Quick Take

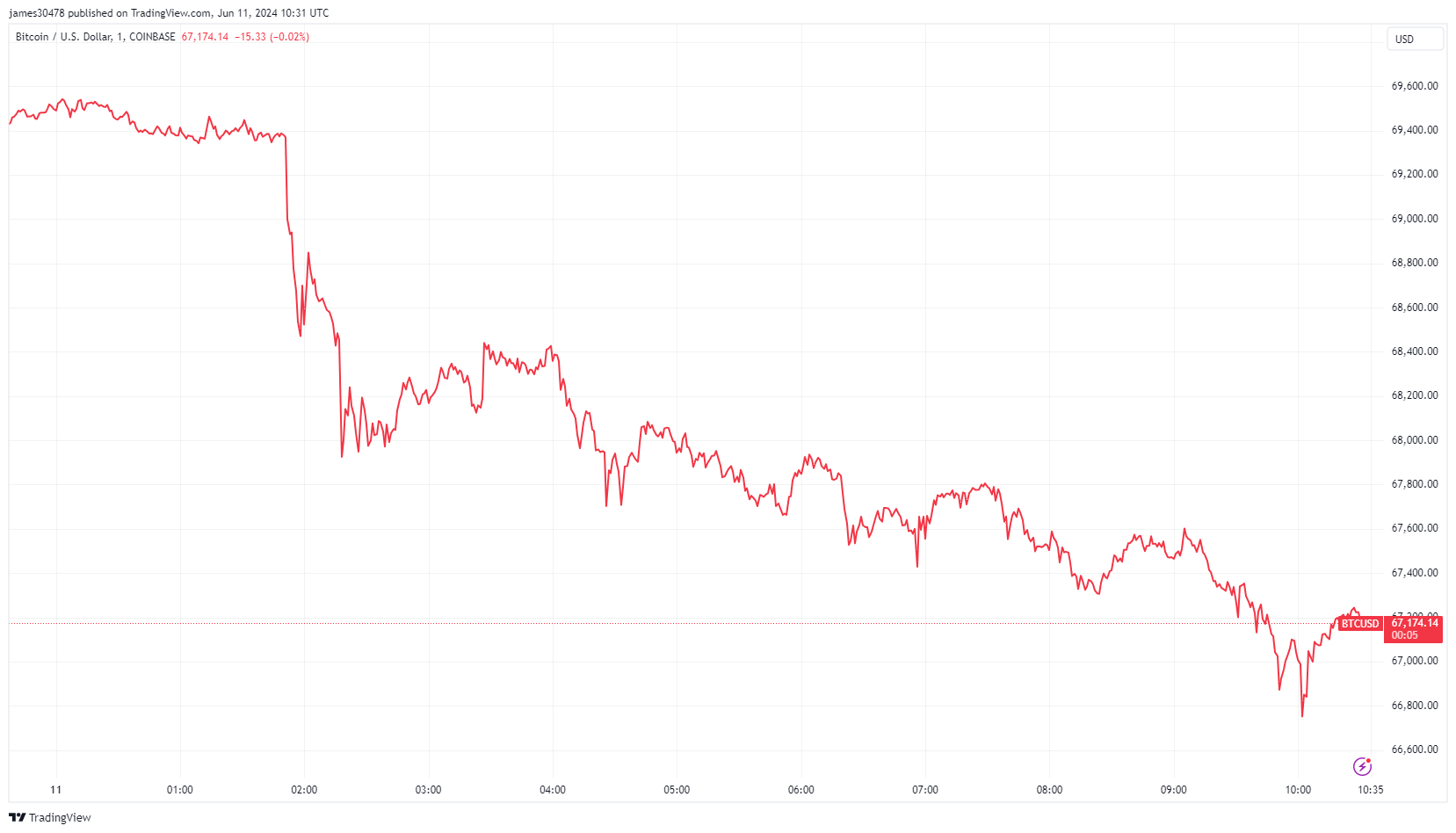

Bitcoin experienced a notable dip earlier today, briefly dropping below $67,000 to a low of approximately $66,800, marking a roughly 3% decrease over the past 24 hours.

