The post BiT Global vs. Coinbase: What’s the Truth Behind the Lawsuit? appeared first on Coinpedia Fintech News

Coinbase and BiT Global Digital Limited are in court over Coinbase’s decision to delist wrapped Bitcoin (wBTC). It’s not just about a token; it’s about risk, reputation, and trust in the crypto ecosystem. Sun affiliated BiT Global filed a lawsuit against Coinbase and they have submitted a response to it.

BiT Global isn’t happy with the delisting. They’ve accused Coinbase of damaging their reputation and profits. Meanwhile, the exchange has made it clear: their priority is user safety, not BiT’s business interests.

What’s About wBTC Delisting?

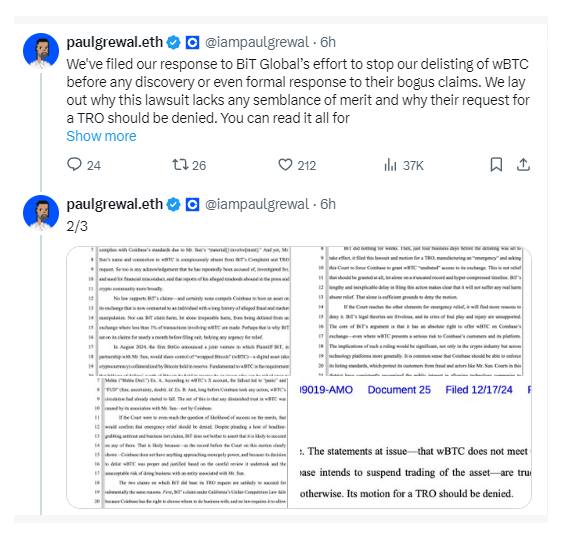

Coinbase decided to drop wBTC from its listings after discovering BiT Global now controls the token. What is the problem with that? Well, BiT Global is tied to Justin Sun and he has faced allegations of fraud, market manipulation, and is even under investigation by the FBI. Paul Grewal, Coinbase’s Chief Legal Officer, addressed the situation directly in a tweet. He called BiT’s claims “baseless” and reaffirmed the commitment of the exchange to protect its platform and users.

For Coinbase, this connection was a red flag. They use strict reviews to make sure all listed assets meet their safety and integrity standards. To them, wBTC no longer made the cut. But BiT Global claims this move hurts them and wBTC users worldwide. They’ve gone to court to stop the delisting, asking for a Temporary Restraining Order (TRO).

Coinbase’s Defense: Facts Over Fears

Coinbase’s legal team isn’t holding back. In their response, they pointed out that BiT delayed filing the TRO until days before wBTC’s delisting. If it was so urgent, why wait? They also argued that the delisting wouldn’t make much of a dent. Less than 1% of global wBTC trading happens on Coinbase. So even if they delist it, the impact on the market is tiny.

And the bigger issue? Reputation. According to Coinbase, any damage to wBTC’s trust didn’t start with their decision. It started with Justin Sun’s history. Legally, Coinbase stood firm. They said platforms have the right to decide what assets they list. No one can force them to list something they believe puts users at risk.

What Comes Next?

The case is heading to court on December 18, 2024. Coinbase seems confident in their stance, and they’re sticking to their decision. For BiT Global, this is a tough fight—they’ll need to prove their claims hold water. The outcome could change how crypto platforms handle delistings in the future. But for now, Coinbase has one focus: protecting their platform and the people who use it.

This isn’t just another crypto dispute. It’s about setting standards for safety and trust in an unpredictable industry.