Bitcoin (BTC) continues to trade below the $85K level, fueling fears of further downside as the bearish trend remains intact. Bulls are losing momentum, failing to reclaim key resistance levels and hold lower demand zones, raising concerns about a potential continuation of the correction.

Macroeconomic uncertainty and volatility remain key drivers of price action, with erratic policy decisions from U.S. President Donald Trump adding to the turbulence in both crypto and traditional markets. The global trade war narrative and tightening monetary conditions continue to weigh heavily on risk assets, contributing to Bitcoin’s inability to sustain a meaningful recovery.

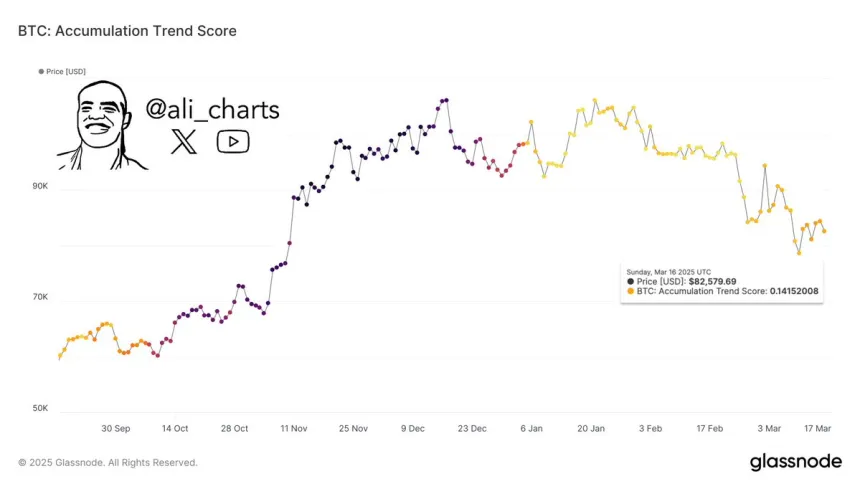

However, there is a shift in market behavior that could indicate a turning point. Key metrics from Glassnode reveal that after three months of distribution, Accumulation Trend Scores hint at early signs of BTC accumulation. Historically, a transition from distribution to accumulation has often preceded a recovery phase, suggesting that investors might be stepping back in at these lower levels.

The next few weeks will be crucial, as Bitcoin’s ability to hold support and attract fresh demand will determine whether the market is preparing for a rebound or a deeper correction.

Bitcoin In Correction Mode – Accumulation Trends Hint At A Possible Shift

Bitcoin has officially entered correction territory after losing the $100K mark, and the bearish trend was fully confirmed when BTC failed to hold above $90K. Since reaching its all-time high (ATH) of $109K in January, Bitcoin has dropped over 29%, and it appears this trend could continue as global macroeconomic conditions remain unfavorable.

Trade war tensions between the United States and key global economies like Europe, China, and Canada continue to pressure financial markets, leading to uncertainty and risk-off sentiment. As these geopolitical issues intensify, both crypto and traditional markets remain highly volatile, struggling to find stability.

However, not all indicators are bearish. Ali Martinez shared insights on X, revealing that the tide is turning for Bitcoin. After three months of distribution, the Accumulation Trend Scores model is hinting at early signs of BTC accumulation. Historically, these phases signal that large investors are re-entering the market, positioning themselves ahead of a potential recovery.

This accumulation phase is a critical turning point that will determine whether Bitcoin sees a fast recovery above key supply levels or a long consolidation period before the next major move. The next few weeks will be decisive for BTC’s short-term outlook.

$80K Retest on the Horizon?

Bitcoin is currently trading at $83,000, caught in a tight consolidation as it struggles to break above $85K while maintaining support at $82K. This range-bound price action has left investors uncertain, with bulls attempting to reclaim higher levels and bears pressing for further downside.

If bulls want to regain control, BTC must push above $89K, a key resistance level aligned with the 4-hour 200 moving average (MA). A successful breakout above $90K could confirm a recovery trend and open the door for further gains toward $95K and beyond.

However, if Bitcoin fails to break above $90K in the coming sessions, the risk of a deeper correction increases. Losing $82K could send BTC into a downward spiral, potentially retesting $80K or even lower levels. With market sentiment still fragile, the next major move will likely determine the short-term trajectory of Bitcoin’s price action.

Featured image from Dall-E, chart from TradingView