On-chain data shows the Bitcoin adoption rate has slowed to the lowest since July 2018. Here’s what could be behind this trend.

Bitcoin New Addresses Count Has Plunged To Multi-Year Lows

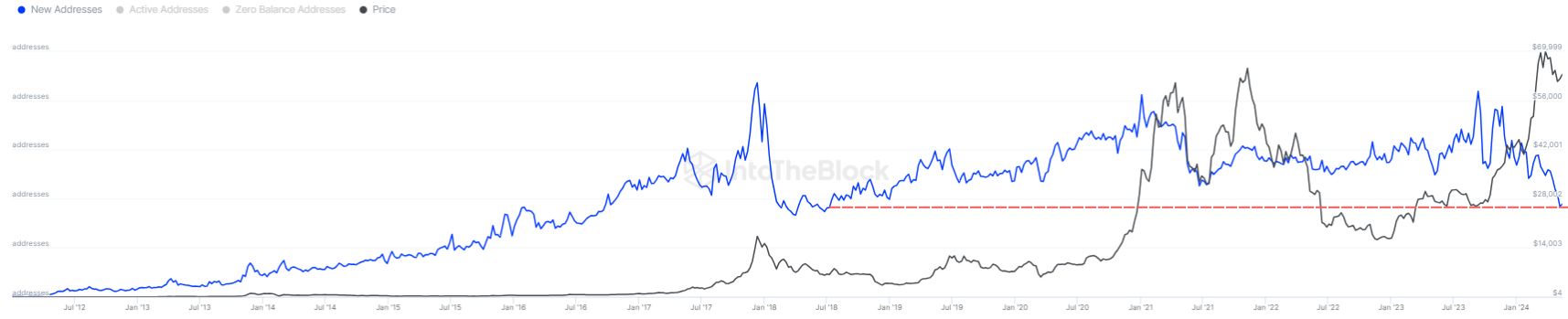

According to data from the market intelligence platform IntoTheBlock, an interesting trend has appeared in the Bitcoin New Addresses metric. The “New Addresses” indicator keeps track of the total number of new addresses created on the BTC network every day.

When this metric has a high value, it suggests many new addresses are currently popping up on the blockchain. Such a trend could indicate that new investors are entering the cryptocurrency.

However, this isn’t the only reason why the metric would register an increase, as old investors who had exited earlier could also contribute to the indicator’s value when they return. Holders making multiple wallets for privacy purposes would also naturally influence the metric.

In general, though, all of these are happening at once to some degree, so on the net, some adoption would occur for the asset. Thus, a high number of new addresses can be a bullish sign in the long term.

On the other hand, the indicator’s low value potentially suggests the cryptocurrency isn’t currently attracting fresh investors. Naturally, this would possibly imply a bearish outcome for the asset.

Now, here is a chart that shows the trend in the 7-day average New Addresses metric for Bitcoin over the history of the asset:

As the above graph shows, the 7-day average of Bitcoin New Addresses has declined this year. This suggests that fewer and fewer new hands are potentially entering the asset.

Following the latest decrease, the metric’s value has dropped to just 276,000, the lowest since July 2018. The chart shows that a sharp cooldown in new addresses has generally coincided with the end of bullish periods.

Thus, going by this pattern, the latest rally may have run out of steam. There can, however, be alternative reasons for the recent trend rather than just a lack of interest among investors.

A big event for Bitcoin at the start of the year was the approval of spot exchange-traded funds (ETFs) by the US Securities and Exchange Commission (SEC).

Spot ETFs are investment vehicles that provide an alternate route of gaining exposure to the cryptocurrency in a format that’s more familiar to traditional investors.

It’s possible that the new users these days simply prefer to buy into spot ETFs instead. Since this adoption is happening off-chain, it makes sense why an on-chain metric wouldn’t be able to detect it.

BTC Price

At the time of writing, Bitcoin is trading at around $66,100, up more than 5% over the past week.