Futures open interest is the total amount of funds (USD Value) allocated in open futures contracts.

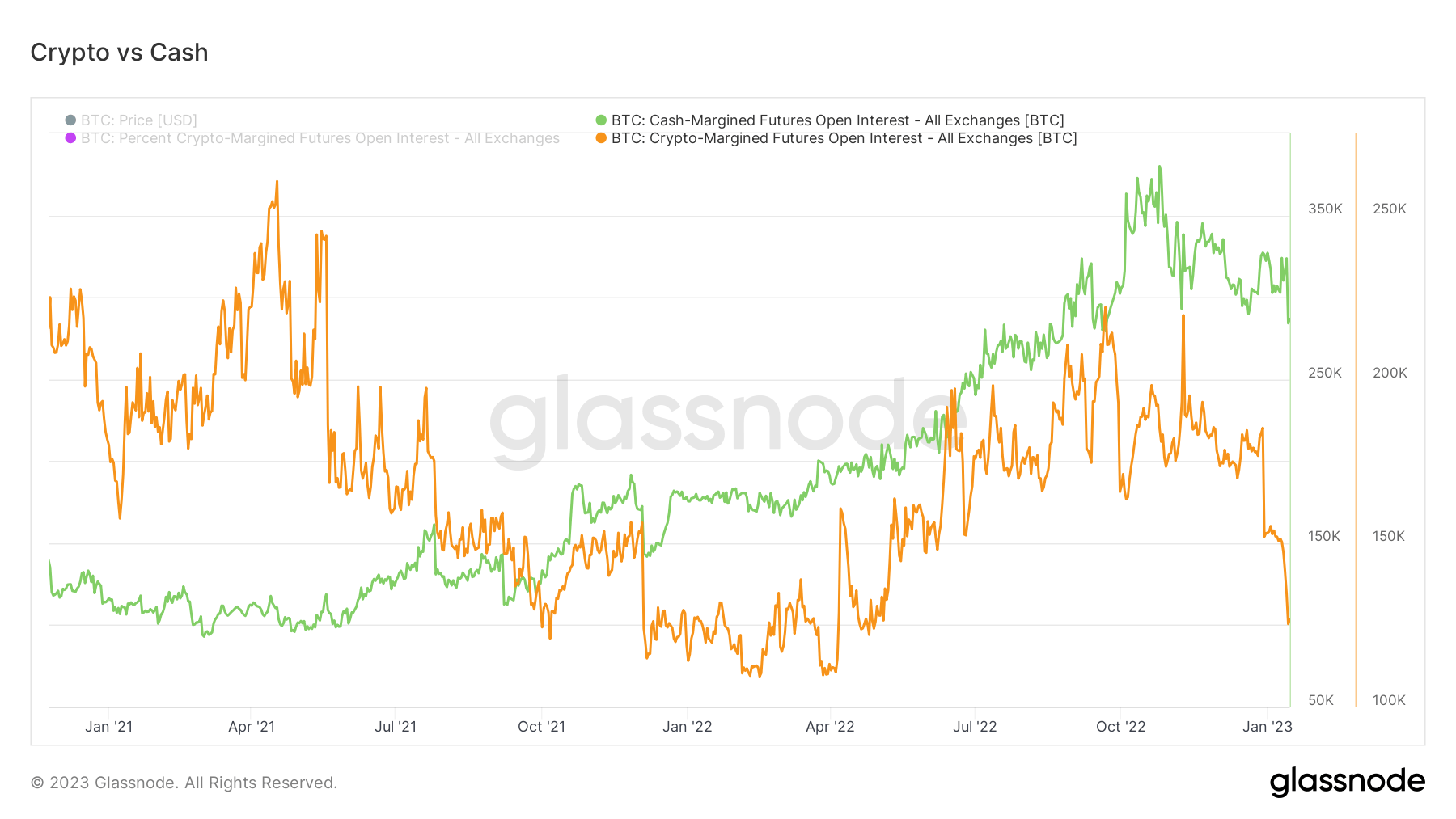

At the time of writing, futures open interest is around 415k BTC, equivalent to $8.5bn. However, the instrument that is being used that is either margined in USD or USD-pegged stablecoins or crypto margin ie BTC.

