Data shows the Bitcoin Coinbase Premium Gap has surged to highly positive values recently. Here’s what this says about the market.

Bitcoin Coinbase Premium Gap Has Seen A Strong Increase Recently

As pointed out by CryptoQuant Netherlands community manager Maartunn in a post on X, there appears to be a strong bidder present on the cryptocurrency exchange Coinbase.

The “Coinbase Premium Gap” refers to an indicator that keeps track of the difference between the Bitcoin prices listed on Coinbase (USD pair) and Binance (USDT pair).

The former exchange is known to host a more US-dominated traffic, while the latter has a global user base. So the difference between the prices on the two platforms can provide hints about the buying or selling behaviors of the two demographics.

When the premium gap is positive, it means that the price listed on Coinbase is higher than that on Binance right now. Such a trend implies that US investors are participating in a higher amount of buying, or at the very least, they are selling to a lesser degree.

On the other hand, negative values suggest that global investors are the ones providing a higher buying pressure/lower selling pressure to the BTC market currently.

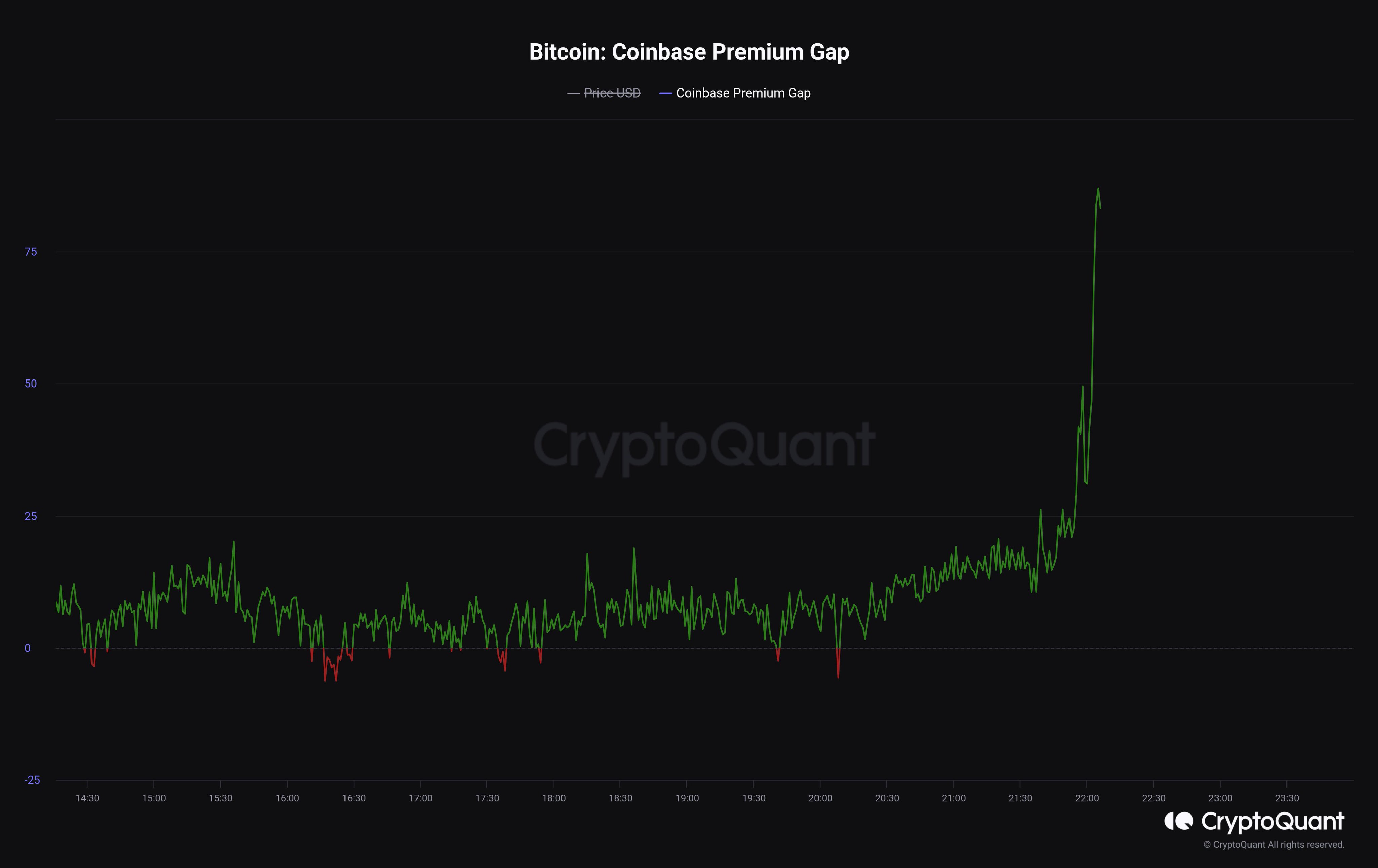

Now, here is a chart that shows the trend in the Coinbase Premium Gap over the past day:

As displayed in the above graph, the Bitcoin Coinbase Premium Gap has registered a sharp increase during the past day, implying the distance between the Coinbase and Binance BTC prices has widened.

This would imply that large US investors have potentially ramped up their buying. The accumulation is perhaps a reaction to the BTC spot ETF becoming more inevitable, as an SEC commissioner has come forth and said there is no valid reason to impede one from being approved.

If this is indeed a sign of accumulation from the institutional and other large entities based in the US, it would naturally be an optimistic sign for Bitcoin, as it could suggest these holders are supportive of the rally’s continuation.

Another development that has appeared to have taken place in the sector recently has been a switch of coins between Binance and Coinbase, as an analyst in a CryptoQuant Quicktake post has explained.

The above chart shows the data for the “exchange reserve,” a metric that measures the total amount of Bitcoin sitting in the wallets of an exchange, for these two platforms.

Binance had observed outflows of about 5,000 BTC at the time the quant had shared the chart, while Coinbase had seen inflows of 12,000 BTC. The outflows on Binance are likely an outcome of the CEO change that the exchange has gone through.

Given the timing of these outflows and inflows, it’s possible the large investors simply moved their assets from one platform to the other. However, as the inflows on Coinbase were significantly greater than Binance’s outflows, a large part of the tokens are bound to have come from other sources.

BTC Price

Bitcoin had plunged under the $36,000 level during the volatility that followed the aforementioned Binance news, but the coin has already jumped back above $37,500.