Bitcoin offers an opportunity for society to move toward systems of clear, easy-to-understand rules instead of our current system of rulers.

Human beings, for the most part, all know what fairness means. Of course, we don’t agree with one another: Who’s to say what is and isn’t fair? We don’t even agree on whether we should strive for a fairer world or just accept that it isn’t fair and get on with it.

But the vast majority of people have their understanding of the concept, even if it differs from everyone else’s. It’s the basis of what we generally refer to as our conscience and it forms part of our human nature.

It gives us a sense of right and wrong and can serve as a strong motivating force, sometimes even overcoming the drive for self-preservation, despite the fact that it’s often impossible to explain conscientious conclusions in rational terms.

Now, more than ever before, my conscience is telling me (with escalating urgency) that something is seriously wrong. And this thought isn’t new. It’s what led me to buy into bitcoin in the first place. Both financially and ideologically, perhaps before I even grasped the basics of the network. Some would call that irresponsible and perhaps it is, but it wasn’t the first time I made a decision based on conscience and it won’t be the last. More importantly, conscience is also what led me to dedicate myself to spreading the adoption of Bitcoin.

There are more red flags than ever before, all over the place. Recent developments only serve to heighten the urgency of the feeling I almost started growing accustomed to, until it was ratcheted up by several notches in early 2020 and again early 2022. I’m reminded: “Do not become complacent. Stay focused on what you’ve come to understand about the problem.” That’s my conscience talking to me. And what it’s saying is summed up by what’s written between the lines of a recent article shared by the Bitcoin rock star president of El Salvador, Nayib Bukele, in his tweet. His questioning attitude toward the article’s conclusion that Bitcoin is “making the world that bit harder to police” is on point.

The purpose of this article is to really try to elucidate and simplify that point, which is what I’ve come to understand about the problem we face. Because without an understanding of the problem, we’re just running around in circles.

The problem is one of governance and the fact that, in its current form, it isn’t fair, but it’s not inherently so. The problem is a result of the dynamics of global players occupying untenable positions. And while we may not all agree on the specific meaning of that term “fairness,” including all its subtleties, I do believe there are some basic principles that are hard-coded into us.

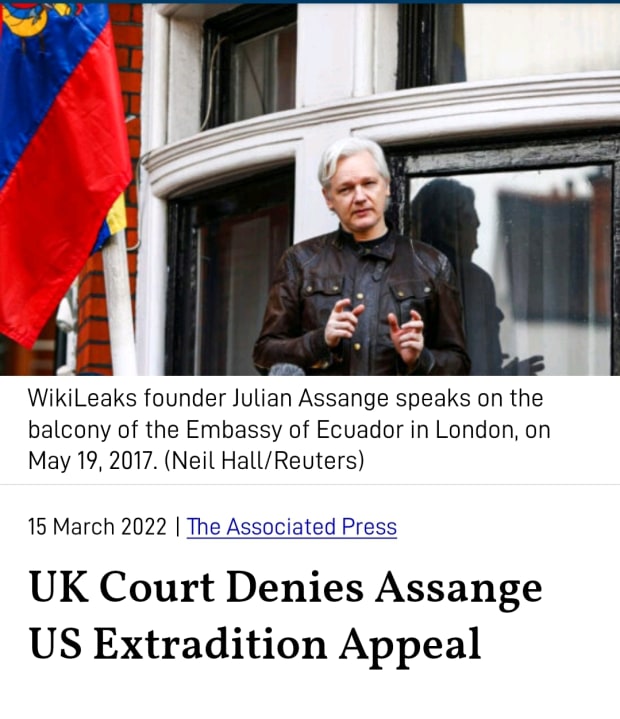

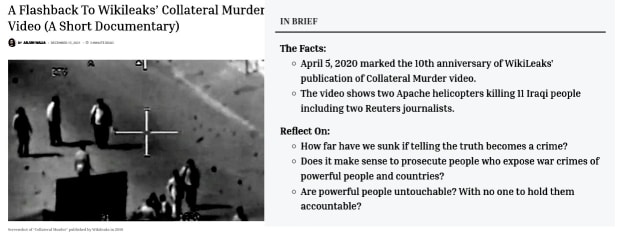

Now, take a deep breath and put your personal opinions on WikiLeaks aside. The problem (and solution) is neither WikiLeaks, nor the U.S. Government. In this context, it serves merely as an example to try and point at the problem, which is the dynamic at play: The people who have been put in the position of policing the planet also want to be a player in the game. And, if there’s one thing we can all agree on it’s this: When the referee starts kicking the ball around, the game has lost all meaning. Particularly if the referee is the strongest player on the field and, by virtue of being human, addicted to the most powerful drug of all, power itself.

Clearly, the solution is not to replace that power with another different version of itself. Should the U.S. continue its decline on the world stage, China seems poised to take its place. As Lyn Alden pointed out on a recent “What Bitcoin Did” podcast, China is the only country that really stands to benefit from this current war. But no one wants to live in a world dominated by Communist China and its complete disregard for individual freedom and human rights.

Instead, the solution can only be to adopt systems without rulers. “Wait. What?! You mean anarchy?!”

Now again, take a deep breath and put aside what you think you understand about the idea of a ruler-less world. I am not suggesting any particular solution here. I am merely trying to frame the possibilities.

Consider Bitcoin.

I am not suggesting that Bitcoin fixes everything. And I am not suggesting that the technology used in Bitcoin is in any way applicable to any other system. I am not even suggesting that there is a solution to the problem of governance because I don’t think there is one. Not yet.

What I’m suggesting is that the perceived need for rulers is the problem, and not the solution, as so many people seem to believe. Clearly the rulers can’t stick to the rules, and instead, they end up ruling according to their own best interest and not in the interest of keeping the game fair.

While the solution may not be obvious, the direction we need to move in is clear. We have to move toward systems of rules instead of rulers. Thanks to Bitcoin such a system is no longer impossible to conceive of.

Bitcoin is just a computer protocol designed to account for sending and receiving payments. Nothing more. But seen from a more abstract perspective, it should be clear that it’s also an example of the kind of systems that must be built if we want to survive and thrive.

I don’t know what those systems are because they haven’t been built, not at scale anyway. But thanks to Bitcoin, I can hazard a guess at what they’ll look like when they are built. Their structures will be fair. It’ll be transparent. The rules will be clear, easy to understand but not easily changed. Participation will be voluntary. There will be enforceable rules, but those rules will not be enforced by individuals or small groups susceptible to the shortcomings of human nature.

I truly hope we can build those systems, because the alternatives clearly don’t work. If anything is clear it’s this: Human nature cannot be trusted with the power to police.

This is a guest post by Hermann Vivier. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.