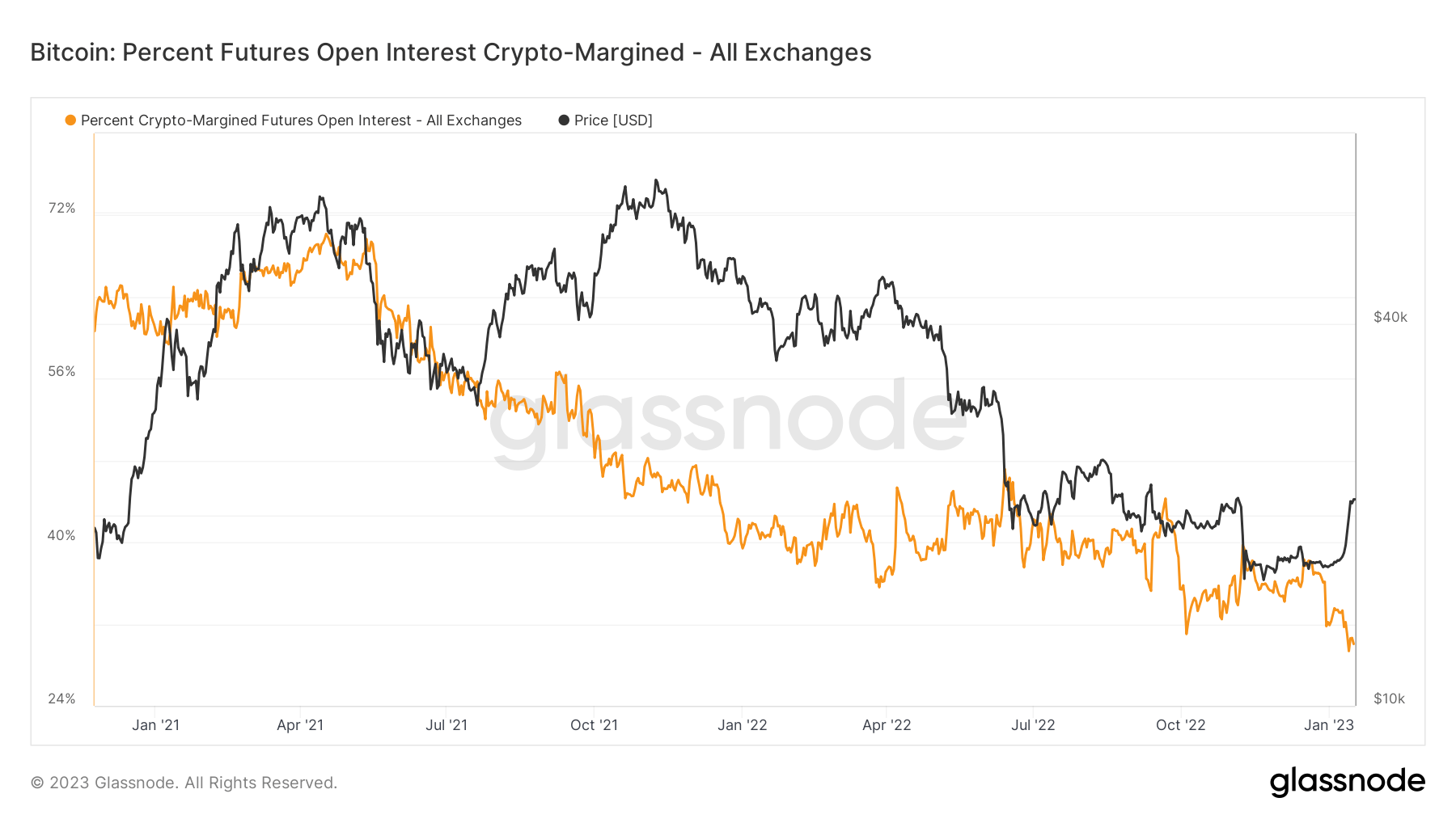

Currently, crypto margin is at an all-time low (29%), for the the percentage of futures contracts open interest that is margined in Bitcoin.

This suggests the environment in 2023 is risk off as 60k BTC in open interest have declined since the turn of the year.

The post Bitcoin: All-time low, 29% in crypto-margin futures open interest, suggests risk-off environment appeared first on CryptoSlate.