Bitcoin’s cumulative transfer volume (CTV) exceeded $100 trillion in recent weeks, coming in at $105 trillion at present, according to Glassnode data.

CTV refers to the accrued monetary value of transactions settled on a particular network. As a measure of activity, it can be used to gauge adoption and pinpoint adoption trends.

Bitcoin cumulative transfer volume streets ahead of the rest

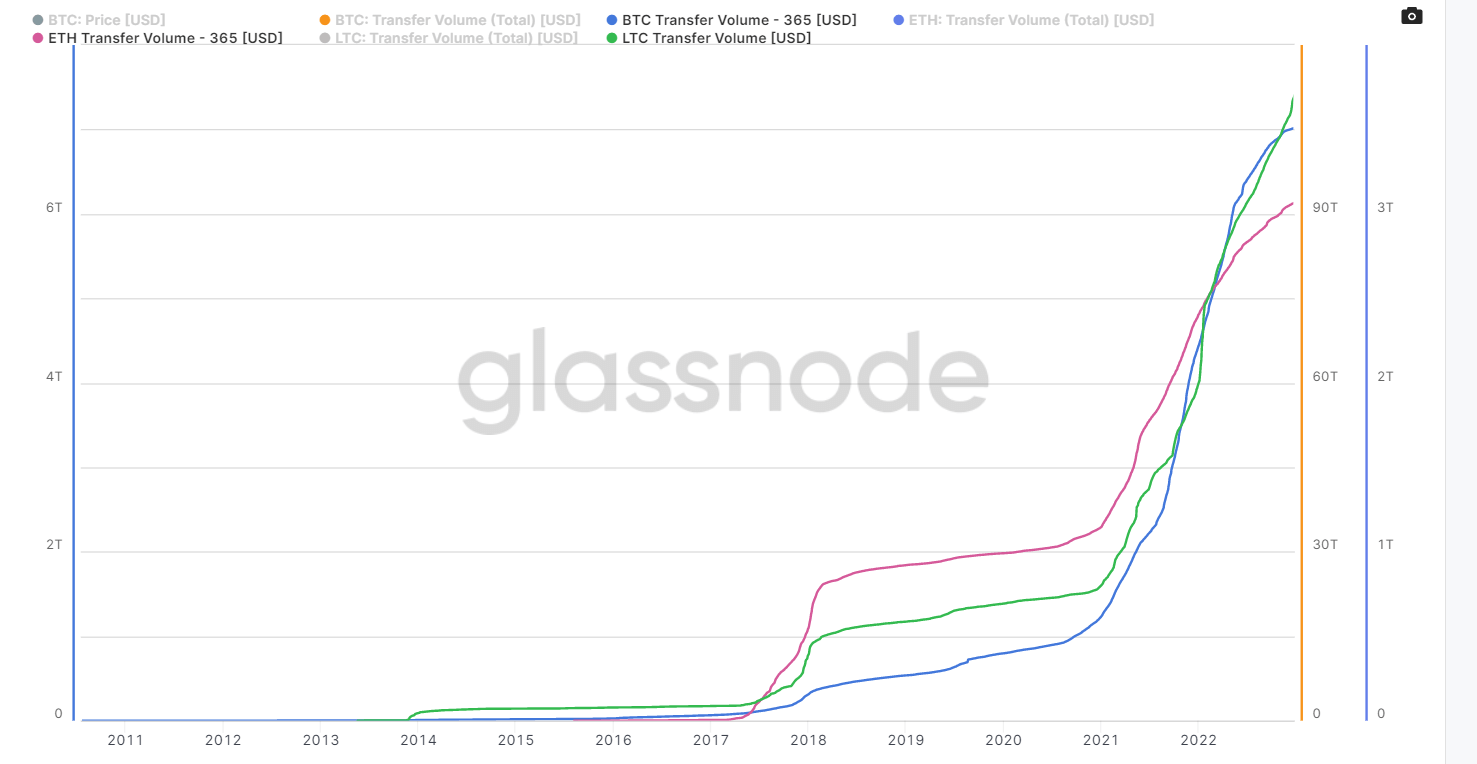

The chart below shows the CTVs of Bitcoin, Ethereum and Litecoin on individual logarithmic scales. Ethereum and Litecoin’s CTVs amount to $6.1 trillion and $3.7 trillion, respectively — both smaller than Bitcoin’s by orders of magnitude.

Interestingly, Litecoin’s CTV noticeably accelerated in 2022, as denoted by its representative line moving closer to a vertical position.

The CTVs of all three tokens show a degree of likeness, from the uniform uptick from the start of 2018, leading to a gradual uptrend until the beginning of 2021, followed by a sharp expansion across the board.

Post-2021, the three tokens converge at various points with one another. However, the relative change of Litecoin sees it exceed Ethereum and Bitcoin in recent weeks.

Commenting on Bitcoin’s CTV, Will Clemente said reaching the $105 trillion milestone was a “tremendous feat” and showed how many millions “have utilized Bitcoin as a global settlement network.”

Criticisms

As CTV is calculated using the token price at the time of transfer, the impact of movement on the chart is significantly greater during bull cycles compared to bear cycles. This price discrepancy arguably distorts the true measure of adoption.

Similarly, the CTV does not distinguish between volume relating to actual settlement in exchange for goods and services and internal transfers and other such trading or speculative reasons to move tokens.

The post Bitcoin cumulative transfer volume exceeds $100 trillion milestone appeared first on CryptoSlate.