Bitcoin (BTC) finds itself in a curious position, caught in a tug-of-war between the bullish conviction of whales (large investors) and the jittery hands of short-term holders. The world’s top cryptocurrency recently surged to within a hair’s breadth of its all-time high, fueled by a buying spree from whales. However, lurking beneath the surface are potential threats that could derail this rally.

Whale Appetite Increasing

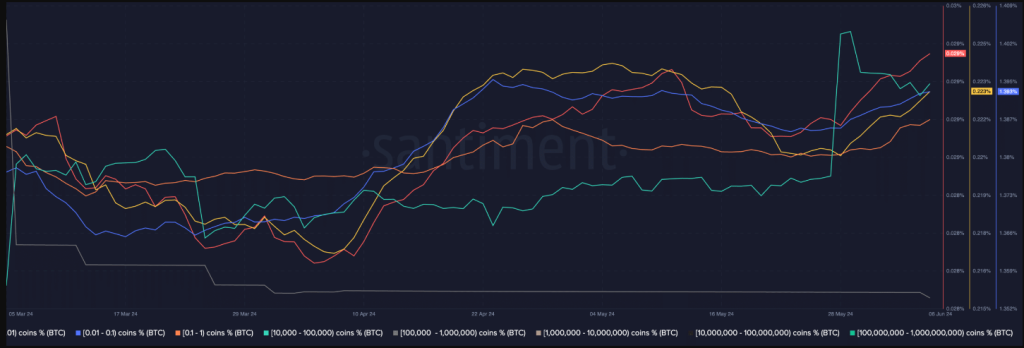

Big investors have been accumulating Bitcoin at an alarming rate, close to $1 billion worth per day according to some estimates. This insatiable appetite suggests a strong belief in Bitcoin’s long-term potential. Analysts point to this whale activity as a bullish indicator, fueling optimism that Bitcoin can break past its previous highs of around $71,000.

While you are scared, whales are buying #Bitcoin like never before. pic.twitter.com/QAVXpdWER4

— Vivek

(@Vivek4real_) June 8, 2024

The sentiment isn’t isolated to the big leagues. Retail investors, the average person on the street, are also joining the party. The number of addresses holding between 0.01 and 1 BTC has increased, indicating a broadening of interest in the cryptocurrency. This confluence of whale and retail investor enthusiasm, representing millions of users, could propel Bitcoin to new heights.

Profit Taking And Short-Term Jitters

As the price climbs, a double-edged sword emerges – the MVRV ratio. This metric indicates how much profit holders are sitting on. With Bitcoin nearing its peak, the MVRV ratio has climbed significantly, suggesting many investors are now in profit territory. This profitability can be a blessing and a curse. The allure of locking in gains could entice some holders, potentially millions based on address growth, to sell, creating downward pressure on the price.

Related Reading: Cardano Bloodbath? Sell-Off Raises Fears Of Imminent ADA Price Drop

Bitcoin Miners Feeling The Squeeze

In a related development, Bitcoin miners are dedicating significant computational power to verifying Bitcoin transactions and are rewarded with newly minted coins. However, recent times have seen a decline in miner revenue, with some reports suggesting a drop from $53 million to $48 million in just a few days.

If this trend continues, miners may be forced to sell their Bitcoin holdings to stay afloat. This influx of additional coins on the market could further exacerbate selling pressure and hinder the current rally.

Bitcoin Price Prediction

Meanwhile, according to the latest Bitcoin price prediction, Bitcoin is expected to rise by 28%, reaching $89,300 by July 10, 2024. The market sentiment is bullish, supported by a Fear & Greed Index reading of 72, indicating strong greed. Additionally, Bitcoin has recorded 16 green days out of the last 30, showing a consistent upward trend with a 4.16% price volatility over the same period.

The high number of green days and manageable volatility levels suggest a stable market, reinforcing the bullish outlook. This environment appears conducive to further price increases, aligning with the prediction of a significant rise. The sentiment indicators and recent price performance both point to continued optimism among investors.

Featured image from Treehugger, chart from TradingView