According to Tony Severino, a crypto analyst on X (formerly Twitter), the Bitcoin price could surge significantly to $120,000 by next week. The analyst has grounded his bullish projection on Bitcoin’s daily Bollinger Bands (BB), highlighting that these indicators are expanding while BTC displays a similar price action observed in 2023.

BTC Price Targets $120,000 ATH

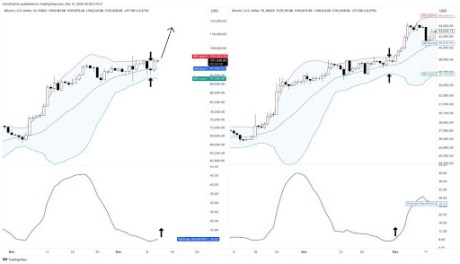

On December 12, Severino shared a chart demonstrating a technical analysis of Bitcoin using the Bollinger Bands and a historical correlation of late 2023 price behavior. The analyst predicted that if history repeats itself, the Bitcoin price could reach a $120,000 all-time high by next week.

Severino disclosed that Bitcoin’s daily Bollinger Bands are expanding, while its current price action reflects a similar bullish trend observed in 2023. Looking at the analyst’s 2024 price chart, Bitcoin’s upper and lower Bollinger Bands are represented by a respective red and green trend line.

Typically, an expanding Bollinger Band indicates increasing price volatility. Bitcoin could start a bullish trend if it breaks above the upper band or enter a bearish phase if it drops below the lower band. Bitcoin has also tested the lower Bollinger Band at $92,560 and is now steadily approaching the upper band at $102,323. Additionally, the analyst has placed Bitcoin’s Bollinger Band basis at $97,442.

Severino observed that the Bitcoin price chart on the right shows a historical instance in late 2023 when BTC broke above the upper Bollinger band and followed with a substantial price rally as it walked the bands higher. This historical trend is currently being replicated in Bitcoin’s 2024 price setup, indicating a potential for a significant upward price movement if similar conditions seen in 2023 are met.

If Bitcoin’s price closes above the upper Bollinger Band with a buy signal, it could spark a rally toward $120,000. Currently trading at $100,219, Bitcoin would need to increase by 20% to reach the analyst’s projected target by next week.

Analyst Confirms Bitcoin Bollinger Band Bullish Signal

Also commenting on Bitcoin’s recent price action, Trader Tardigrade, an analyst on X, revealed that BTC’s Bollinger Bands and Bollinger Band Width (BBW) are signaling the potential for a strong uptrend continuation. Sharing a price chart, the analyst noted that Bitcoin previously dipped to the middle of the band but quickly recovered, underscoring the supportive nature of the mid-band.

Trader Tardigrade has revealed that Bitcoin’s BBW has hit a lower contraction, while its recent price movements resemble those of early November, just before its price skyrocketed from $70,000 to $100,000. If Bitcoin’s price maintains its current bullish trend, the analyst predicts a surge that could drive the cryptocurrency to a new all-time high at $136,000. This substantial price increase would represent a massive 36% rally from Bitcoin’s current price.