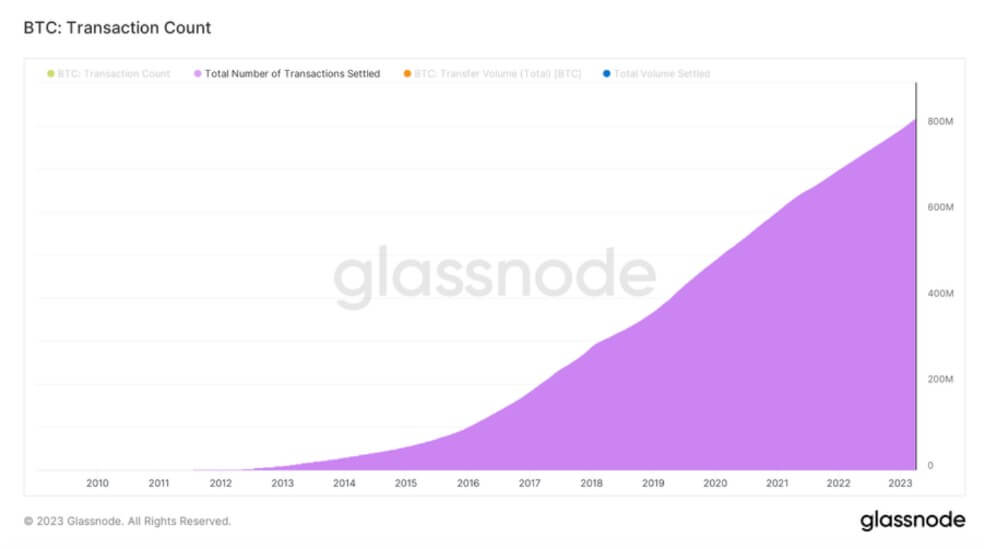

The total number of transactions settled by the Bitcoin network crossed 800 million during the first quarter of the year, taking the cumulative value to $107 trillion, according to Reflexivity Research.

BTC has settled an average of $8.2 trillion in transactions yearly since its launch, with its volume steadily rising.

Bitcoin settled more transactions than traditional financial institutions Mastercard and Visa in 2022. The digital asset settled transactions amounting to $14.843 trillion, while Master Card and Visa processed $14.1 trillion and $7.7 trillion, respectively.

Reflexivity Research said the record is a “tremendous feat” for a decentralized network that has only existed for 13 years.

Active Bitcoin addresses grow to new ATH in Q1

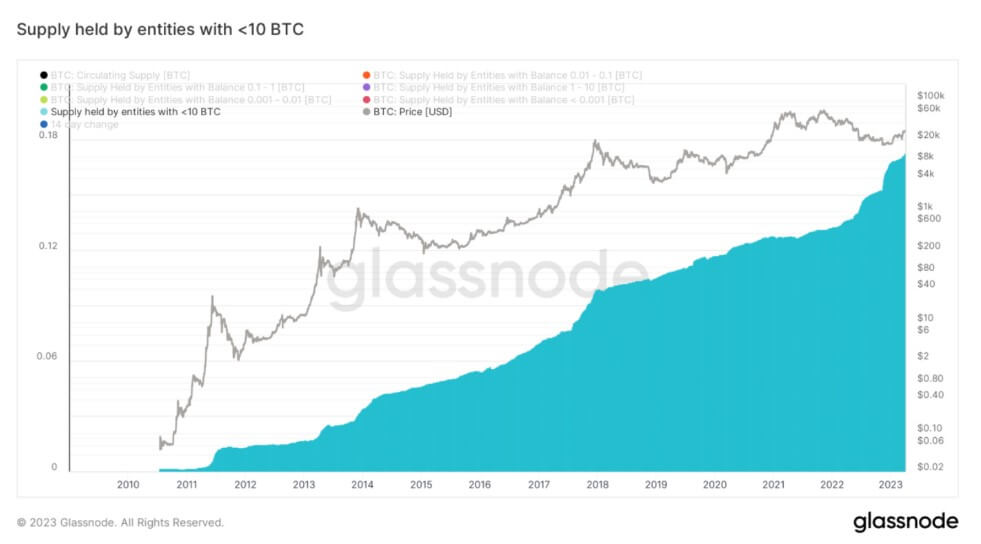

Bitcoin network saw addresses with a non-zero balance climb to a new all-time high during the year’s first quarter.

BTC supply has also become more distributed, with addresses holding less than 10 BTC increasing to over 17% — a new all-time high.

The growth coincided with the launch of Bitcoin Ordinals NFTs, whose adoption and utilization have pushed network activity to new highs.

Reflexivity Research described the growth rate as one of the highest since early 2021, when the market witnessed a bull run. It added that Bitcoin sees vibrant network activity.

The improved network activity was also buoyed mainly by the growth of Bitcoin layer2 network, Stacks (STX). STX is one of the best-performing digital assets in the first quarter, gaining 338%, and its market capitalization rising beyond $1 billion, according to CryptoSlate data.

Bitcoin’s over 70% rise allows miners respite

Miners enjoyed respite during the first quarter despite the network’s increasing mining difficulty because of the BTC’s positive price performance.

According to CryptoSlate data, Bitcoin rose by more than 70% to over $29,000 after starting the year at around $16,000. This positive performance allowed miners to record gains despite the network difficulty growing by 33% during the same period.

Bitfarms corroborated the above in its monthly report. According to the miner, mining revenue is up 31% dollars per TH in the quarter.

Besides that, the network’s increasing activity also translated to an improvement in miners’ transaction fees. Reflexivity Research said miners’ total revenue improved because of the increased transaction fees and BTC’s over 70% gain.

However, this development is a double-edged sword because it has encouraged more miners to plug in machines, increasing Bitcoin hashrate. The hashrate has risen significantly this year, reaching over 300 EH/s on several occasions.

The post Bitcoin crossed 800M transactions in 2023 Q1; price grows 70% appeared first on CryptoSlate.