A crypto analyst has unveiled uncanny similarities between Bitcoin’s Chicago Mercantile Exchange (CME) chart from late Q4 2024 and 2023. According to the analyst’s report, the 2024 Bitcoin CME chart replicates the price action seen in 2023, experiencing similar technical patterns, wave structures, price movements, and specific key indicators.

Bitcoin CME Chart Mirrors 2023 Price Action

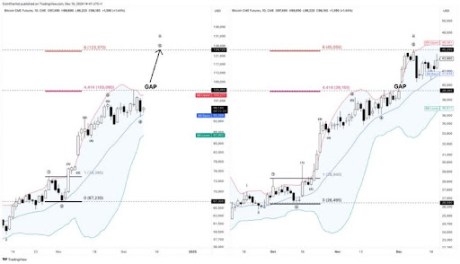

A comparative analysis of the Bitcoin CME charts from Nov/Dec 2023 and Nov/Dec 2024 reveals striking parallels. The charts, shared on X (formerly Twitter) by crypto analyst and market technician Tony Severino, feature a near-identical Elliott Wave count, showcasing five distinct waves that indicate classical bullish patterns.

The price action in both charts highlights a significant breakout from consolidation, with Bitcoin’s bullish momentum surging as November and December approach. Moreover, the Bollinger Bands for the Bitcoin CME charts are expanding similarly, indicating a potential for an upward trend continuation.

Bollinger Bands are unique technical analysis tools for identifying sharp short-term price movements and potential entry and exit points. Looking at Severino’s Bitcoin CME chart for 2023 and 2024, the price is riding the upper Bollinger Band for both years, suggesting a strong bullish trend.

Adding weight to the analysis of these parallel CME charts, the analyst has revealed that both charts showcase similar Fibonacci extensions. In 2023, the 4.416 and 6 Fibonacci extension levels served as crucial markers, with BTC rallying to reach their equivalent price levels at $39,265 and $45,250, respectively. These same Fib extension levels have also been highlighted on the 2024 Bitcoin CME chart, suggesting that Bitcoin could repeat history and hit new price targets of $105,465 and $124,125, respectively.

Another key factor Severino identified on both Bitcoin CME charts is the presence of gaps. A CME futures gap refers to the differences between the closing and opening prices of BTC on the CME. In 2023, a CME gap was filled during Bitcoin’s price rally, with the 2024 chart also spotlighting a comparable gap near the $124,125 mark.

$120,000 BTC Price Target In Sight

While delving deep into the price action and key technical indicators of the Bitcoin CME charts of Nov/Dec 2023 and 2024, Severino predicted that Bitcoin could prepare for a bullish move above $120,000. The analyst has based this optimistic projection on the striking similarities between the Fibonacci extension levels of both Bitcoin CME charts.

Earlier last week, the price of BTC experienced a sharp surge above $104,000, marking a new all-time high. However, the cryptocurrency quickly corrected to $94,000, with many analysts describing this decline as a “Bitcoin flash crash.”

Currently, Bitcoin is trading at $97,638, experiencing a steady price increase from previous lows. If the cryptocurrency can maintain a stable bullish position, it’s possible that Bitcoin could rise back towards its $100,000 ATH.