’s Top Traded Altcoin in December ’24

“XRP is the most traded altcoin on the Binance Futures market, with a trading volume of 116.6B already, and the month isn’t over yet.” – By @JA_Maartun

Full post

https://t.co/oR5GhIAZ9e pic.twitter.com/Kv9sZyy0vz

— CryptoQuant.com (@cryptoquant_com) December 23, 2024

Analysts have established a correlation between the velocity of XRP’s recovery from losses and recent declines in the currency. Analysts indicate that the digital asset’s trading volume is notably robust and dynamic in derivatives.

Derivatives trading for XRP increased by 34%, reflecting heightened trader interest in possible price movements. Nonetheless, the open interest in XRP contracts declined, indicating that certain traders might be liquidating their positions due to uncertainty.

Wallet Growth Signals Growing Adoption

The second positive signal coming for XRP is related to wallet holders growth. Santiment data indicates a rise in non-empty XRP wallets of 5.75 million over the past two years, meaning growth of 28%. An increase like this mirrors greater trends in increasing cryptocurrency acceptance seen with the bigger coins like Bitcoin and Ethereum.

The past 2 years have seen big increases in cryptocurrency holders. Here are the number of non-exmpty wallets for crypto’s top 4 coins by market cap:

Bitcoin $BTC: 54.7M (+27% rise)

Ethereum $ETH: 134.9M (+47% rise)

Tether $USDT: 6.57M (+66% rise)

XRP $XRP: 5.75M (+28% rise) pic.twitter.com/rcd50VAikZ— Santiment (@santimentfeed) December 23, 2024

The rise in wallet numbers shows that more investors are now ready to stick on XRP for the long run, therefore stabilizing its price and raising its market presence. XRP is predicted to be the center of attention for traders and investors both as curiosity rises.

Featured image from X/@RippleXrpie, chart from TradingView