Some analysts were frightened by the recent drop in Bitcoin prices. Though the coin is showing signs of strength, multiple leveraged longs were liquidated early this week.

In a post on X, one analyst thinks Bitcoin might have just found support, bottoming up after the contraction this week, pushing it lower from the multi-week range established in mid-March through to the better part of April.

Bitcoin Retracement Is Deeper And Took Longer: Bottom In?

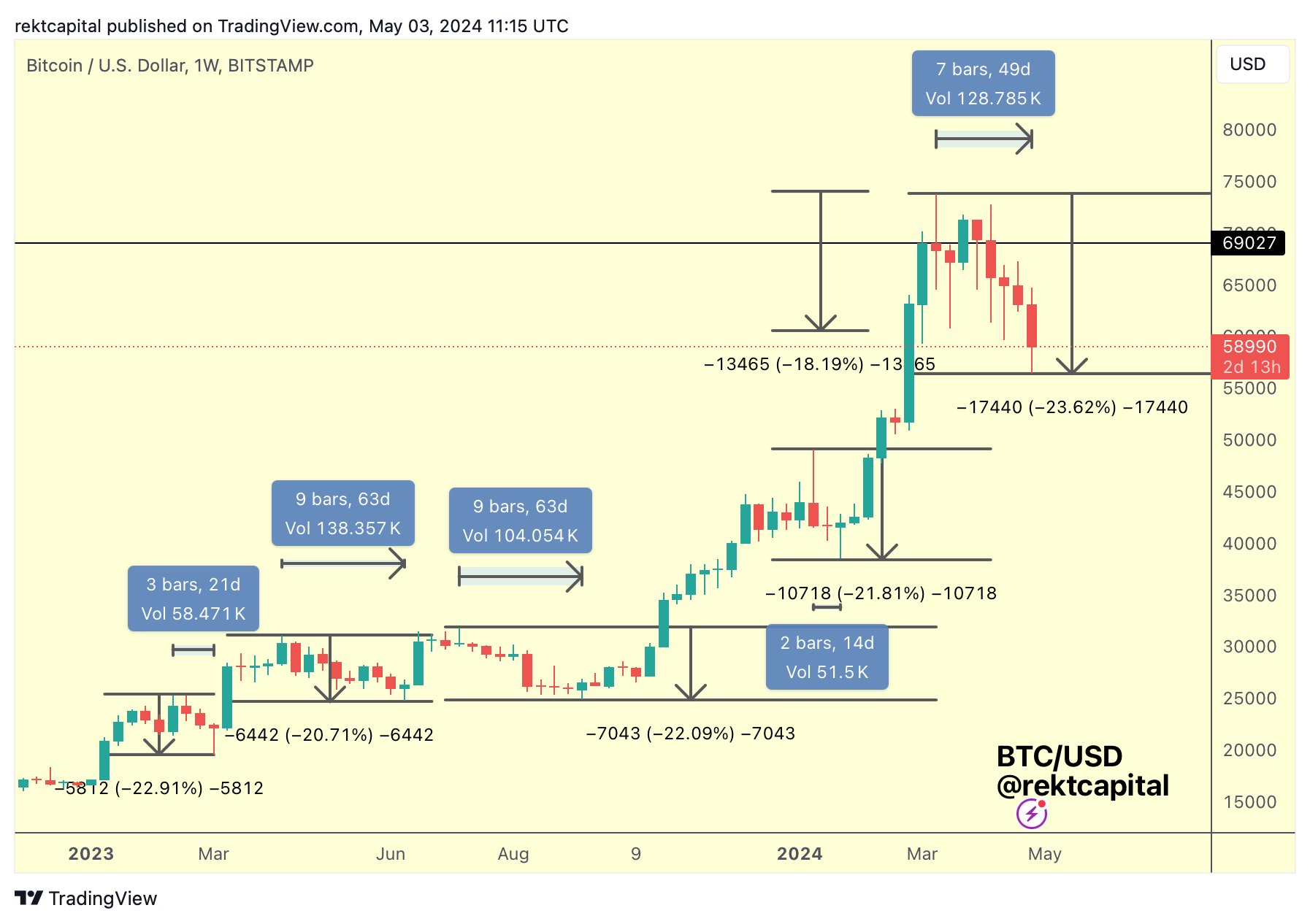

Expressing confidence, the analyst cited a historical pattern. Based on a price action assessment in the weekly chart, the analyst notes that whenever Bitcoin posts a deep retracement, there is usually a higher probability of the coin bottoming up and shaking off weakness.

At the same time, prices tend to recover after a retracement that takes longer than expected.

Building on their historical pattern observation, the analyst applied it to the current BTC situation. The trader said up to the current level, the retracement from an all-time high is deeper and also took longer than usual, spanning several weeks. As a result, the analyst projected a high likelihood that Bitcoin prices might have found a bottom.

While confidence abounds, it is still challenging to pick bottoms. Bitcoin and crypto assets are volatile, with prices moving quickly in either direction. At spot rates, Bitcoin is trading above $60,000, reversing losses of May 1.

Even though this might cement the analyst’s position, BTC remains within a bear breakout formation, defined by the wide-ranging, high-volume bear bar of April 30.

Moreover, the coin is still boxed away from the April trade range, suggesting that weakness remains. Should there be a conclusive close above $62,000, the trend will likely shift in favor of bulls, reversing the losses of April 30.

Before then, aggressive traders might be unloading at higher prices, aligning with the current bearish formation.

Market Forces Will Shape BTC Prices

Despite the bearish outlook, most analysts are bullish, expecting a sharp price recovery. One of them took to X, suggesting that buyers will likely take charge if prices recover from spot rates and return to the horizontal range of March to April.

The pace and direction at which prices move going forward lean on market factors. So far, spot Bitcoin exchange-traded fund (ETF) issuers are decreasing their holdings.

At the same time, the United States Federal Reserve is tracking inflation and other metrics as they tune monetary policy. If inflation drops, the USD will likely strengthen, heaping more pressure on the world’s most valuable crypto.