The rejection of lower prices after the climactic drop in early August assuaged trades. Despite the welcomed recovery, Bitcoin bulls are yet to build on the momentum and break above the local resistance levels. Even so, traders are optimistic, expecting buyers to take charge and resume the uptrend set in motion in Q1 2024.

In their forecasts, more analysts think any breakout above $72,000 and July highs could spark a wave of demand that may see Bitcoin record fresh all-time highs above $73,800.

Bitcoin Breaking To All-Time Highs Will Take Time

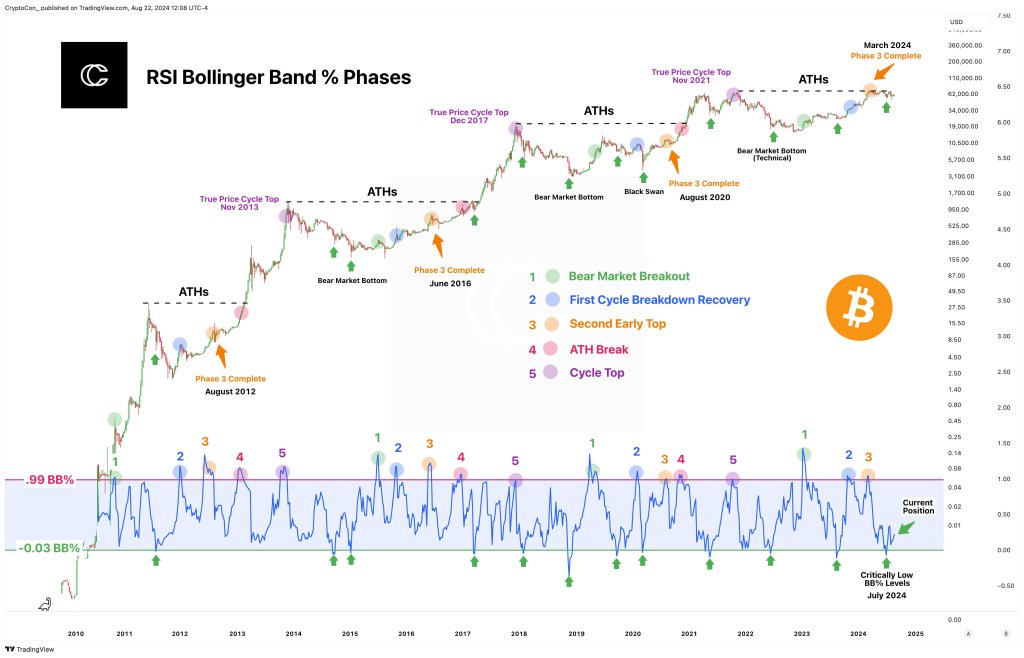

Taking to X, one trader, pointing to Bitcoin’s historical price cycles, is convinced that there are two more phases to go before the coin breaks an all-time high and registers fresh all-time highs. In the past, all cycles tops–from the RSI Bollinger Band % Phases indicator, the analyst continued, tend to print out on the fifth move. So far, only three of these five cycles have been completed.

Judging from the current state of price action, another analyst, commenting on this preview believes Bitcoin bulls may not have the momentum to break above $73,800 and sustain this level on the first attempt.

Instead, in the next two months or so, between September and October, the all-time high will be conquered. However, these gains will be extended with the coin printing new all-time highs in early January 2025. This forecast will align with the Bitcoin historical 4-year cycle.

Will Bitcoin Find Favor In Q4 2024?

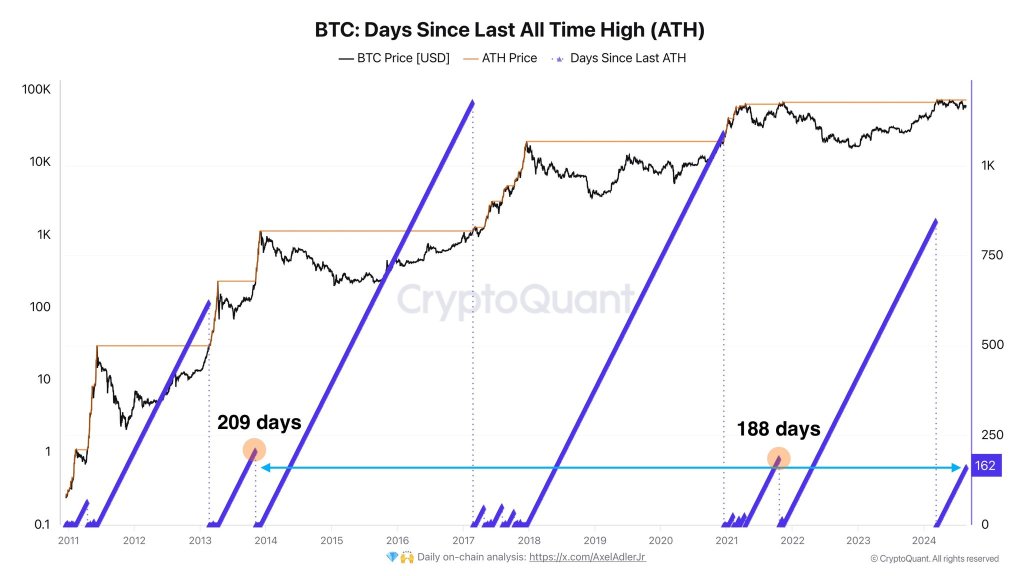

As traders chip in, making predictions, another analyst, pointing to price data, notes that it has been 162 days since Bitcoin broke November 2021 highs and printed fresh all-time highs.

The previous cycle only required 209 and 188 days to print fresh all-time highs. Now that history favors Bitcoin in every last cycle of the year, the analyst expects prices to expand rapidly in the last three months.

As of August 23, bulls are back in the equation, according to the Bitcoin bull-bear market cycle indicator. After fluctuating since early August, the signal is back to blue, pointing to interest, a net positive.

Overall, Bitcoin remains within a narrow range. Bulls must decisively push prices higher, reversing all losses of early August. However, any drop below $50,000 would trigger a sell-off to new H2 2024 lows.