Reports showed that Bitcoin price slightly dipped in the last 24 hours but continues to hang on the $69,000 level after breaching over $73,000 several days ago.

Despite the impressive BTC price hike, interest in the cryptocurrency is not picking up as Google searches remained flat.

Bitcoin Nears All-Time High

Bitcoin still performed well last October 2024 despite experiencing a slight decrease in price, falling below $71,000 to $70,800 and failing to meet investors’ expectations of the coin hitting the $73,700 mark.

Despite the dip, it has been a good month for BTC because its performance nearly reached an all-time high.

Records showed that October has always been a pivotal month for Bitcoin to gain momentum for a price upsurge.

According to Lookonchain, the cryptocurrency consistently obtained significant gains in October, a recurring trend since 2013.

Last year, Bitcoin’s October rally brought a 28% gain for the coin which according to analysts paved the way to a five-month price upswing.

During the bull run, BTC started at $26,965 and gradually gained momentum over the succeeding months, breaching the $73,000 barrier in March 2024.

Will BTC repeat the same price movement as last year? A price rally could unfold as October 2024 ends.

Interesting Phenomenon

Bitcoin might be performing well and nearly hitting an all-time high, but an analysts noted a bizarre phenomenon.

Analysts remarked that BTC is near its record high, but its online mentions are falling behind, saying, Google searches for Bitcoin remained notably low. It could mean that there is little retail participation despite the price upsurge.

According to AltIndex, the cryptocurrency’s score at Google Trend is 37 out of 100, indicating that only a small number of people are searching for Bitcoin on the search engine Google.

BTC Bull Run And Google Searches

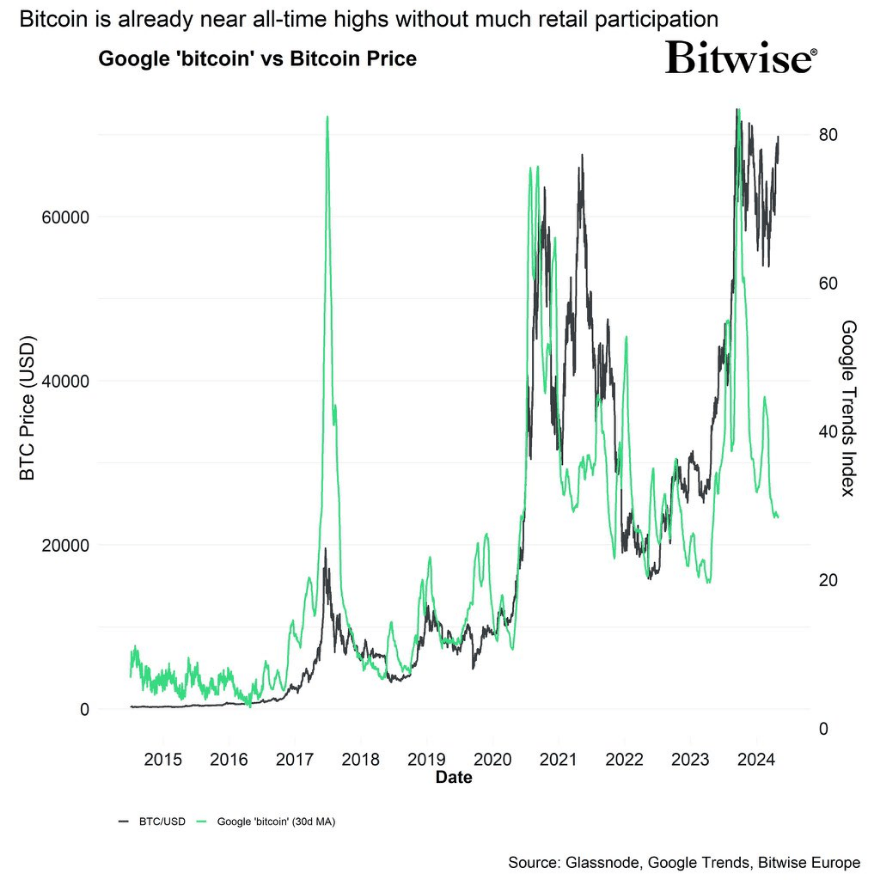

Analysts said that there is a relationship between the previous Bitcoin bull run and Google Trends, adding that usually, bull runs coincide with an uptick in BTC search volume.

Bitcoin’s bull run in 2017 serves as a prime example of this relationship. Analysts explained that during the said price rally, Bitcoin went up about $20,000 while its Google Trends score reached 80 out of 100. A trend that analysts have also seen during BTC’s bull run in the late 2020 to 2021.

Historically, BTC price rallies occurred simultaneously with significant search interest on Google, something that is not happening yet at the moment.

Would the search volume in Google remain a key indicator of BTC’s price movement? It is something that investors and analysts will have to keep an eye on the upcoming months.

Featured image from DL News, chart from TradingView