The post Bitcoin Crushes Gold and Silver to Become 2024’s Top Surged Asset—Is $90K Next? appeared first on Coinpedia Fintech News

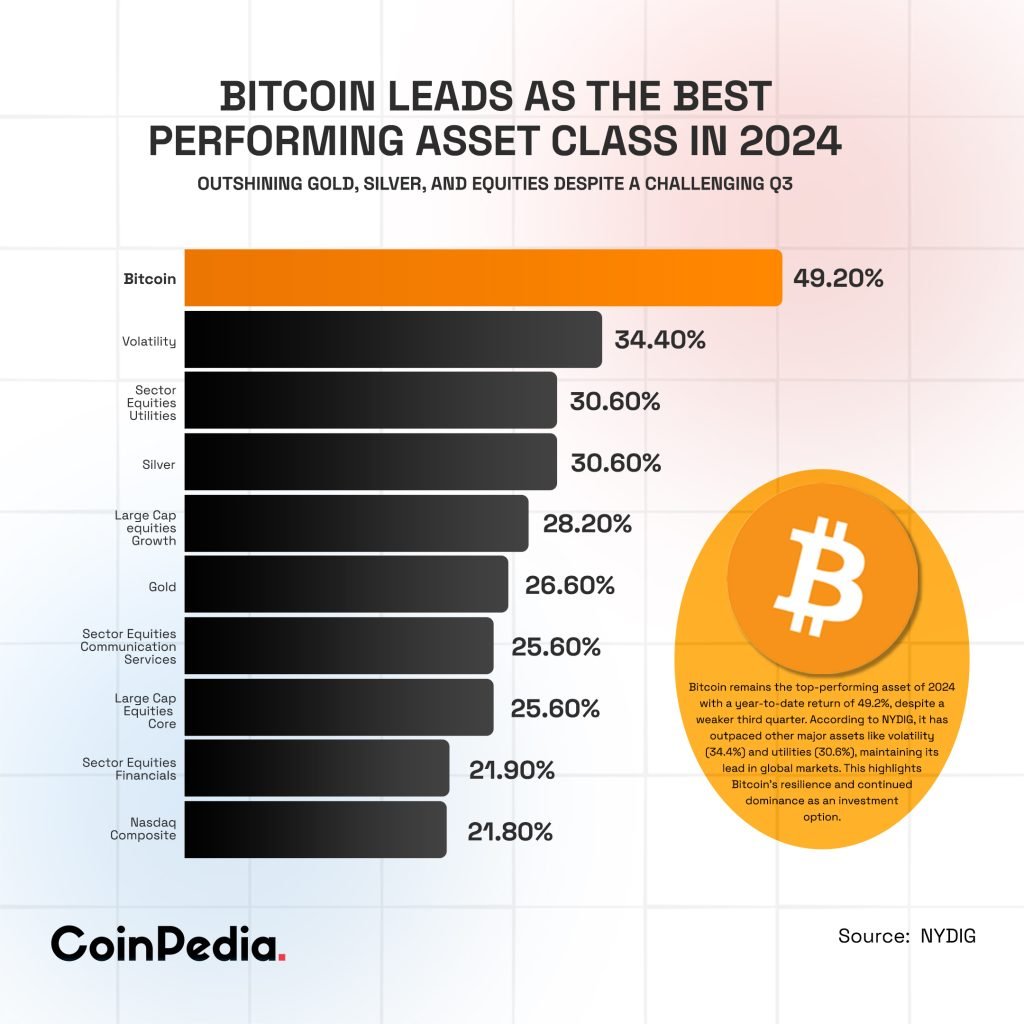

In 2024, Bitcoin has proven to be the best-performing investment, outshining traditional assets like gold, silver, and stocks. Despite a few market challenges, Bitcoin’s year-to-date growth stands at an impressive 49.2%. According to a recent report from the New York Digital Investment Group (NYDIG), Bitcoin’s upward trend may continue into the final quarter, driven by favorable conditions and increased interest.

Bitcoin’s Standout Rise Amid Market Pressures

So far in 2024, Bitcoin has demonstrated remarkable resilience. Its 49.2% increase makes it the best performer among assets, even with a pullback of around 30% in Q3. While other assets like silver and gold saw gains of 30.6% and 26.5% respectively, Bitcoin’s rise has been more notable, managing to stay above the $60,000 mark.

NYDIG’s report notes that some of Bitcoin’s Q3 challenges to government sell-offs, including the U.S. and Germany selling BTC obtained from bankruptcy cases like the Mt. Gox incident. Yet, even with this pressure, Bitcoin’s performance remains robust.

Key Reasons for Bitcoin’s Q4

NYDIG points out several reasons for optimism as Bitcoin moves into the last quarter. Both U.S. presidential candidates, Trump and Harris, have shown positive views on the crypto industry, which could lead to helpful regulation for digital assets like Bitcoin. Bitcoin’s connection with U.S. stocks has also grown, which could attract more investors looking for diversity in their portfolios.

Another factor that could support Bitcoin’s growth is the increasing global money supply, also known as M2. When there’s more money in the system, investors often look to assets like Bitcoin as a hedge against inflation.

Meanwhile, crypto analyst Joe Consorti suggests that if Bitcoin’s price continues to follow M2’s rise, it could reach $90,000 by year-end.

Trends Show Bitcoin’s Strength for Q4

Additional trends suggest continued strength for Bitcoin in Q4, including steady demand from Bitcoin ETFs and major companies like MicroStrategy, which continue to add Bitcoin to their holdings.

Historical data adds to this optimistic view: Bitcoin has closed Q4 positively in 7 of the past 11 years, with an average gain of over 81% during the quarter.

As 2024 comes to a close, Bitcoin’s strong year-to-date performance and favorable trends hint that it may end the year as the leading asset in the market.

(@JoeConsorti)

(@JoeConsorti)