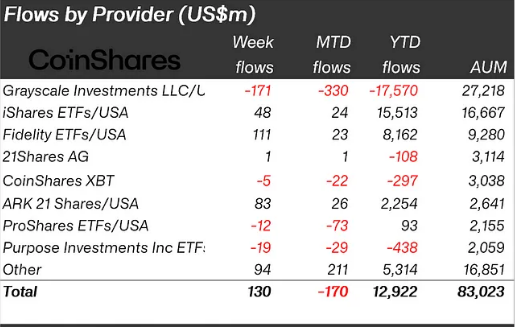

After five weeks of fleeing the digital asset market, investors are cautiously dipping their toes back in, with Bitcoin (BTC) emerging as the clear favorite. A recent report by CoinShares reveals a net inflow of $130 million into crypto investment products, marking a potential turning point after a period of sustained outflows.

US Investors Lead The Charge

The United States emerged as the primary driver of this shift, contributing the lion’s share of the inflows. This trend can be attributed, at least partially, to a slowdown in selling pressure from Grayscale, the world’s largest digital currency asset manager. Grayscale’s Bitcoin Investment Trust (GBTC) witnessed its lowest weekly withdrawals in five months, further bolstering investor confidence.

Hong Kong Joins The Inflow Party

While the US spearheaded the net inflow movement, Hong Kong also displayed a newfound interest in Bitcoin. Hong Kong-based Bitcoin ETFs attracted nearly $20 million, showcasing a growing regional appetite for the flagship cryptocurrency. However, these inflows paled in comparison to the dominance of Wall Street offerings, which raked in more than $130 million across various Bitcoin-focused products.

ETP Trading Volume Hints At Investor Caution

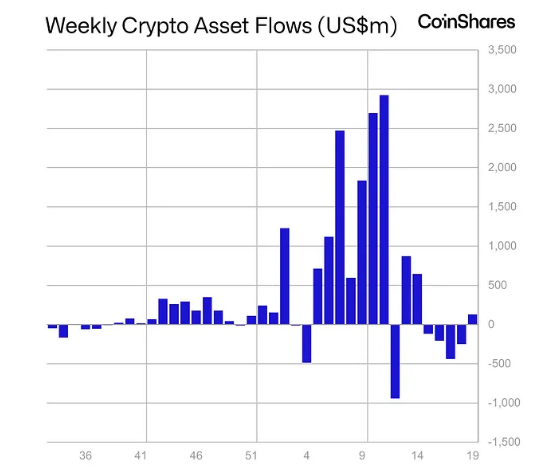

Despite the positive news surrounding net inflows, the report also highlights a concerning trend – a significant decline in overall trading volume within Exchange Traded Products (ETPs).

Compared to last month’s $17 billion weekly average, the current volume of $8 billion suggests a more cautious approach from investors. Analysts interpret this as a sign that while some are dipping their toes back in, a large portion of investors remain on the sidelines, waiting for a clearer market picture.

Bitcoin Sentiment Rebounds, Ethereum Outflows Persist

The recent price fluctuations within the crypto market appear to have had a contrasting impact on investor sentiment towards Bitcoin and Ethereum (ETH). Bitcoin, which witnessed a downward spiral of outflows earlier in May due to plummeting prices, seems to be regaining investor favor with the recent inflows.

However, the story is quite different for Ethereum. Unlike Bitcoin, the world’s second-largest cryptocurrency continues to experience outflows, amounting to $14 million last week.

Regulatory Uncertainty Clouds Ethereum’s Future

Analysts point towards the ongoing regulatory uncertainty surrounding Ethereum ETFs in the US as a major factor contributing to the outflows. The SEC’s delay in approving spot Ethereum ETFs has fueled skepticism among investors, leading many to believe that regulatory approval may not materialize.

This sentiment has been further solidified by recent enforcement actions taken against Ethereum-related entities like Consensys, Uniswap, and even crypto trading platforms like Robinhood.

Light At The End Of The Regulatory Tunnel?

While the SEC’s current stance remains ambiguous, there’s a potential ray of hope on the horizon. Proposed bills and initiatives in Congress might bring much-needed clarity regarding the regulatory body that will oversee the crypto industry. A definitive framework could significantly impact future market trends and investor confidence.

Featured image from Gangnam Times, chart from TradingView