Despite recent price volatility and market uncertainties, a renowned bitcoin specialist has offered an extremely positive assessment on Bitcoin and the other cryptocurrencies. Michaël van de Poppe, the creator of MN Consultancy, believes we’re witnessing the dawn of a historic bull market that could push Bitcoin’s value to previously unimaginable heights.

The ‘Perfect Storm’ For Bitcoin & Ethereum

In a radical change, the Trump administration’s pro-crypto policies have produced what van de Poppe refers to as “the perfect storm” for the growth of Bitcoin and Ethereum. This institutional support and improved banking custody alternatives have created the foundation for what may turn out to be the biggest cryptocurrency boom in history.

The crypto guru suggests that similar exponential growth patterns could emerge by drawing comparisons to the dot com bubble of 1995-1999.

“We’re currently in an ecosystem that has the most bullish government ever standing behind the whole perspective of tokenizing all assets […] and the adoption of Bitcoin into the government’s balance sheets,” van de Poppe wrote on X.

Two Possible Market Peak Scenarios Arise

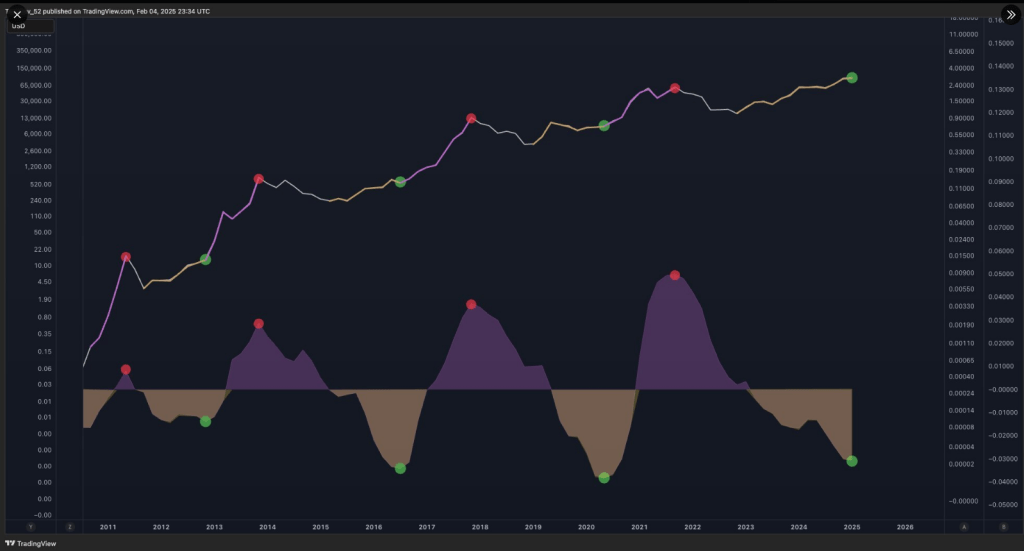

Van de Poppe suggests two possible routes of development for the bitcoin industry. Based on the first scenario—which is rooted on the traditional four-year cycle—by the end of the year, Bitcoin may reach between $300,000 and $500,000, therefore attaining a remarkable peak. The crpyto expert also predicts Ethereum to reach $20,000.

The perfect storm for #Bitcoin at $500,000 and #Ethereum at $20,000.

The current sentiment of the markets is ultra bearish as the biggest daily capitulation in the history of the crypto markets has been taking place.

Understandable.

What’s next?

Well, if your positions were… pic.twitter.com/q7IvIXM7VU

— Michaël van de Poppe (@CryptoMichNL) February 5, 2025

Conversely, he advises two more years of bull run might see Bitcoin valued at $1 million. These forecasts beat the present trade price of $99,000, with possible gains that would surpass the 20x surge exhibited during the 2017 bull market.

Trade Conflicts May Accelerate Growth Of Crypto

Van de Poppe believes that the looming trade war between the United States and China might benefit the bitcoin industry instead of being a danger. He believes that China’s choice to lower its currency value by selling dollars might reduce the value of the US dollar and bond prices, which could benefit other cryptocurrencies. This perspective challenges common mindsets about the market and offers a new way to understand how global conflicts impact digital assets.

Short-Term Market Volatility

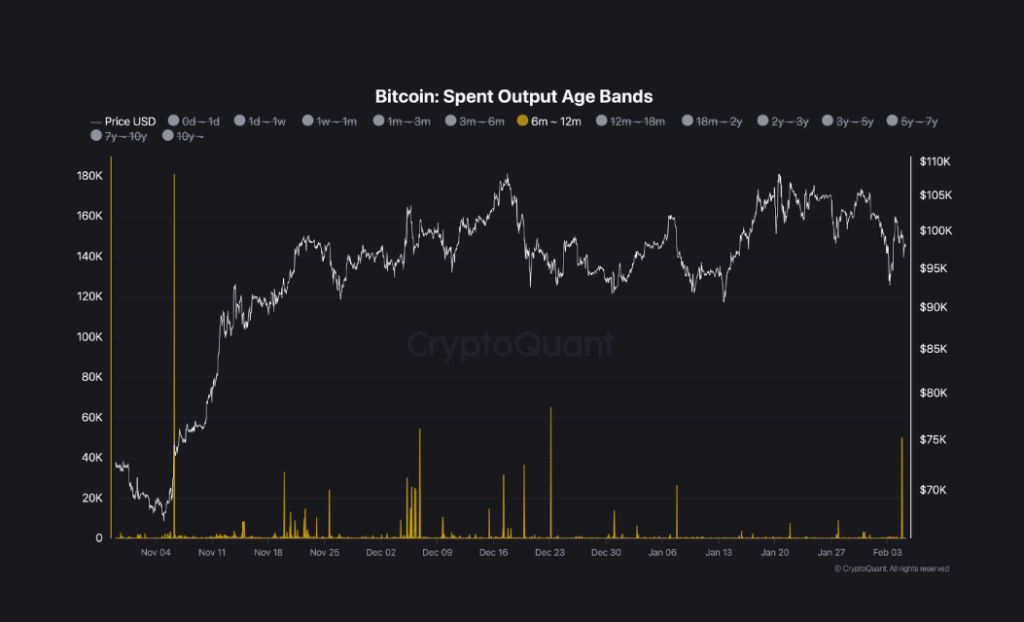

Even while the future appears bright, there are still obstacles to overcome right now. For the first time in six to 12 months, analytics firm CryptoQuant discovered that nearly 50,000 Bitcoin units are in circulation.

Despite the broad bullish sentiment, the sale of this large amount of dormant coins could result in extreme market turbulence and short-term price pressure.

Furthermore, even though long-term projections are still positive, the arrival of these ostensibly dormant coins onto the market raises doubts about the near future. This comparison between short-term volatility and long-term potential demonstrates how volatile and dynamic the bitcoin market is.

Featured image from Gemini Imagen, chart from TradingView