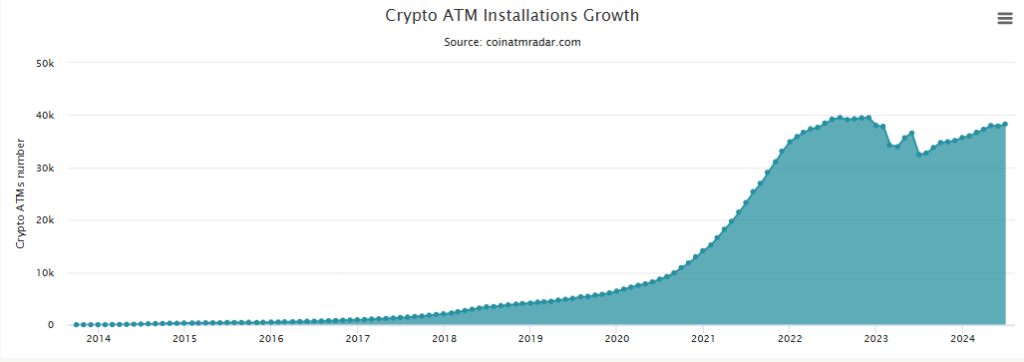

The world of cryptocurrency is witnessing a boom in accessibility, with Bitcoin ATMs leading the charge. From a meager 10,000 in October 2020, the number of these cash-to-crypto converters has ballooned to over 38,000 globally. This surge isn’t just a fad; experts predict continued growth fueled by a perfect storm of convenience, profitability, and strategic expansion.

Beyond The Bank Branch: Stepping Into Crypto With Cash

For many, traditional financial institutions remain a barrier to entry in the crypto world. Bitcoin ATMs bridge this gap by allowing users to buy cryptocurrency with cash, eliminating the need for bank accounts or navigating complex online exchanges. This fosters financial inclusion, particularly for the unbanked population and those who prefer the familiarity of physical cash.

The benefits extend beyond accessibility. Bitcoin ATM transactions often offer a layer of privacy compared to online exchanges, where users might need to provide extensive personal information. Additionally, some users value the immediate nature of the transaction – cash goes in, cryptocurrency goes straight to their digital wallet. This eliminates the waiting period associated with bank transfers commonly used on online exchanges.

A Lucrative Market With Room To Grow

The growth of Bitcoin ATMs isn’t solely driven by user demand. Operators are finding these machines to be a lucrative business proposition. Transaction fees charged on top of the spot price of Bitcoin provide a healthy profit margin.

With the crypto market experiencing a bullish year in 2024, the potential for even greater returns is enticing for entrepreneurs venturing into this space. As of the most recent count, there were 38,279 deployed Bitcoin ATMs worldwide, according to statistics available on Coin ATM Radar.

As the cryptocurrency market has recovered over the past 11 months, about 6,000 new crypto ATMs have been installed; these are made by 43 different companies and are available in 72 countries.

Bitcoin remains the leading digital asset used in crypto ATM transactions, followed by Bitcoin Cash and Ether, the world’s second-largest cryptocurrency. While over 80% of crypto ATMs are currently installed in the US, a growing market is emerging in countries like Canada, El Salvador, Germany, Hong Kong, and Spain.

Governments Greenlight Crypto Growth

Furthermore, regulatory environments in many countries are becoming increasingly crypto-friendly. Governments are recognizing the potential of digital assets and are implementing frameworks that support the responsible growth of the industry. This regulatory clarity fosters trust and encourages further investment in Bitcoin ATMs, expanding their reach and solidifying their role in the financial landscape.

Challenges And The Road Ahead

Despite the optimistic outlook, the Bitcoin ATM industry isn’t without its hurdles. Some operators lack the necessary experience or financial backing to navigate the complexities of this nascent market. This can lead to security vulnerabilities and ultimately hinder user confidence. Additionally, regulatory uncertainties persist in certain regions, creating a wait-and-see approach for potential investors.

Industry leaders are actively addressing these challenges. Educational initiatives are being rolled out to inform users about the benefits and risks associated with cryptocurrency transactions. Additionally, robust customer support systems are being established to ensure a smooth user experience. Building trust and fostering a sense of security will be paramount in encouraging wider adoption of Bitcoin ATMs.

Featured image from Bybit Learn, chart from TradingView