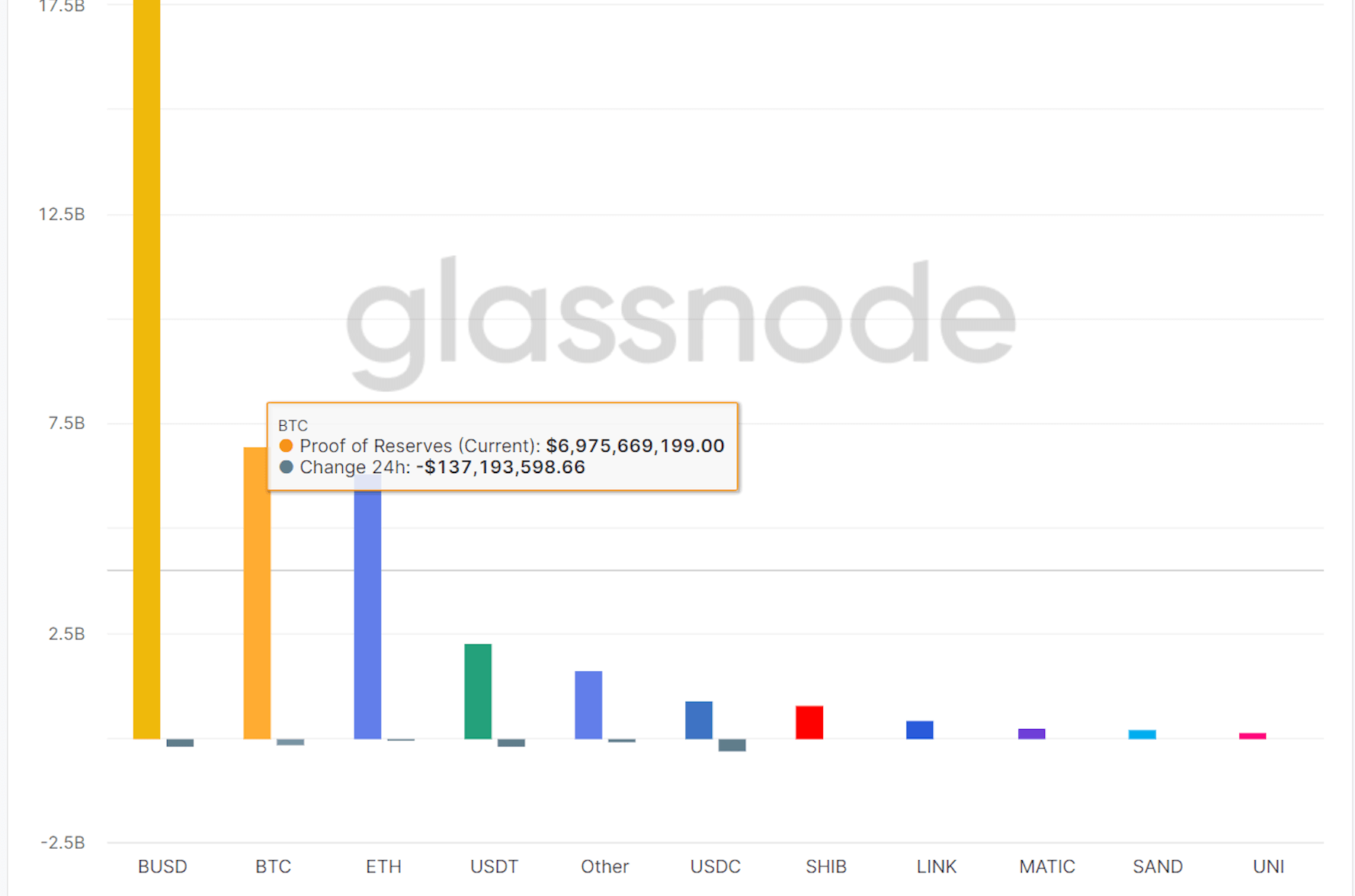

Glassnode data analyzed by CryptoSlate shows that leading exchange Binance offloaded $137 million worth of Bitcoin (BTC) in the last 24 hours.

In the meantime, nearly $32 million worth of Ethereum (ETH), $300 million worth of USD Coin (USDC), and $200 million in both Binance USD (BUSD) and Tether (USDT) were withdrawn. The total withdrawals equate to over $860 million.

Considering that BTC is currently following an upwards trajectory, Binance’s loss could increase in accordance with the BTC price. At the time of writing, BTC is being traded for around $17,390. According to CryptoSlate data, BTC increased 0.14% in the last hour. It also recorded 1.37% and 1.14% spikes in the last 24 hours and seven days, respectively.

Binance halts USDC withdrawals

On Dec. 13, Binance’s CEO Changpeng Zhao (CZ) Tweeted to say that the exchange suspended USDC withdrawals temporarily.

CZ explained that Binance saw an increase in USDC withdrawals recently. Since the exchange converts them 1:1, CZ said that the exchange must pay the banks a visit to supply the withdrawal requests.

He said the withdrawals were suspended not because the exchange lacked the resources but because the banks were slow in meeting Binance’s withdrawal demand.

Large transfers that caught the eyes

TRON DAO’s CEO, Justin Sun, said he deposited 100 million USD into Binance to help with Binance’s liquidity crisis.

Sun withdrew $34 million worth of BUSD and $15.4 million worth of USDT from Binance earlier on Dec. 13. He reportedly transferred these funds to Paxos and Circle to cash out, and said that these transactions were “just normal business cooperation.”

In the meantime, according to crypto reporter Wu Blockchain, Wintermute reportedly withdrew $153 million worth of USDC from Coinbase and transferred around $150 million of it to Binance.

The post Binance offloaded $140M in Bitcoin in the last 24 hours appeared first on CryptoSlate.