Bitcoin gained by over 10% in the past week as it reclaimed the $60,000 price mark on Friday. Following an initially negative performance in September, this recent price rise by the crypto market leader has elicited much positive sentiments from investors. However, a Cryptoquant analyst with the username CRYPTOHELL reports that this bullish momentum is being challenged by opposite forces driving the BTC market to a crossroads.

Bitcoin Market Forces At A Standstill – What Next?

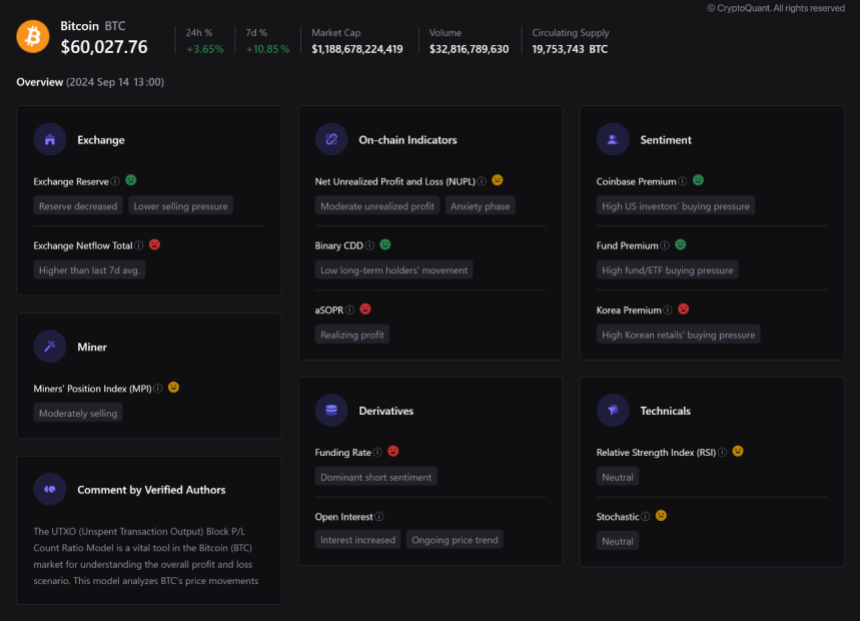

In a Quicktake post on Saturday, CRYPTOHELL stated that the current Bitcoin market presents both optimistic and cautionary signals.

On the positive front, the crypto analyst notes that there has been a decrease in BTC exchange reserves which hints at a diminished selling pressure, with investors opting to maintain their holdings in anticipation of a future price gain. This bullish sentiment is further strengthened by a strong demand from US-based investors as evidently seen in the demand for the Bitcoin spot ETFs and indicated in metrics such as the Coinbase Premium Index.

Alternatively, CRYPTOHELL states there are market developments that may require investors to apply some caution.

Firstly, the analyst highlights that there is a higher-than-average exchange netflows of Bitcoin over the last 7 days, which may indicate the presence of some significant selling pressure. Furthermore, the Adjusted Spent Output Profit Ratio (aSOPR), a key metric for assessing market sentiment shows that there is a modest level of profit realization by investors which indicates a selling pressure on Bitcoin.

In addition, this bearish sentiment is bolstered by the negative funding rates in the derivatives market which means that many traders are taking leveraged short positions in anticipation of a price drop.

The presence of these bullish and bearish factors simultaneously has pushed the BTC market into “an anxiety phase” where most investors are uncertain about the digital asset. However, long-term investors are still largely dormant which is a big positive for the bullish forces.

In conclusion, CRYPTOHELL states the Bitcoin market is at a “decision point”, and with technical indicators also presenting a neutral position, future price movements will be potentially influenced by significant changes in market sentiment and important news possibly in terms of adoption, regulation, etc.

BTC Leverage Ratio Hits New Yearly High

In other news, crypto analyst Ali Martinez has reported that the total estimated leverage ratio of Bitcoin across exchanges has attained a new yearly high. This development largely means Bitcoin traders are taking more risks as they open more positions with borrowed funds. While leveraging generally can lead to amplified gain, it also presents the risks of significant losses which can induce large-scale liquidations. Thus, there is a need for increased caution in the BTC market.

At the time of writing, Bitcoin trades at $60,220 with a 0.23% decline in the last day. Notably, Bitcoin’s trading volume is down by 51.83% and valued at $15.74 billion.

Related Reading: Bitcoin Price Recovery Hinges On This Key Market Indicator, Reveals Analyst