The Commodities Futures Trading Commission (CFTC) filing against Binance represented the culmination of increased regulatory pressure on the crypto industry.

On March 27, the CFTC sued the company, its CEO Changpeng Zhao (CZ), and its compliance lead Samuel Lim for violating commodities regulations in the U.S. The market reacted switftly to the filing, with Bitcoin dropping 5% and sinking to a 10-day low of $26,500.

In the immediate aftermath of the filing, there was tangible fear of contagion. With Paxos faced with a Wells notice for its issuance of BUSD, the exchange was already on thin ice with regulators. A bombshell report from FT further pressured the exchange, alleging it lied about its ties to China.

The fears about a broader market downturn were largely unfounded. Bitcoin cracked $28,000 the day after the filing, regaining its losses from the previous day and creating solid support.

However, rising outflows from Binance worried analysts as many saw it as a sign of the exchange losing its footing on the market.

A recent report from Glassnode dove deep into net coin flows through the exchange, finding that Binance saw the largest net outflow of stablecoins in history at the end of March.

This is in line with the overall decline in the USD value of Binance’s reserves, which decreased by 45% since the collapse of FTX in November 2022.

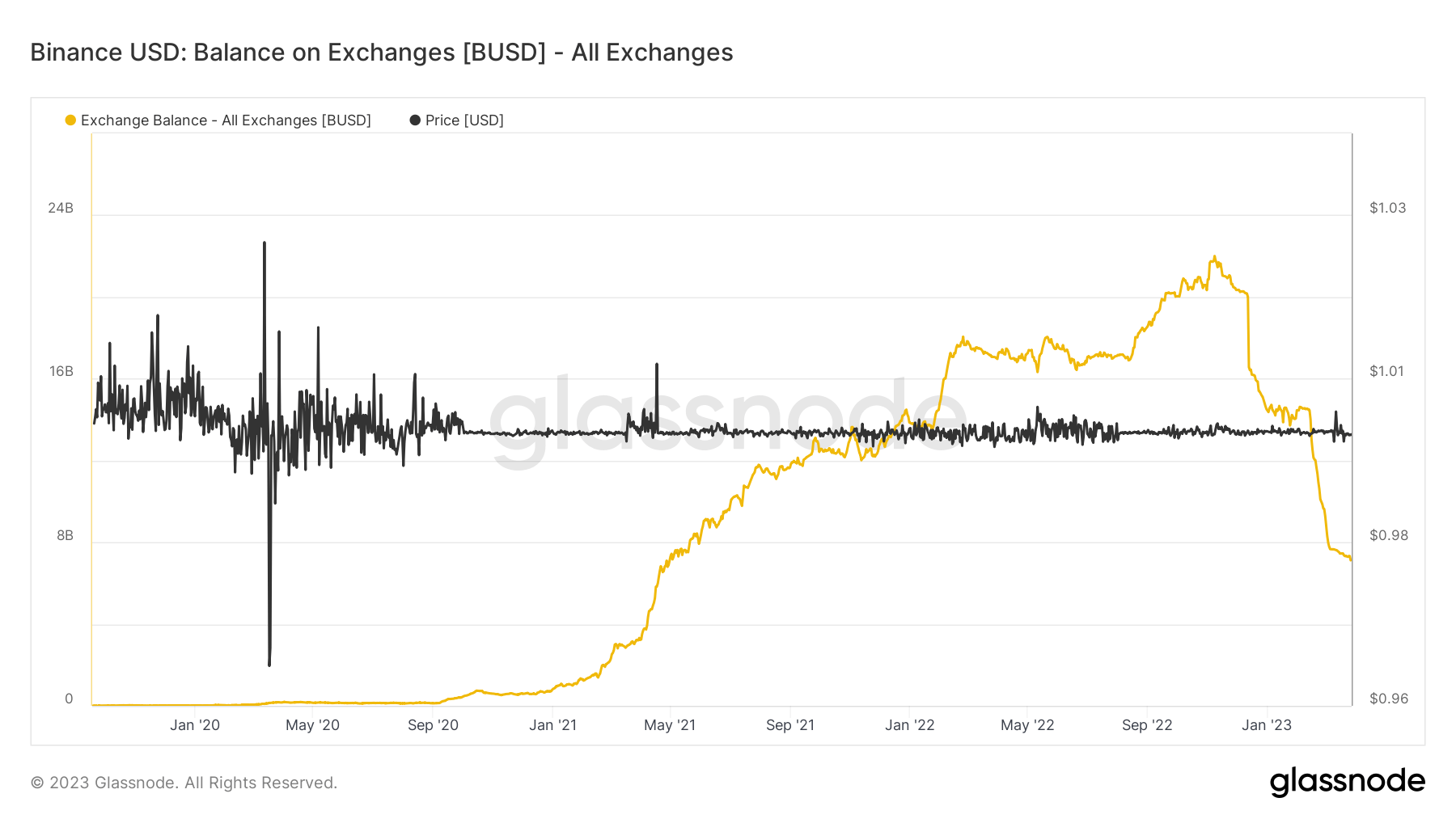

The report also notes there has been a significant outflow of BUSD from Binance. This is in line with CryptoSlate’s previous analysis, which found that roughly $14 billion worth of BUSD left exchanges since November 2022.

BUSD outflows caused the Bitcoin trading volume on Binance to drop 13%, reaching its lowest level in over 8 months.

Further Glassnode research found that the decrease in stablecoin balances hasn’t affected Bitcoin. Analyzing the coin-denominated balances of BTC shows that Bitcoin reserves on Binance increased by 67,930 BTC since the beginning of the year. On the other hand, ETH reserves on the exchange have remained mostly flat.

“Despite the developing friction between Binance and regulators, the platform appears to be primarily experiencing a stablecoin shuffle, and remains the largest centralized exchange in the market,” the report concluded.

The massive stablecoin outflows are a direct result of the ongoing banking crisis in the U.S. The domino effect that began with the collapse of Silicon Valley Bank erased a good chunk of investor confidence in stablecoins. At the beginning of March, nine out of the top 10 stablecoins by market cap traded below their peg, revealing the fragility of the asset class that led traders to seek stability in Bitcoin.

Despite its decreasing stablecoin balances, Binance still remains the largest centralized exchange on the market. A rising BTC balance on the exchange further confirms this trend, showing investors prefer its highly-liquid market for deploying the newly acquired BTC.

The post Binance’s regulatory woes don’t seem to scare crypto investors appeared first on CryptoSlate.