Bitcoin is firm, recently trending above $71,200 and easing past local resistance levels, much to the delight of holders. However, the current leg up is just the beginning for Willy Woo, an on-chain analyst.

Bitcoin Rally Getting Started: Analyst

Taking to X, Woo, who has been maintaining a bullish outlook for the world’s most valuable coin, boldly asserts that the current Bitcoin rally is only halfway through its welcomed bullish journey.

Sharing a chart, the on-chain analyst notes that the Bitcoin VWAP oscillator just bottomed up from oversold territory and is now at the zero mark, which is midway. Though Woo is upbeat and expecting even more gains, the analyst didn’t specify when or at what level prices will peak.

Even so, the analyst explained that a period of consolidation below the all-time high is necessary. Woo says this consolidation might allow users to accumulate before a “second leg” propels the Bitcoin to new heights.

Looking at the Bitcoin daily chart, this “second leg” is expected to be a breakout moment that will lift the coin above March highs.

At press time, Bitcoin is still in a bullish formation. The uptick above $68,000 and last week’s high were crucial for trend definition. Moreover, since the May 20 breakout bar is wide-ranging and has a high trading volume, the odds of trend continuation are high. If bulls follow through, confirming May 20 gains, BTC will likely break $73,800, aligning with Woo’s forecast.

BTC Bull Run To Last 300 Days If There Is No Black Swan Event

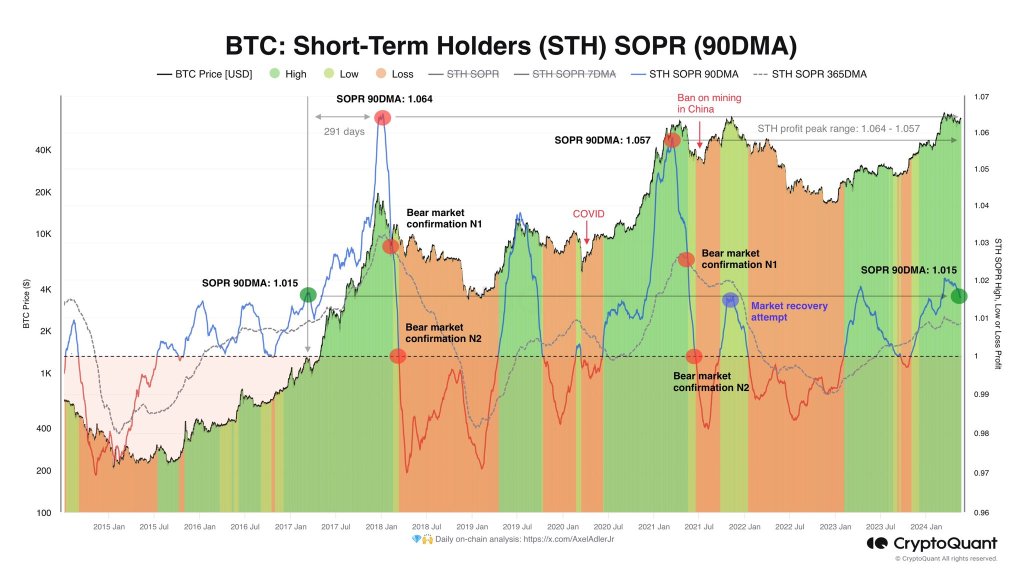

Besides Woo, another analyst says the Bitcoin uptrend is in full swing. Sharing a chart, the trader said that barring any unforeseen disruptions, such as the impact of a major exchange going bankrupt, it is highly likely that the current bull run will extend for another 300 days.

This prediction is based on profit and loss analysis of short-term holders (STHs) with a 90-day moving average. Currently, the STH is moving lower but is relatively higher. Analysts use the STH to determine market sentiment from short-term price movements and trader speculations.

As sentiment improves and prices recover, the pace at which the coin edges higher will depend on external factors. Besides the impact of the United States Federal Reserve and their monetary policy declaration, inflow to spot Bitcoin exchange-traded funds (ETFs) will be crucial. After a lull, demand is picking up, helping to propel bulls.