Bitcoin is steady at press time but is under immense selling pressure after the liquidation of August 27. Technically, there is a tinge of weakness.

However, this preview will shift when BTC bulls push prices above the immediate resistance at $66,000. This reaction point marks August 23 highs, and a subsequent leg up will confirm the uptick of August 8.

Binance Traders Are Net Bearish

Before then, traders were cautiously optimistic, acknowledging Bitcoin’s fragile nature and historical volatility. Despite prices stabilizing at spot rates, one analyst on X notes that traders on Binance, the largest exchange by client count, are primarily bearish.

Based on the analyst’s assessment, more traders are not placing shorts, a net bearish development for the world’s most valuable coin. As more retailers place bearish bets, the coin could carve in, confirming August 24’s losses.

The shift in sentiment, favoring sellers, happens when most traders are neutral on the coin. According to the CMC Crypto Fear and Greed Index, traders adopted a wait-and-see approach when writing on August 28 and are mostly neutral.

This has been the dominant sentiment since prices tumbled in early August when most traders scrambled for the exit, pushing sentiment to the most “fearful” territory since early September 2023. Looking at the sentiment chart, the only time traders were extremely greedy over the last year was when Bitcoin rose to all-time highs, rallying to $73,800.

Therefore, if prices are weak and sentiment is neutral, it could help to aid optimistic bulls, at least in the short term. A recovery above $63,000, helping reverse August 27 losses, may further spark demand. This expansion may be the building block for even more gains above August 2024 highs.

Why Is Funding Rate Positive Amid Falling BTC Prices?

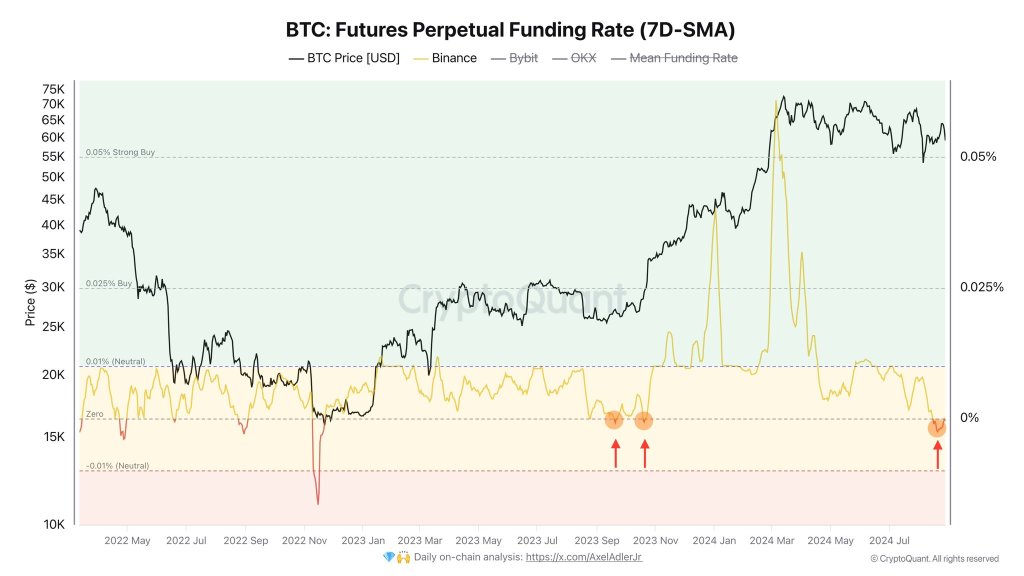

Even with the optimism, it is emerging that the average funding rate across Binance, Bybit, and OKX, is in positive territory at 0.002%. This means that short-leverage traders are getting paid for holding their positions.

Typically, this means that perpetuals are trading at a premium versus the spot price, a development that could incentivize more sellers and fuel the downtrend.

Usually, funding rates are positive when prices rally, pointing to bullish sentiment. It turns negative whenever prices tank, meaning leverage short sellers have to pay those betting for prices to rally.