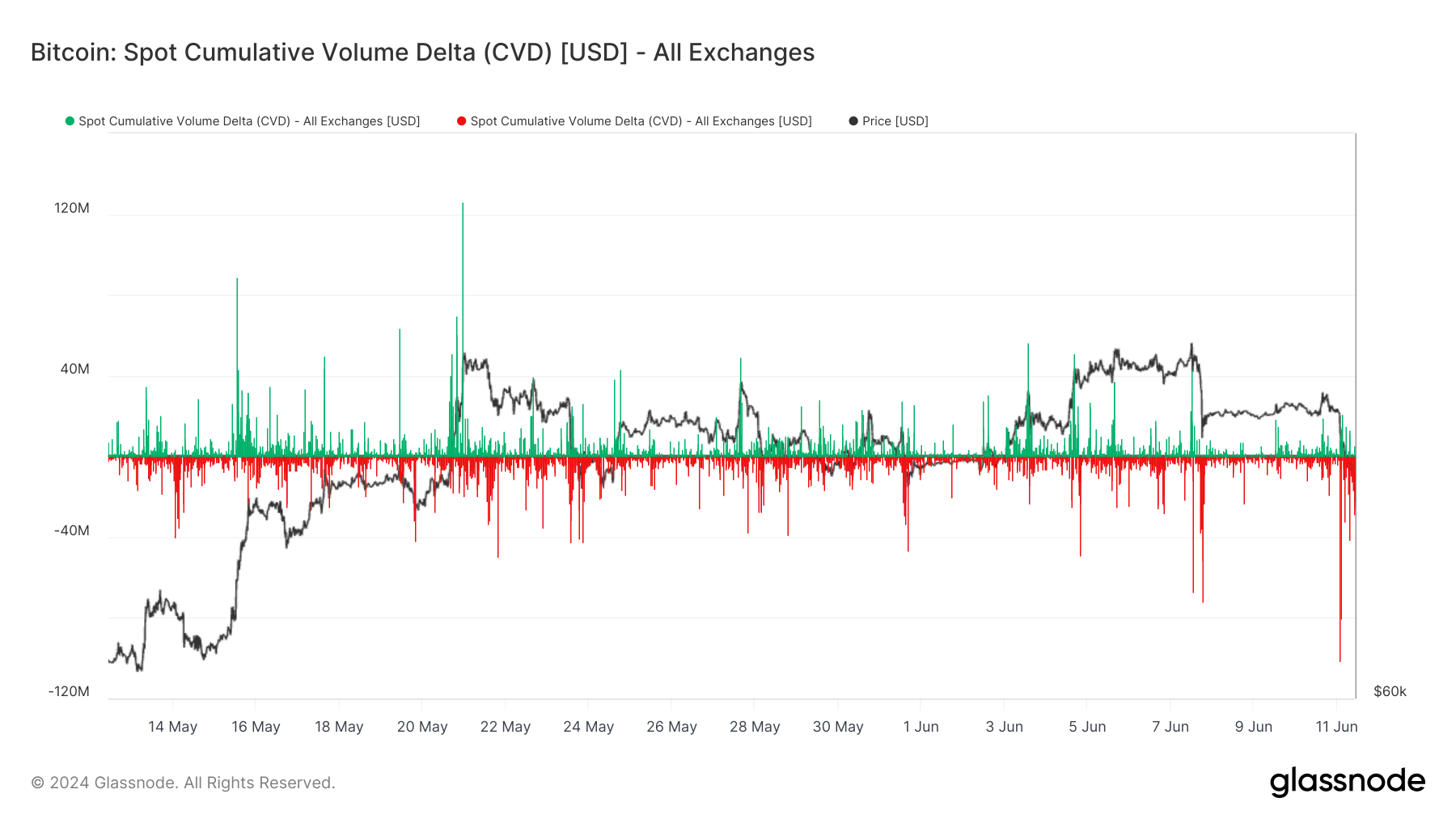

According to data from Glassnode, significant spot-selling activity contributed to a total of about $200 million in selling across all exchanges. The majority of this selling activity came from Binance. This activity is measured by the Spot Cumulative Volume Delta (CVD), which tracks the net difference between buying and selling volumes, emphasizing who—buyers or sellers—is driving the market.

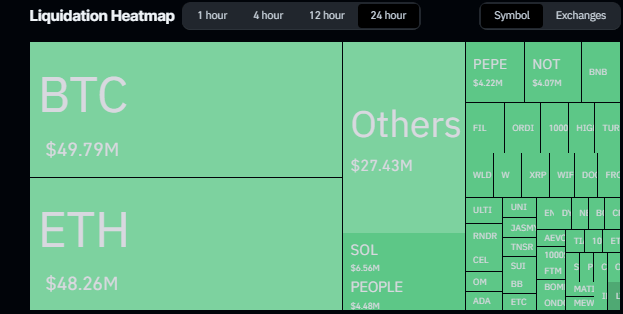

The increased selling pressure has resulted in substantial liquidations. Coinglass data showed that $185 million in liquidations occurred within the last 24 hours, with $160 million coming from long positions. Both Bitcoin and Ethereum have experienced significant liquidation impacts, each seeing around $50 million in total liquidations during this period.

The post Bitcoin briefly dips below $67k amid $200M in Binance-driven spot selling appeared first on CryptoSlate.