On-chain data shows the Bitcoin active addresses metric has been decreasing recently, a sign that investors may be losing interest in BTC.

Bitcoin Active Addresses Have Taken A Hit Recently

As an analyst on X pointed out, the active addresses metric may signal that the network activity has dropped recently. The “daily active addresses” is an indicator that measures the total number of addresses taking part in some transaction activity on the blockchain daily.

This metric naturally counts both the senders and receivers. It only accounts for unique addresses, meaning that even if a wallet makes several transactions in a single day, its contribution towards the indicator’s value will remain one unit.

The number of active addresses on the network may be considered analogous to the total number of unique users visiting the blockchain, so this indicator can tell us about the amount of traffic the Bitcoin network is receiving.

When this metric’s value is high, many addresses are making transfers on the chain right now. This trend can be a sign that the users are currently finding the network attractive.

On the other hand, low values of the indicator imply low usage of the chain, which may indicate that the interest in the cryptocurrency is low among the general investor.

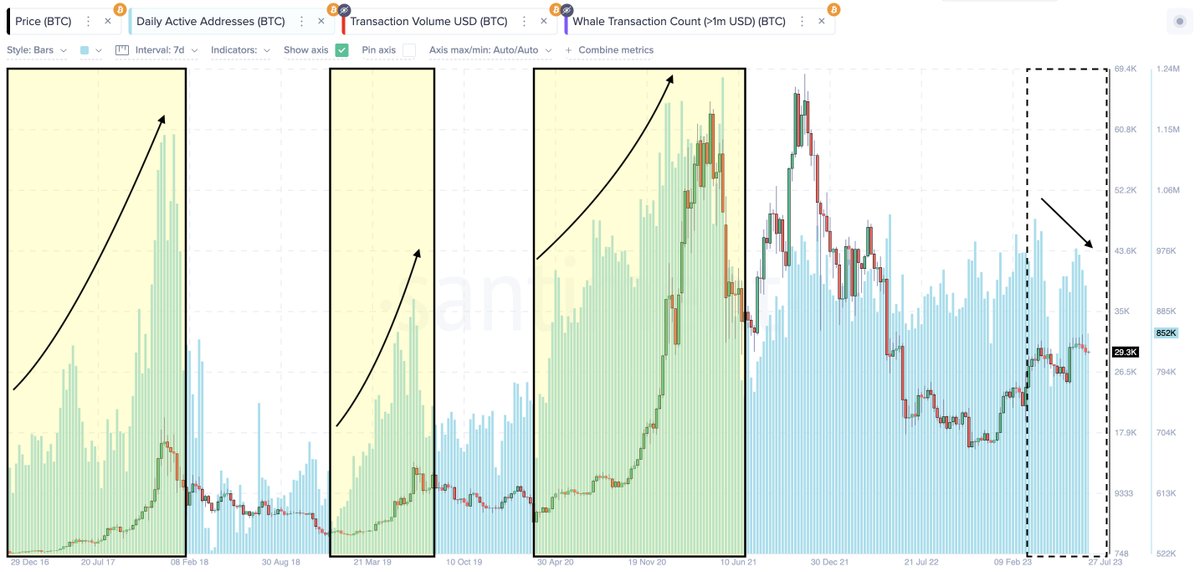

Now, here is a chart that shows the trend in the daily Bitcoin active addresses over the last few years:

As displayed in the above graph, the Bitcoin daily active addresses surged when the rally above the $30,000 mark occurred. Generally, investors get FOMO’d into the asset whenever such sharp price action happens, so the blockchain activity naturally shoots up.

The excitement of the rally could only last for so long, however, as the indicator had hit a top after a while when investors had started getting bored from the sideways movement that BTC had fallen to.

This endless asset consolidation had slowly pushed investors away, as the metric had started to register a decline outright. Around the recent peak in the daily active addresses, the metric’s value was more than 970,000, but today it has fallen to just 852,000. This means that around 852,000 users are currently taking an active part on the blockchain.

In the chart, the analyst has also marked the trend that the indicator followed during previous major uptrends in the price. It would appear that the active addresses have generally gone up in the past as the asset has continued its rally.

This makes sense, as such significant price moves are only feasible when a constant fuel supply comes into the market in the form of traders. Without a stream of users joining the network, any such move wouldn’t be sustainable, and hence, it would fail before long.

As the Bitcoin daily active addresses are instead going down recently, it’s unlikely that the price would be able to amass together an upward move right now.

BTC Price

At the time of writing, Bitcoin is trading around $29,300, up 1% in the last week.